Tariff Impact Analysis: Prices Climb for Amazon’s Historic Best-Sellers & Consumer Trade Downs Slow

Consumer price sensitivity on Amazon showed signs of stabilizing in early May, but prices for the retail site’s long-time top products continue to climb. With tariff-related price pressures on Chinese-made goods now temporarily paused, the potential for widespread sharp increases has diminished. However, the lingering uncertainty in conjunction with supply chain lead times means continuing price increases over time remain likely.

The Ways Tariffs May Be Impacting Pricing and Buying Behavior on Amazon

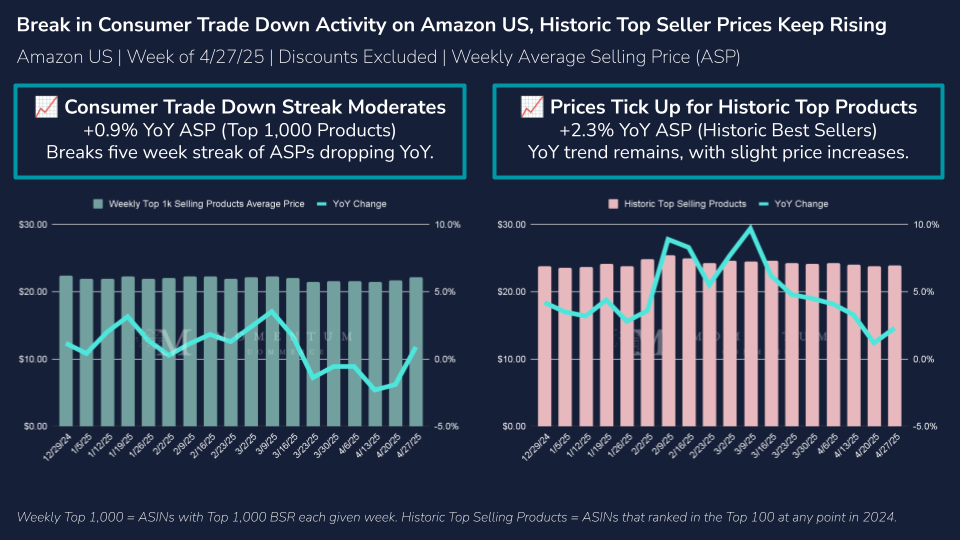

Consumer buying behavior adjustments remain top-of-mind. According to Momentum Commerce’s analysis of Amazon US, the average selling price (ASP) for the weekly 1,000 most popular products rose 0.9% year-over-year in the week ending May 3, 2025. This marks a reversal after five consecutive weeks of ASP declines, hinting at a possible softening of consumer trading down behavior. This is worth monitoring in the wake of the tariff pause, and any potential reinstatement at the 90-day deadline.

The story is different for Amazon’s long-term top sellers. Products that appeared in Amazon’s weekly Top 100 at any point during 2024 saw a +2.3% year-over-year ASP increase. This continues an upward trend that began at the start of 2025.

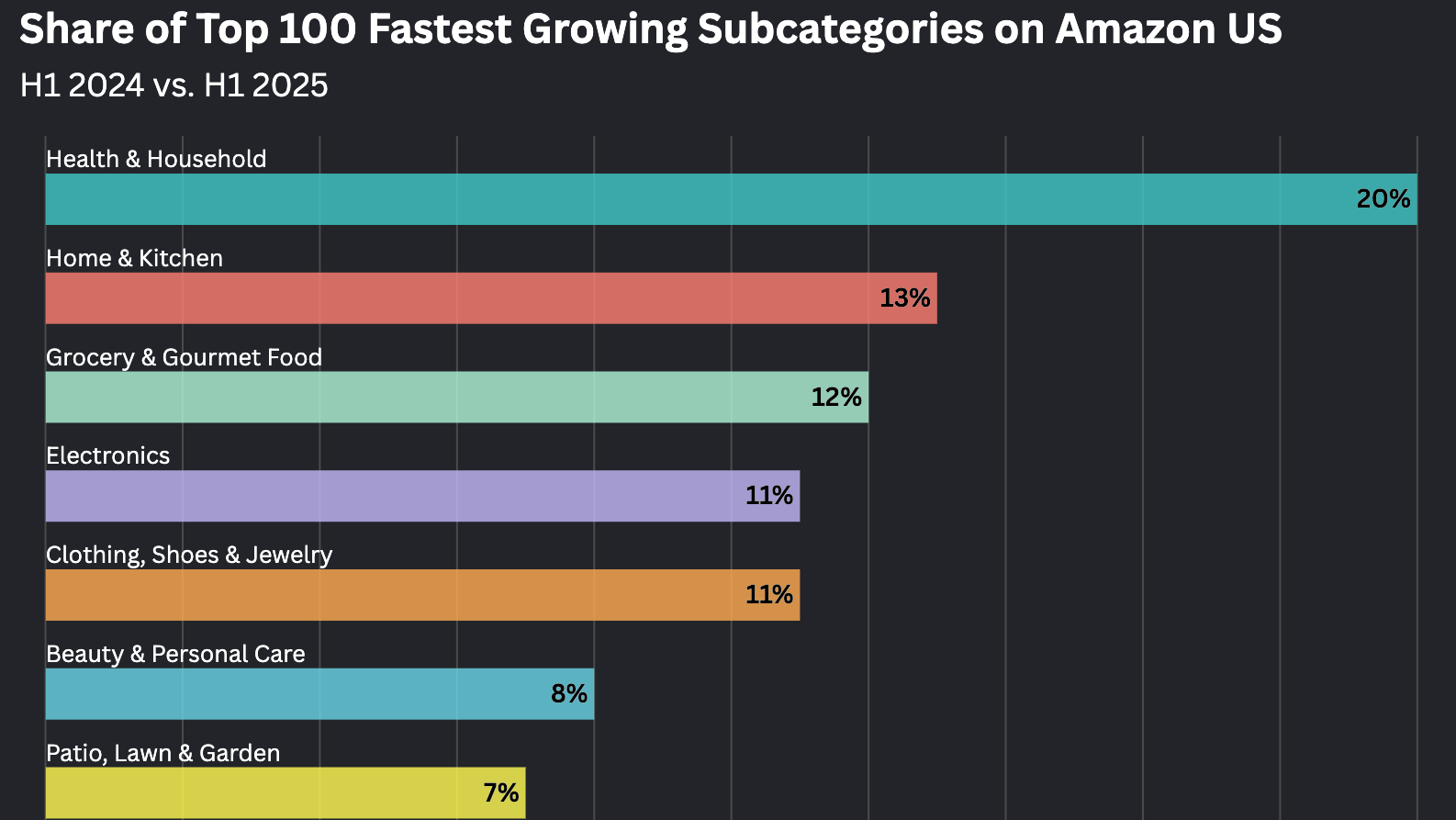

Despite these overarching trends on Amazon US as a whole, pricing and buying behavior impacts have varied fairly significantly on a category-by-category basis. Our next few blog posts will dive into how these are manifesting across several key subcategories.

Key Lessons for Brands

Consider Exploring and Testing Price Elasticity

- Brands should monitor how price hikes are influencing conversion rates, particularly for high-volume or strategic ASINs

- Even with stable overall demand, elasticity dynamics can change quickly when tariffs compound cost structures

Keep a Close Eye on Trading Down within Your Categories

- Trade-down activity can vary widely between categories, and actual on-the-ground behavior should inform discounting strategies generally

- Changes in the average price of the category’s top BSR products over time are worth tracking at a minimum

Be Mindful of Competitive Set Shifts

- Supply and pricing pressures naturally create opportunities for brands who may have different supply chains or cost bases

- Brands should reevaluate their competitive benchmarks monthly, especially in tariff-sensitive categories