What Sets the Best Amazon Product Launches Apart in 2025

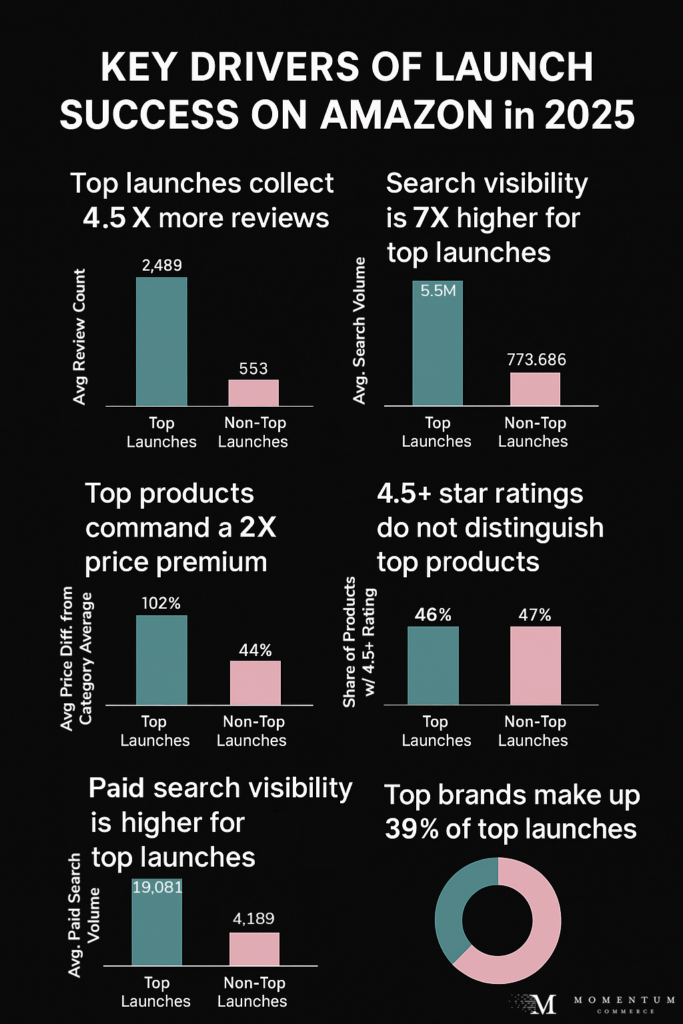

Building on the methodology from our 2024 Top Product Launches study, we took another deep dive to see how the success drivers for new products have changed over the past year. The fundamentals of product launch success on Amazon remain consistent with what we observed in 2024: visibility, review volume, and brand clout all continue to matter. However, the importance of star ratings has diminished considerably.

Our Research Methodology

We analyzed roughly 30,000 products launched in January 2025 on Amazon US, filtering out child variants to focus on unique parent products. Using April 2025 revenue data, we isolated the top 1,000 product launches by revenue growth over that three-month timeframe and compared those products to all other newly launched products in the same cohort.

Star Ratings No Longer Differentiate Top Products

In 2024, top products were much more likely to achieve a high star rating early. In 2025, both top and non-top launches show virtually identical rates of achieving 4.5+ star ratings after three months on the market.

This suggests consumers may be giving more weight to other forms of social proof, like reviews.

Review Volume Still Matters, Especially Relative to the Category

On average, the best-performing product launches had 262% more reviews than the mean within their respective categories. In contrast, non-top launches actually trailed the category average by -2%.

This emphasizes how brands need to remain focused on driving review volume early in a new product’s lifecycle on Amazon. Programs like Amazon Vine can support these activities, but the relatively high cost needs to be taken into account. Fundamentally, this becomes a numbers game. Your ability to drive purchase volume through tactics like paid advertising will naturally increase your review count.

Visibility is (Still) Everything

Search visibility remains a dominant factor associated with new product success on Amazon. On average, top launches consistently outperformed their peers across both organic and paid placements.

- 605% higher organic search volume on average after three months

- 356% more paid search appearances than non-top launches in the same window

Premium Products Generally Make for Better Product Launches

One of the most striking findings this year was that top-performing new products were actually more expensive than their peers.

On average, top launches were priced at nearly 2X the category average. This underscores the importance of both branding and promotional strategy. Amazon US shoppers are willing to pay a premium, but for higher-priced products to succeed they need significant support in terms of effectively communicating the value proposition, level of quality, and achieving high levels of search visibility.

Being a Large Brand is Advantageous, but not Foolproof

39% of top product launches were from brands in the top 1,000 by overall Amazon visibility. By comparison, 21% of non-top launches came from that same cohort.

While big brands had more representation across top launches, the majority of top performers still came from outside the top 1,000. This shows how a well-executed launch strategy can compensate for a relative lack of widespread brand recognition.

Key Takeaways for Brands

- Driving review velocity out of the gate needs to be a major pillar of any product launch strategy

- Consider investing in programs like Amazon Vine as part of launch marketing expenses

- Understanding category averages in review counts prior to launch can help set a realistic goal of doubling or tripling that figure over the first 90 days

- Monitoring growth in overall visibility and search volume is critical

- Track both the search terms where your product currently appears and where key competitive products appear but yours does not

- This will help prioritize additional advertising spend or possible campaign optimizations

- Amazon consumers are willing to pay for quality, even for new products

- Most brands can’t compete with foreign counterparts on price, and the data shows that low pricing shouldn’t be a primary goal for new products on Amazon

- Instead, use limited-time discounts and similar promotions to drive early sales without cutting your baseline price