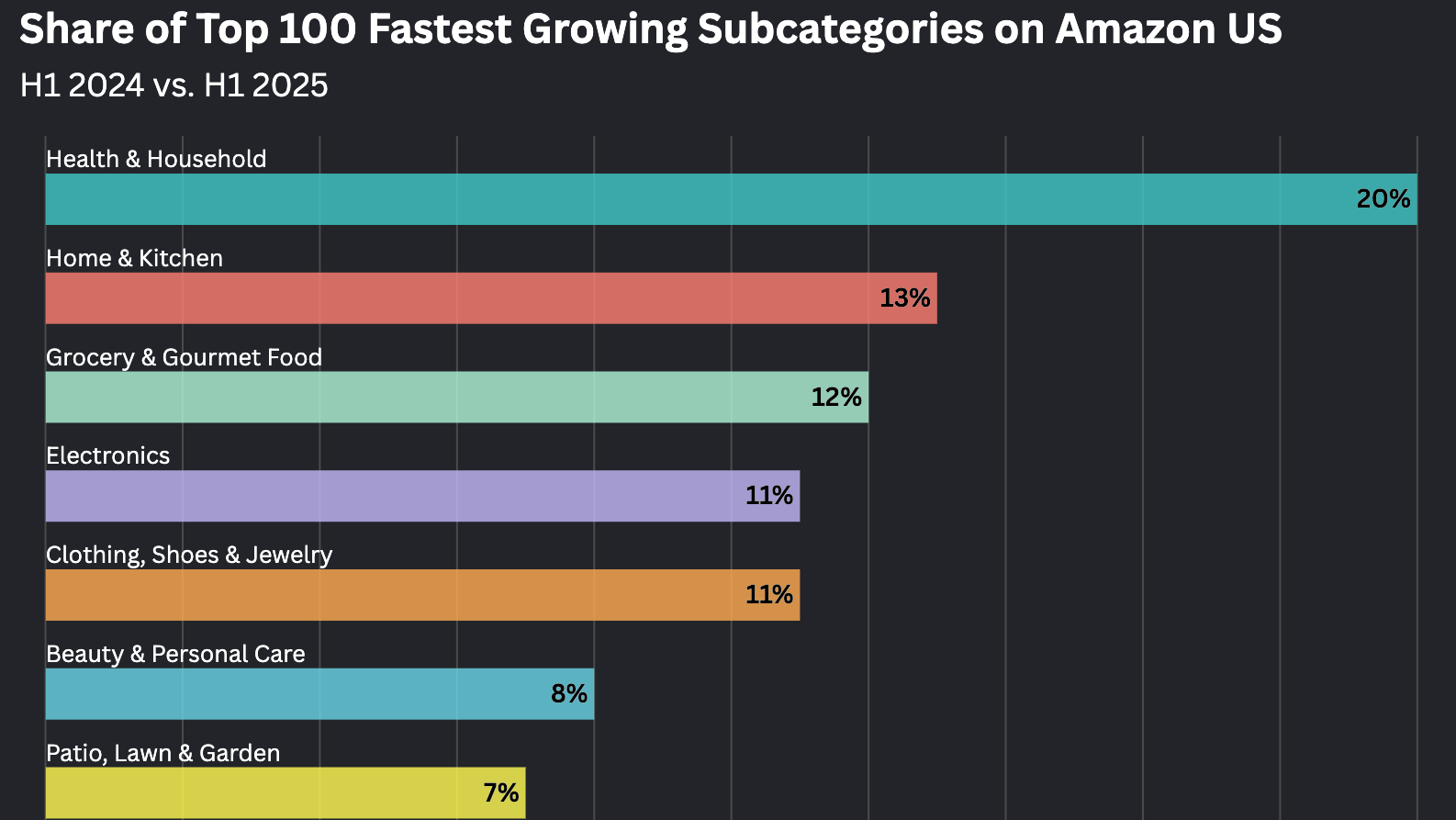

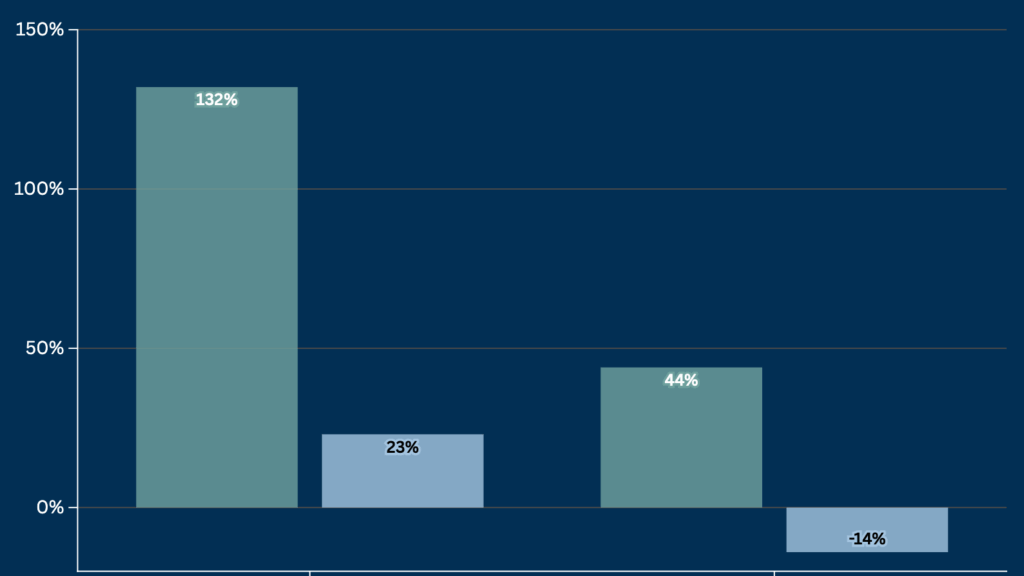

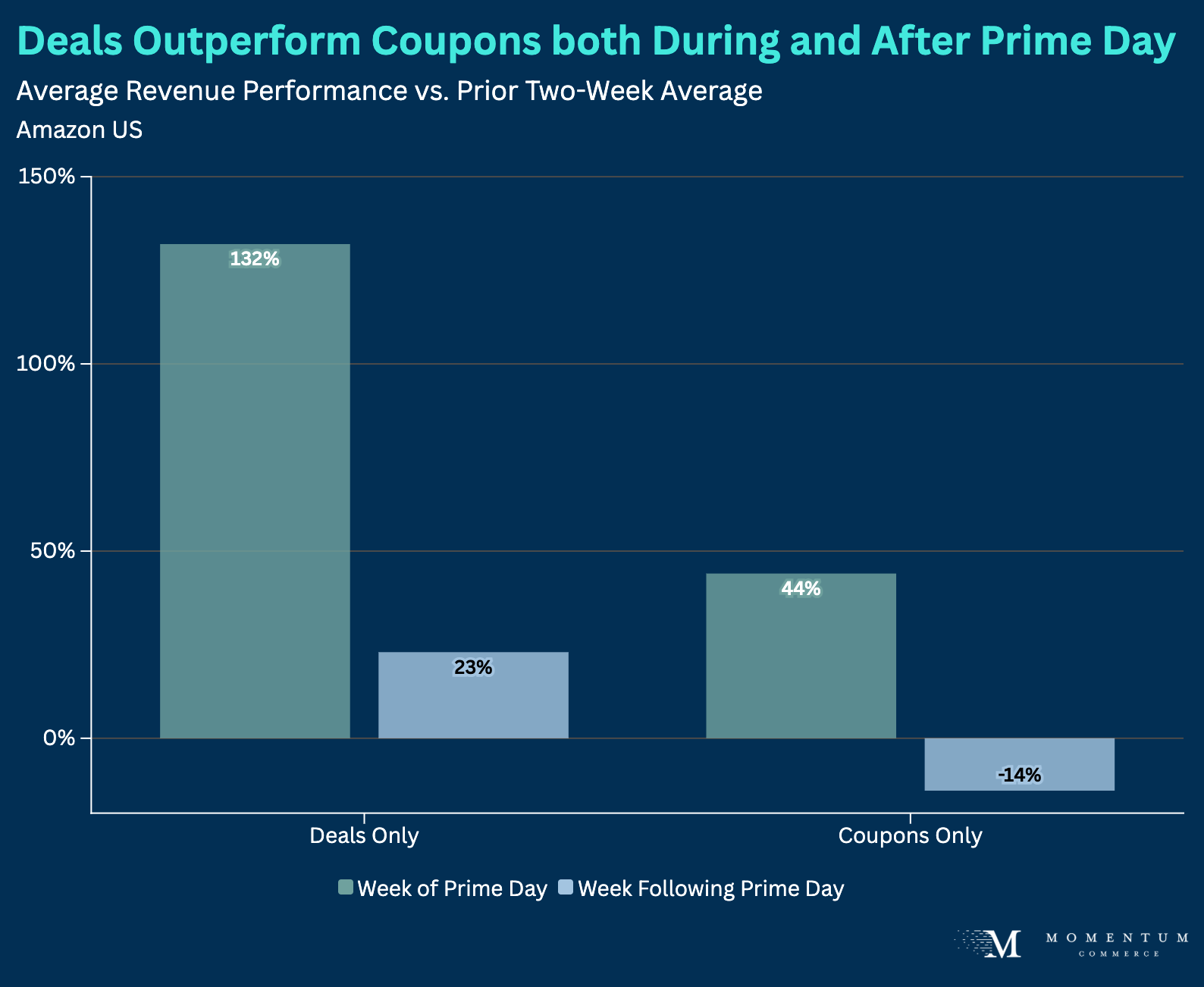

Deals Outperform Coupons both During and After Prime Day

Across Amazon US, products that ran a deal promotion over Prime Day week saw significantly higher average revenue gains compared to products that ran coupons over the same period. Additionally, sales stayed elevated from prior weekly averages the week following Prime Day for products that ran deals over the sale event, but dipped by the same measure for products that just ran coupons. Combined with the new, more challenging economics for coupons on Amazon, this analysis paints a stark picture of deals being significantly more beneficial during tentpole sale events.

Methodology

To analyze the average revenue impact of different discount types, Momentum Commerce broke more than 40M products on Amazon US into cohorts based on the type of promotion(s) run during July 8 through 11, 2025.

The groups included:

- ‘Deals Only’

- ‘Coupons Only’

We then compared revenue seen in each of these groups across three periods:

- The week following Prime Day

- Two weeks prior to Prime Day

- Prime Day week itself

Key Insights

Deal Performance Extends Beyond Prime Day

While it’s perhaps expected that deals would outperform coupons during a sale event given more prominent search placements and the known impact of a deal badge, the elevated performance even after the event concluded – especially in contrast with the downturn by coupon-only products – is eye opening. The reasons behind this shift are likely multifaceted. At a minimum, the virtuous cycle of the ‘Amazon Flywheel,’ with higher purchase rates during Prime Day leading to better organic ranking, would naturally help these products more in aggregate than their coupon counterparts who drove a lower sales increase on average.

Combined Promotions Show No Added Benefit

Aside from the stark performance difference between deal-only and coupon-only products, what’s also notable is how products that ran both types of promotions over the sale period did not outperform the deal-only group. This could be due to the fact that the extended nature of the sale event in 2025 delayed purchase decisions for many consumers as they waited to see if they were getting the best deal. This behavior would have naturally hamstrung some brands who ran deals that ran only for the early portion of the event, even if they subsequently bookended Prime Day with a coupon.

Biggest Takeaways for Brands

- Prioritize Deals Over Coupons

- Deals, rather than coupons, have a better chance of driving short- and longer-term benefits on Amazon around big sale events

- Coupons drive higher search visibility, but these effects may be muted during peak events when promotions are much more plentiful across the site and Amazon shifts how products appear on the site to accentuate top discounts

- While the requirements for brands to launch a deal during tentpole events like Prime Week are more onerous and require more planning than coupon promotions, the likely revenue benefits are worth the trouble

- This does entail more careful planning around things like pricing prior to the event to qualify for deals, inventory levels, and working with your Amazon representative

- Deals, rather than coupons, have a better chance of driving short- and longer-term benefits on Amazon around big sale events

- Avoid Mixed Promotions Strategies

- Don’t try to ‘split the difference’ with coupons and deals during tentpole events

- Particularly during big sale events, coupons clearly just don’t drive the same kinds of revenue increases as deal promotions on average

- If at all possible, extend deals through an entire sale event period, or sequence deals so a product remains prominently on discount (with a ‘deal’ badge to boot)

- Don’t try to ‘split the difference’ with coupons and deals during tentpole events