‘Made in America’ Has Faded on Amazon, with Warning Bells in Amazon Canada

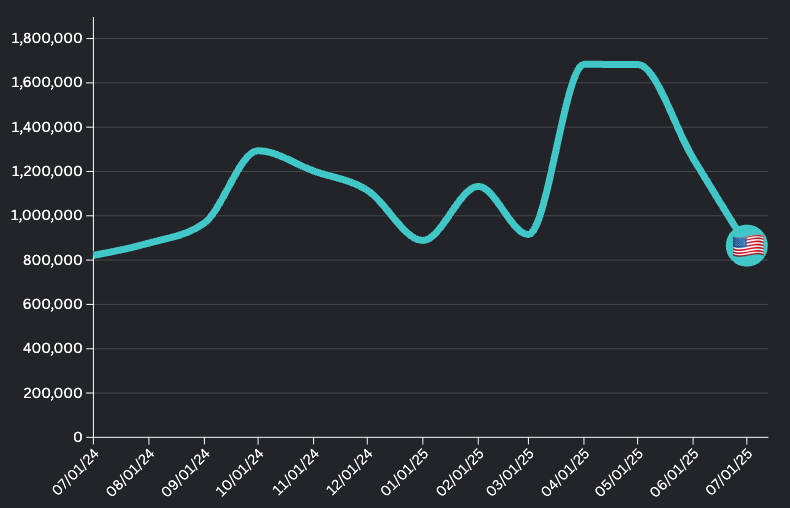

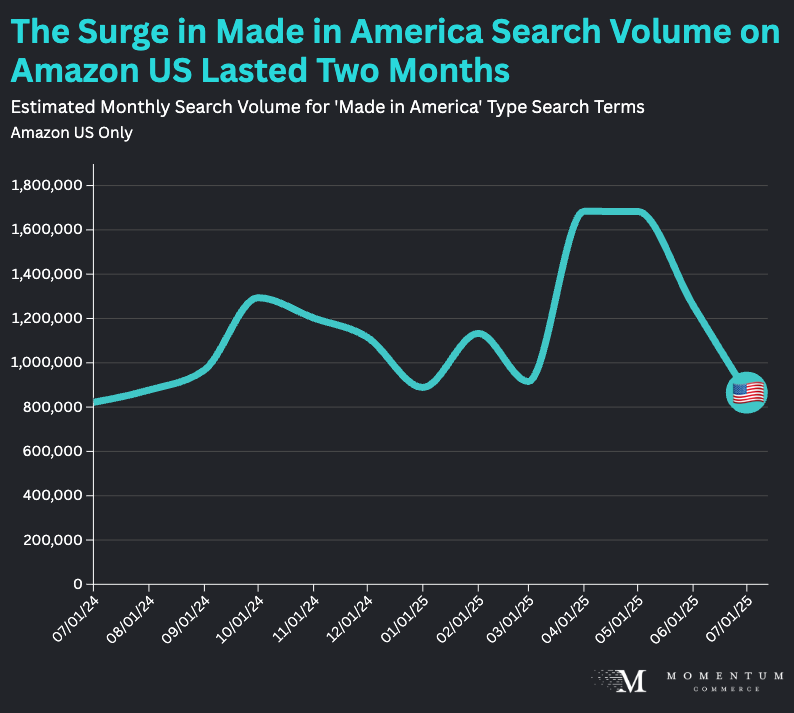

Back in the Spring, we studied how search interest on Amazon US for ‘Made in America’ type terminology had surged in April 2025. While that peak largely held the following month, it has since ebbed dramatically. By July 2025, search volume for terms including ‘Made in America’ and similar keywords fell back to levels largely identical with July 2024. This, combined with very short-lived growth in sales of these products and larger ASP trends, highlights how US consumers are considerably more focused on price than country of origin.

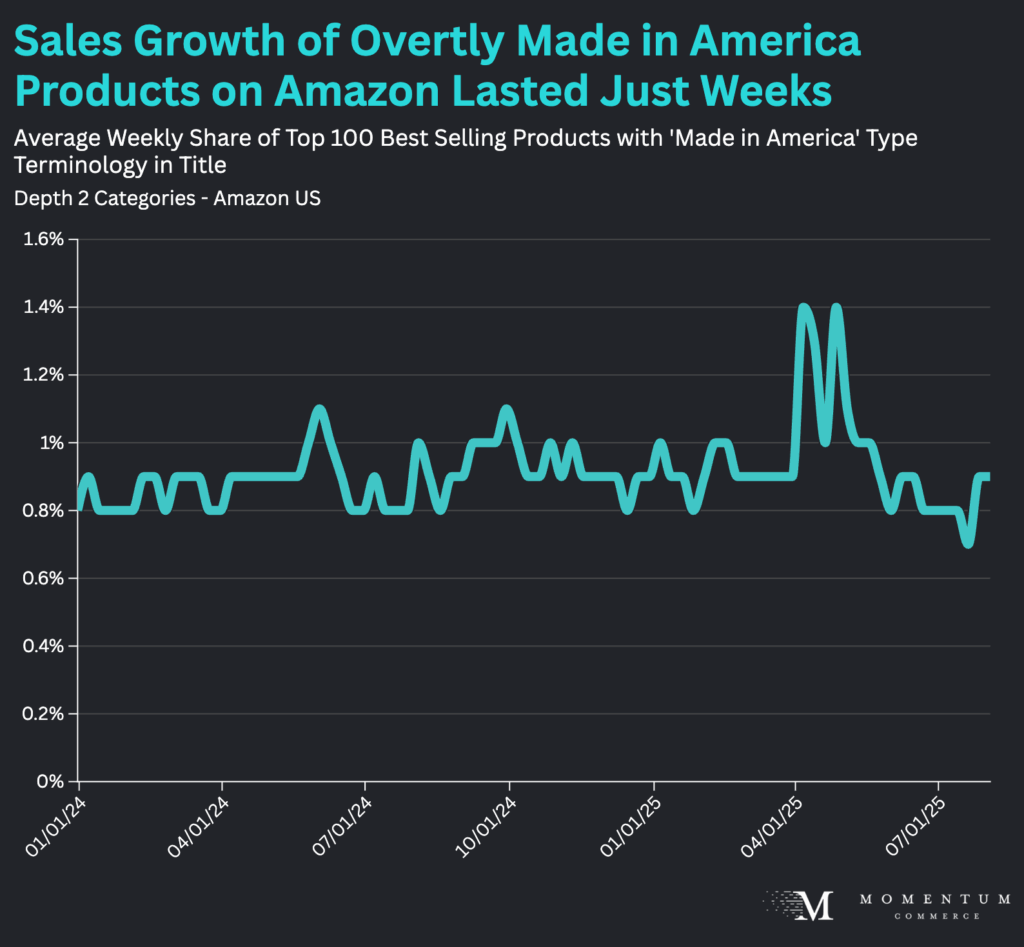

What’s particularly noteworthy is that even during those peak months in terms of search volume, purchase activity of overtly ‘Made in America’ products only surged briefly before trending downwards. Looking specifically at products that achieved a weekly top 100 rank by units sold for every tier-two category on Amazon (e.g. Pet Supplies > Dogs), the average share of products with ‘Made in America’ type terminology in their title never eclipsed 1.5%. Consumers were seemingly curious about looking for ‘Made in America’ type products, but their interest largely stalled there, particularly as the calendar entered June and July.

With the ‘Made in America’ trend on Amazon largely muted, looking abroad there is some anecdotal evidence that Canadian growth is lagging behind the US.

Across Momentum Commerce clients selling in Canada, a sizable majority are seeing growth rates lag behind their US business on the retail site. In many of these same cases, positive YoY US revenue growth is contrasted with negative YoY growth in Canada. This could be an indication that Canadian dissatisfaction with current US foreign policy, which has already impacted sectors like tourism and alcohol, is also extending to other US brands selling in Canada.

Key Lessons for Brands

US consumers on Amazon are hungry for deals, not domestically-made products

- Thanks in part to continuing inflationary pressures, consumers have ‘traded down’ on Amazon largely unabated for the past several months

- The wider purchase trends over Prime Day also emphasized how US shoppers are presumably more deal-conscious, delaying purchases to ensure they have the best discount possible

- Sales trends show that brands can’t rely on trumpeting domestic origins as a meaningful way to drive sales volume

For US brands selling in Canada, be prepared for slower growth and strategic adjustments

- If they are still present, it’s worth considering removing product content for items sold on Amazon Canada that trumpet US origins

- Given larger-scale economic pressures, it may be worth testing additional discounting at the expense of some advertising budget to appeal to more value-conscious consumers who may be more willing to overlook a brand’s US base of operations