Prime Day 2025 Day 3 Sales Surge 165% — Momentum Commerce Data Points to YoY Growth Ahead

Day 4 Sales Prove Critical as Expanded Sale Event Stretches Consumer Sales Over Longer Period

Demand Spreads Out with Longer Prime Day Event

Going into Prime Day 2025, Amazon sales held up nicely despite tariff uncertainty that has impacted retailers, brands and consumers alike. According to Velocity by PMG, Amazon sold nearly $250B of goods in 1H 2025 in the US for more than 6% YoY growth.

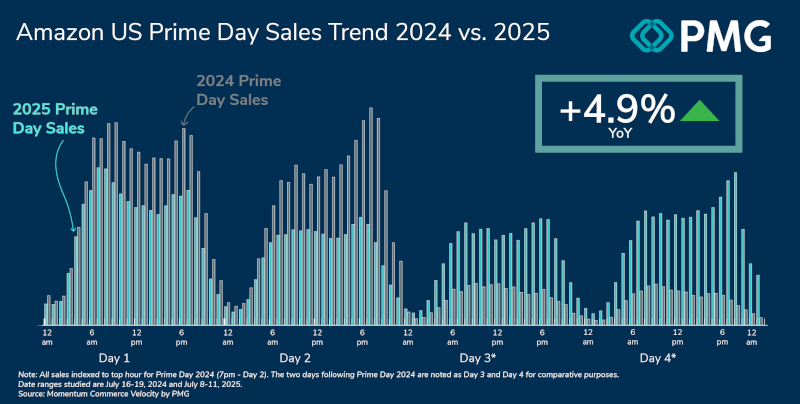

With Prime Day being twice as long this year, we expected to see softer demand on a YoY basis the first two days and stronger demand on a YoY basis during days 3 and 4 of the event. At least through Day 3, those trends have largely borne out.

- Across Momentum Commerce clients, Day 1 and Day 2 sales on Prime Day 2025 were on average 506% higher than a normal day of sales, but fell short of last year’s levels by ~35%

- Day 3 sales came in at +165% YoY vs what would have been Prime Day 3 in 2024. We are also seeing add to cart levels exceed conversion levels, signaling that a lot of American consumers have very full Amazon shopping carts and are waiting to pull the trigger on purchases until Day 4.

- We anticipate that today’s sales will mirror what we saw on Day 1. If that occurs, the event will reach 9.7% YoY growth for the 4 day period, making this by far the largest and most successful Prime Day of all time.

- More broadly, we are hearing anecdotally from many brands and retailers that Prime Day this year has spurred nice YoY growth in shopping rates off Amazon too – a trend that has not typically materialized in years past.

Deal Availability is Different in 2025

- Across the first 3 days of Prime Day 2025, 25.3% of products on the site were discounted. That’s up from 23.6% over Prime Day 2024, an increase of 7% YoY.

- For those deals offered on the site, the average discount rate was 21.6%. That figure is down from 24.4% last event, meaning discounts were 11% shallower in 2025.

- Notably, both of these metrics – deal breadth and depth – have grown incrementally from Day 1, to Day 2, to Day 3.

- Average discount breadth grew from 22.7% on Day 1, to 26.3% on Day 2, to 26.7% on Day 3.

- Average discount depth increased by an additional +0.2 percentage points on both Day 2 and Day 3.

- These trends naturally help prime consumers for a big shopping day on Day 4.

Methodology

Sales data is based on an index of data Momentum Commerce’s Velocity platform observes across hundreds of brands collectively doing over $7B in GMV on Amazon US annually. Across the Extended Prime Day Event in 2025, Momentum Commerce observed more than $750 million in Amazon U.S. transactions.

Discount data encompasses both Prime Day-specific deals and general promotional discounts across more than 30 million products on Amazon US according to Velocity, Momentum Commerce’s proprietary commerce platform.