After New Deal and Coupon Fees, Discounting Drops on Amazon US

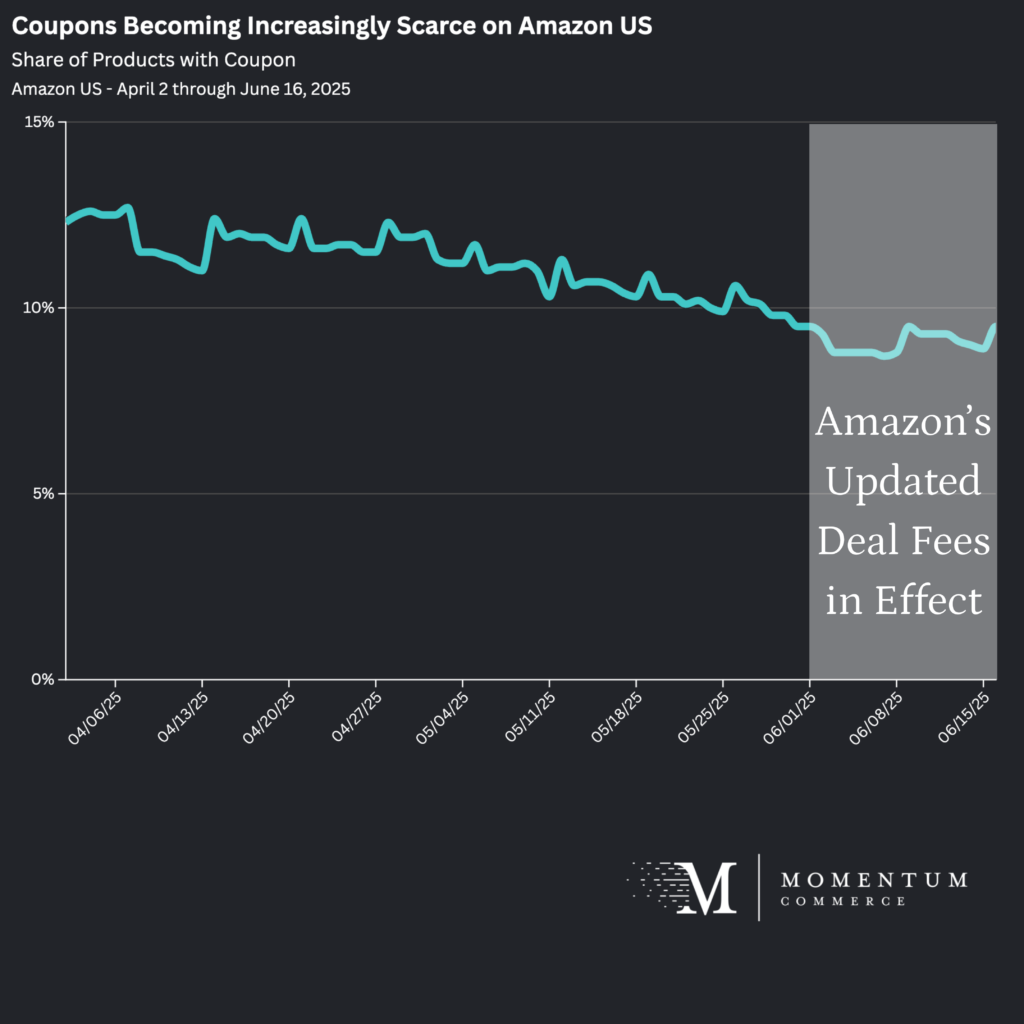

Following Amazon’s new fee structure for deals and coupons announced this Spring, coupon usage has dropped dramatically on Amazon US. Data shows that coupon participation fell from 13.6% to 9.1% of products year-over-year, suggesting brands are pulling back from this promotional tactic ahead of Prime Day 2025.

About this Analysis

This study examines a consistent basket of over 165,000 ASINs across Amazon US that were present at least once in top 20 search results every day from January 1, 2024 through June 16, 2025.

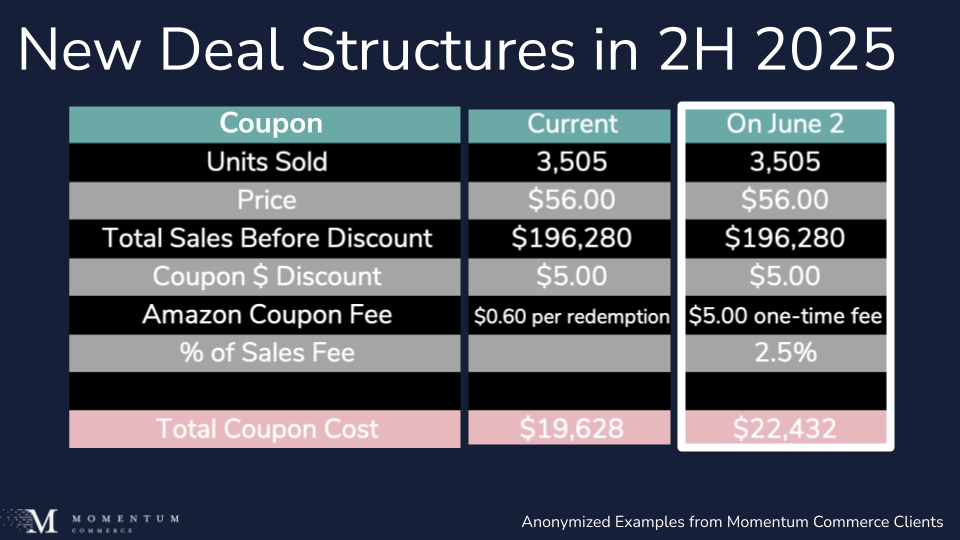

The Change in Amazon’s Fee Structure

Amazon announced a substantial change to the fees associated with certain deal types this June. The biggest shifts were around coupons, Best Deals, and Lightning Deals, and you can see an example of how this would impact a P&L below:

Impact on Coupon Usage

From June 2 through June 16, 2025, 9.1% of products on Amazon US offered a coupon, down from 13.6% over the same period in 2024.

The decline in participation began picking up following the announcement of tariffs in early April but accelerated once the new deal fees went into effect on June 2.

During non-sale event periods, Best Deals and Lightning Deals aren’t as widely employed as Limited Time Deals. Coupons, however, have historically been much more popular with brands as a way to quickly juice sales for a product with a prominent badge on the SERP (even if those coupons go unredeemed).

Broader Impact on Deals

Looking beyond coupons, the share of products with any kind of deal badge has gone down year-over-year, but not nearly as sharply. From June 2 through June 16, 2025, 5.1% of products on Amazon US had a deal tag attached versus 6.1% over the same period in 2024.

Importantly, this shift isn’t a product of what could be considered a typical reduction in discount activity leading up to Prime Day. Comparing May 2 through 16 vs. June 2 through 16, 2024, the share of products with coupons on Amazon US actually ticked up slightly by 0.3 percentage points. Over that same comparative period in 2025, the share of products with coupons dropped by 1.9 percentage points.

Key Lessons for Brands

- Coupons are becoming more onerous for brands to run regularly

- In aggregate, brands are clearly running significantly fewer coupons than they have historically

- In a sense, decreased use of coupons may have been a goal of Amazon for the change in fee structure

- Less coupons mean less ‘clutter’ on the search page, and fee changes encourage tactics like Limited Time Deals that are associated with steeper price cuts

- On the flip side for brands, decreased participation means that coupons you do run may stand out more on the SERP generally

- This is more evidence that deal participation will be lower during Prime Day 2025

- The new deal fee structure for Lightning Deals, which are particularly popular during Prime Day, are going to make them less attractive for at least some subsection of brands

- Similar to coupons, one potential benefit is that brands that are able to run deals during the sale event are naturally going to be positioned better than they would in previous years where deals were more pervasive