Amazon Demand Shifts Towards Essentials, But Some Categories See Pricier Top Products

Over the first seven months of 2025, searches across essential categories on Amazon US became significantly more popular on the retail site compared to the same period in 2024. While this reflects Amazon increasingly becoming a hub for consumers to shop for household goods, average prices of products that achieved top organic results on the most popular terms across a number of top categories rose over the same period. This underscores how premium brands can still thrive on the site despite the change in shopping patterns.

Methodology

Momentum Commerce examined the top 10,000 search terms by search volume across Amazon for each month between January 2024 and July 2025. These terms were mapped to specific categories based on the average makeup of search results on those pages in each given month. Average price was calculated across the top 10 organic search results cataloged daily, for each search term in each month.

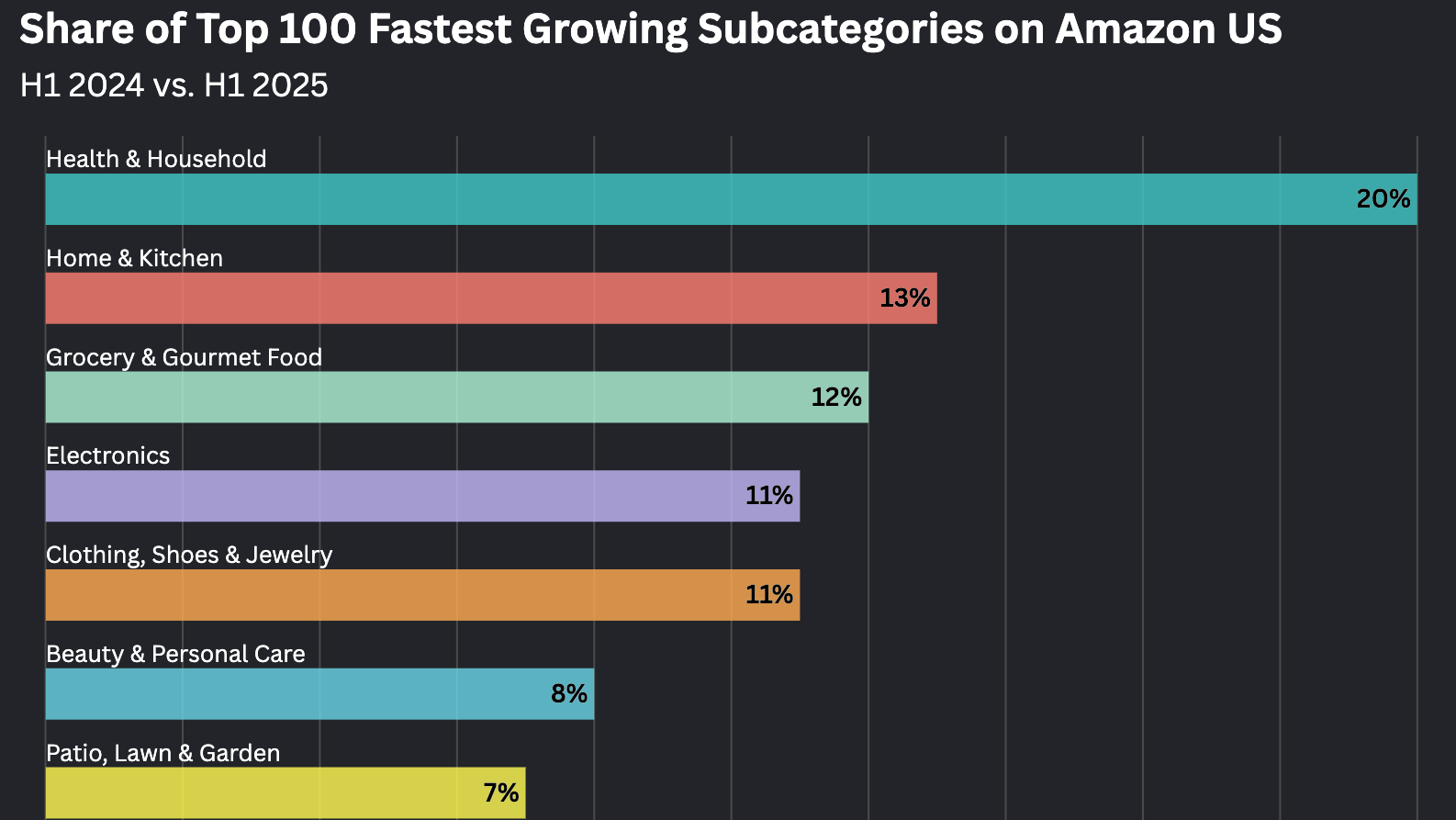

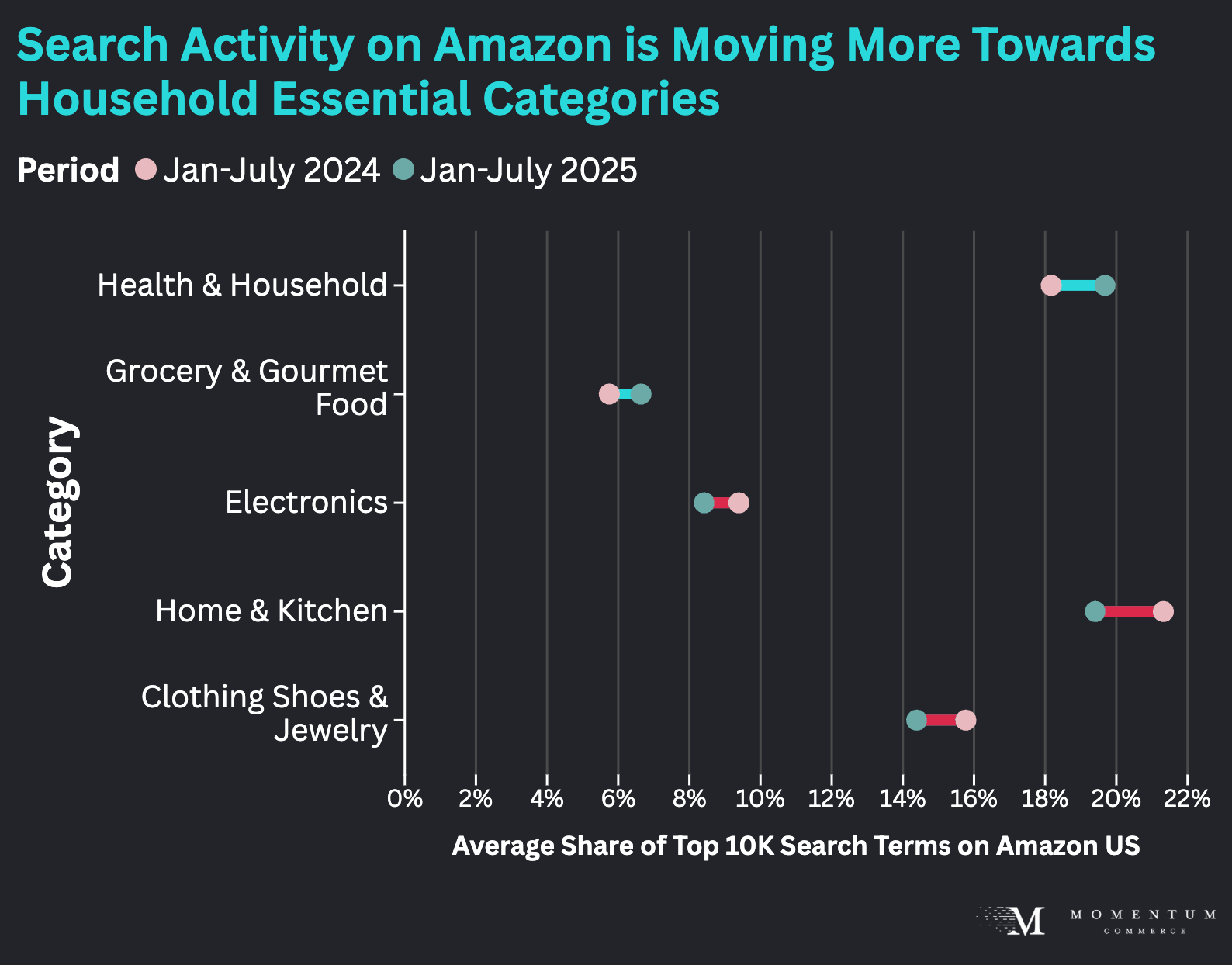

Search Activity on Amazon is Moving More Towards Essential Categories

Health & Household and Grocery & Gourmet Foods categories saw the biggest year-over-year jumps in the share of top search terms on Amazon. Conversely, Electronics, Home & Kitchen, and Clothing Shoes & Jewelry experienced the largest drops in share over the same period.

In some ways, this shift just echoes trends Amazon itself has trumpeted. But while prior announcements focused more on the growth of these categories on Amazon, this analysis highlights that this growth has essentially come at the expense of bigger-ticket categories like Electronics in terms of popularity on the site.

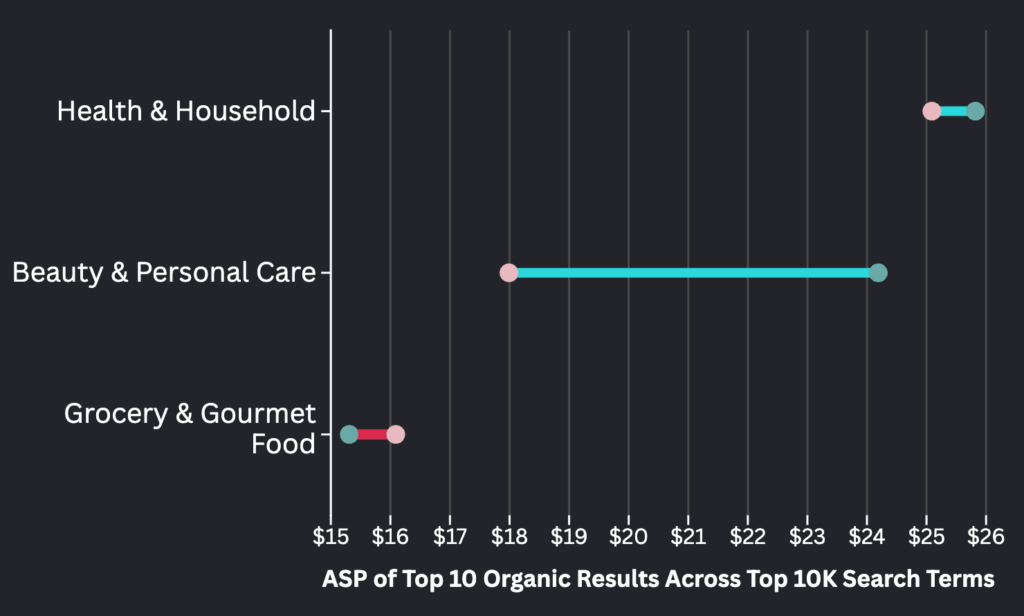

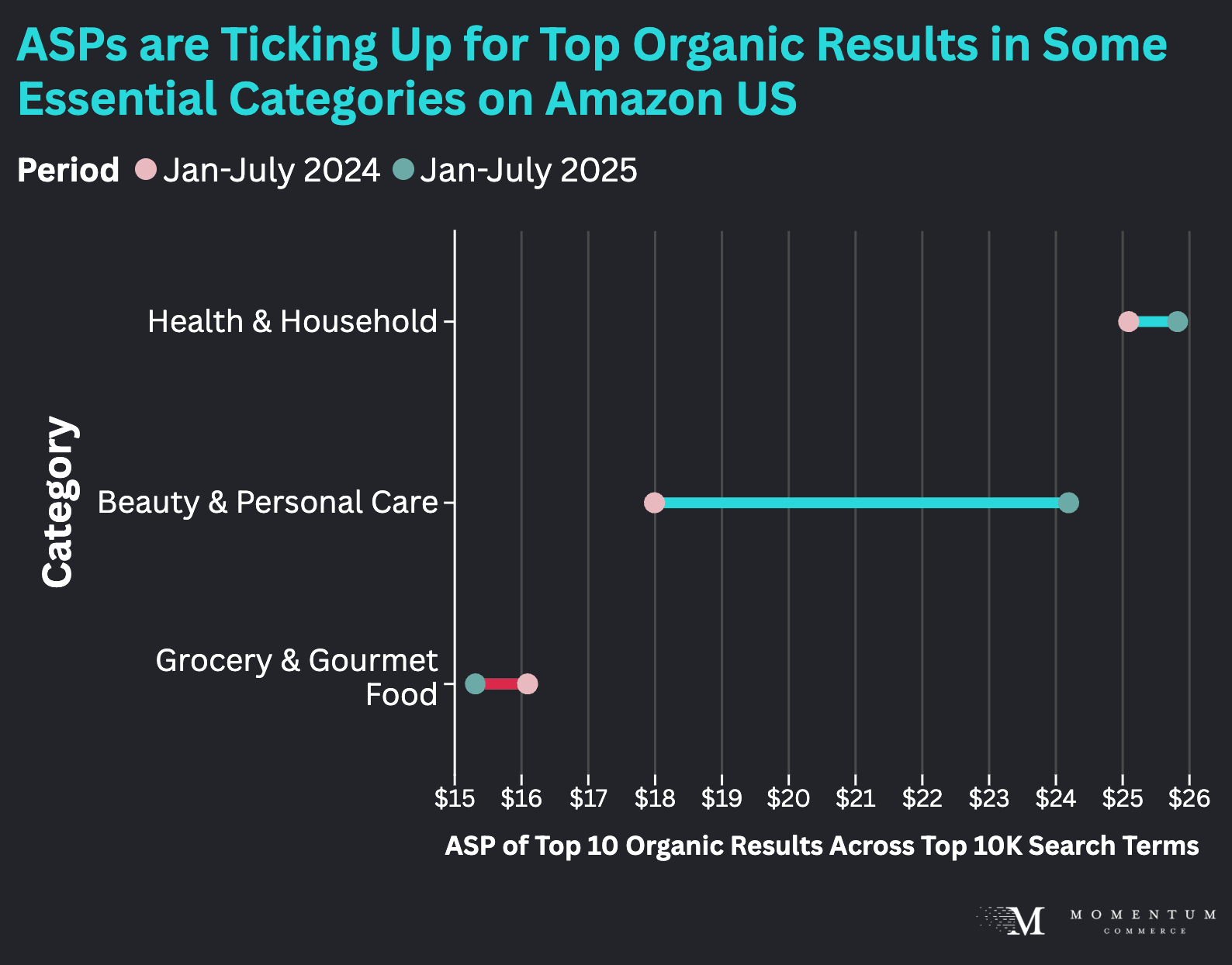

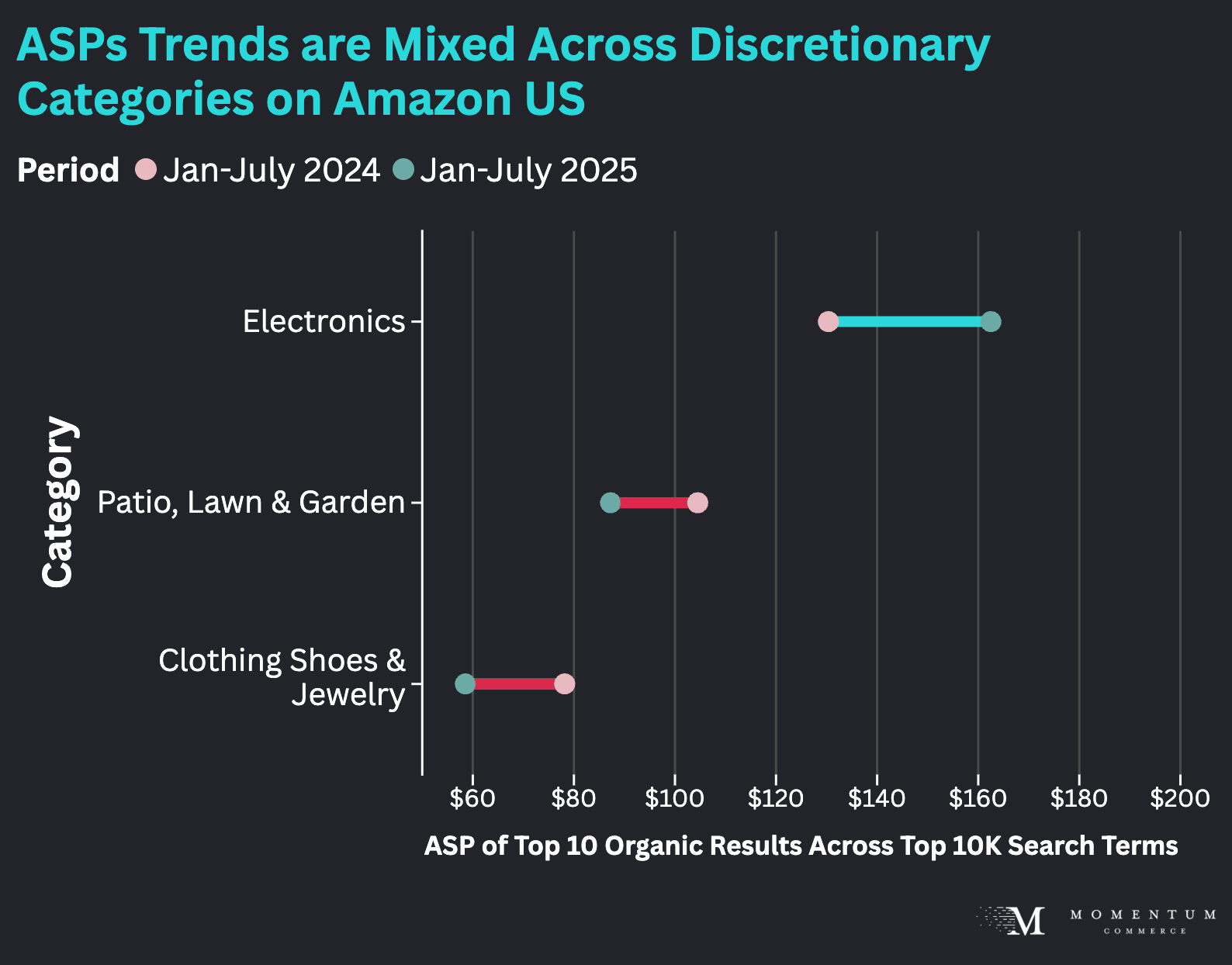

ASPs are Rising Across Top Organic Results on the Biggest Search Terms in a Number of Categories

In more essential-heavy categories like Health & Household and Beauty & Personal Care, the products surfaced at the top of organic search results for the most popular search terms have grown more expensive year-over-year.

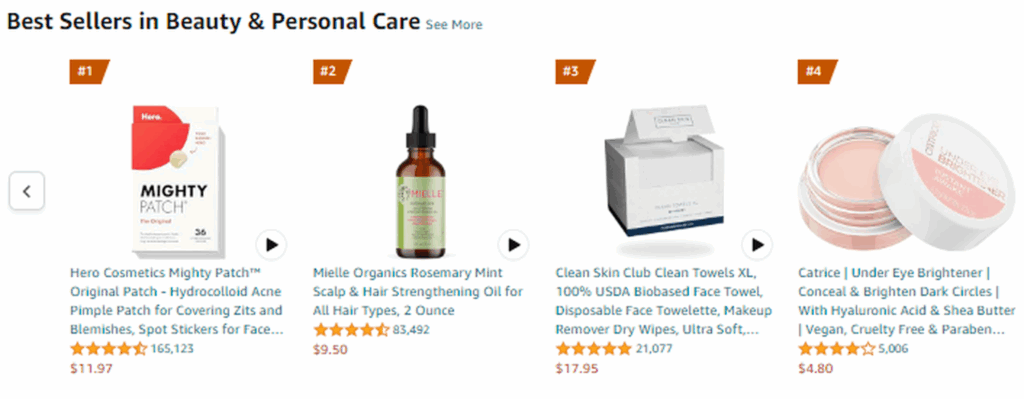

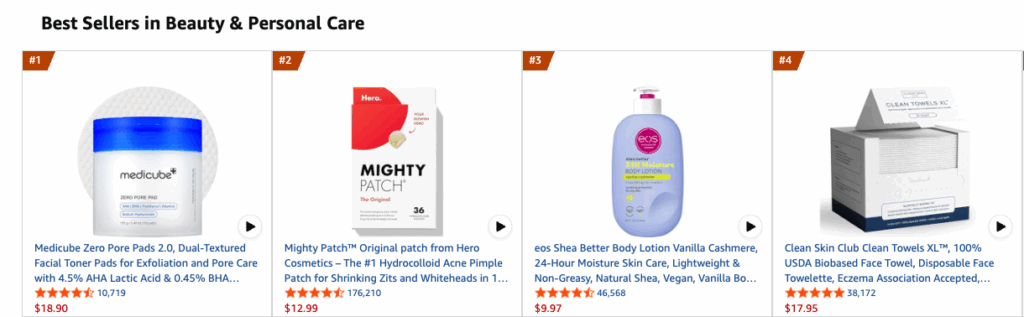

As a simplified example for how this is manifesting on Amazon, compare the top four products by best-seller rank in all of Beauty & Personal Care in June 2024 (the first image) versus August 2025 (the second image).

While some of these broader price increases may be related to tariff impacts, Amazon prioritizes purchase velocity when ranking terms organically, making it likely consumers are indeed buying pricier items in these categories more often. Notably though, this trend is much more mixed across a number of more discretionary categories.

For brands operating in categories seeing marked increases in ASPs, there is a real need to showcase your product’s clear value proposition. In these cases, consumers are willing to spend a bit more, so it’s worth utilizing all the product content tools at your disposal to highlight points of differentiation.

Key Lessons for Brands

Understand how shopping has evolved on Amazon for your category specifically

- Track how ASPs for top BSR products in your key categories have and are shifting

- In cases where ASPs are rising, you have more flexibility to lead with premium value propositions around unique features and capabilities, while not sacrificing on price

- If ASPs are falling within this top BSR group, know where your product sits relative to top performers in terms of price to ensure you’re remaining competitive

- If your product’s relative price is worse off, it’s worth prioritizing price cuts even it may come at the expense of other marketing spend to maintain ideal margins

Essentials brands selling on Amazon need to consider doubling down

- Amazon is clearly working to make the US site even more attractive to buyers looking for grocery and essential goods

- The fact that user behavior has already shifted is a major opportunity to relevant brands to invest and optimize their presence on the retail site to take full advantage of this growth