Tariff Impact Analysis: Beauty & Personal Care on Amazon US

Beauty & Personal Care shoppers on Amazon US are generally choosing lower-cost options on a year-over-year (YoY) basis. Though long-time top selling products in some categories have been able to decrease their prices marginally to keep pace with consumer sentiment, other categories have seen rising prices across historic top sellers, putting pressure on legacy brands. These varying market dynamics are similar to what we’ve observed in other categories.

As the 90-day pause on the bulk of tariffs on Chinese goods continues, it’s unlikely we’ll see massive spikes in ASPs for top-selling products in the near term. However, continued supply chain and inventory challenges make shallower increases a definite possibility. With Prime Day 2025 approaching, these trends will be important to monitor so brands can navigate a changing competitive landscape.

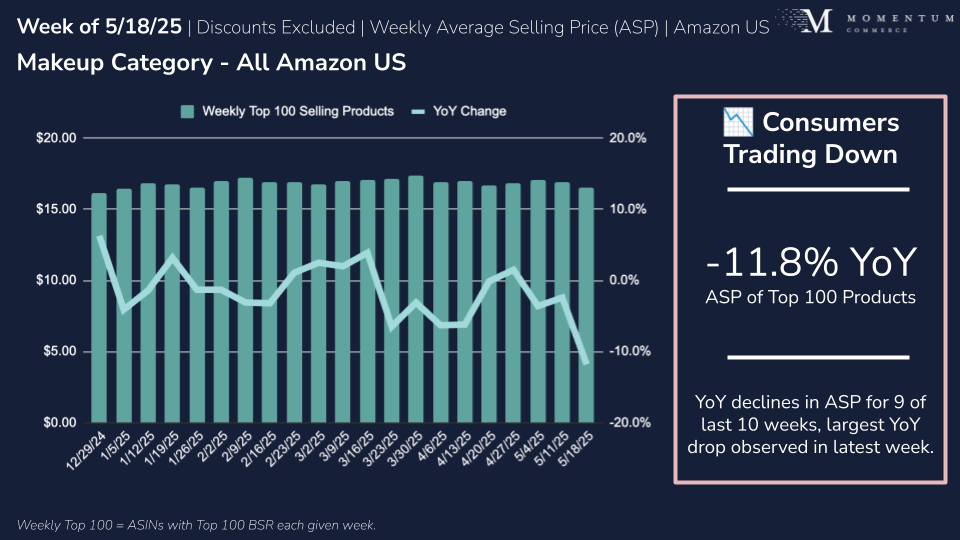

Consumers Pinching Pennies in Makeup

According to Momentum Commerce’s analysis, the weekly top 100 Amazon US products in Makeup saw their average selling price (ASP) decline -11.8% YoY for the week beginning May 18, 2025. This makes nine out of the past 10 weeks where ASPs declined, and the latest week is the sharpest decrease this year.

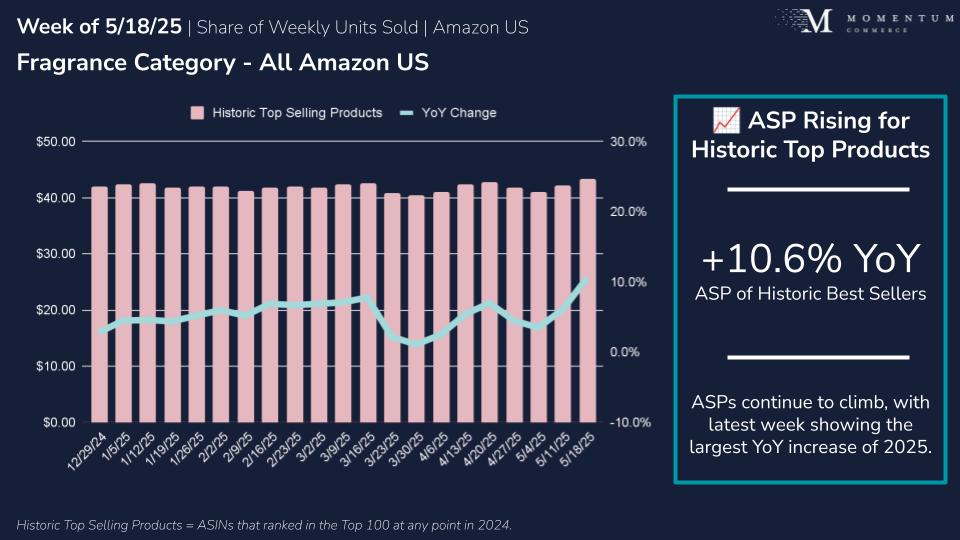

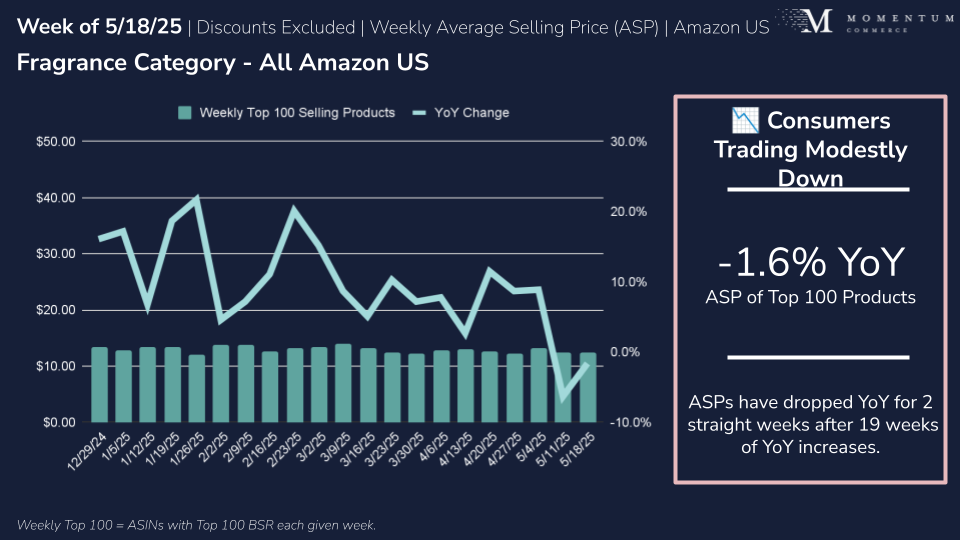

The environment is different in Fragrances. ASPs declined -1.6% YoY, though prices had been rising for most of 2025 prior to the past two weeks. While consumers may be pulling back in Fragrances, the longer-term trend points to some resilience in ASPs. That’s a far cry from Makeup, where shoppers are clearly and consistently reaching for lower-cost options.

Beauty & Personal Care Brands Responding to Consumer Behavior Shifts

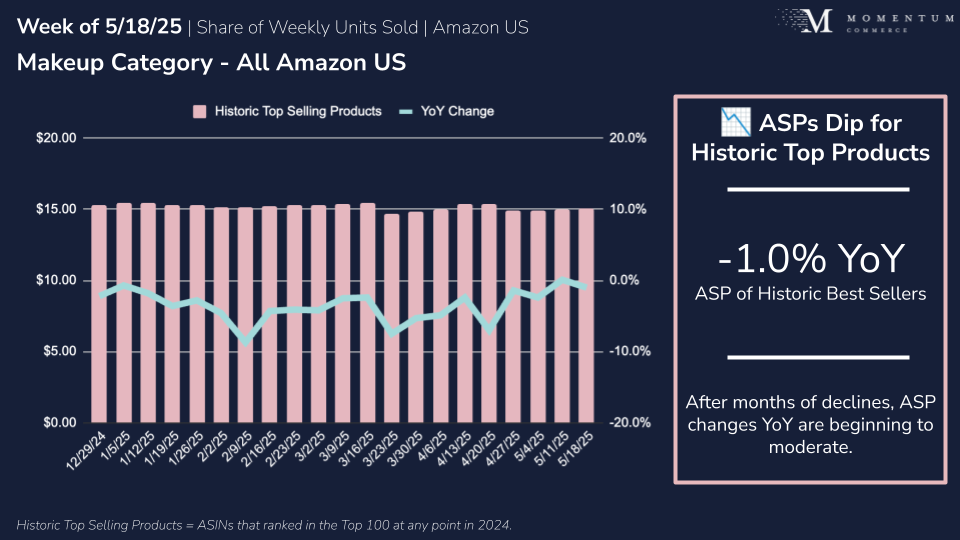

As weekly top product ASPs in Makeup keep declining in the face of changing buying behavior, top brands are trimming prices to maintain competitiveness. Across a consistent basket of Makeup products that achieved a top-100 Best Seller Rank (BSR) at any point in 2024, ASPs dipped -1.0% YoY for the week beginning May 18, 2025. Brands may be tapping out of how much they can flex here, with those declines moderating over the past several weeks.

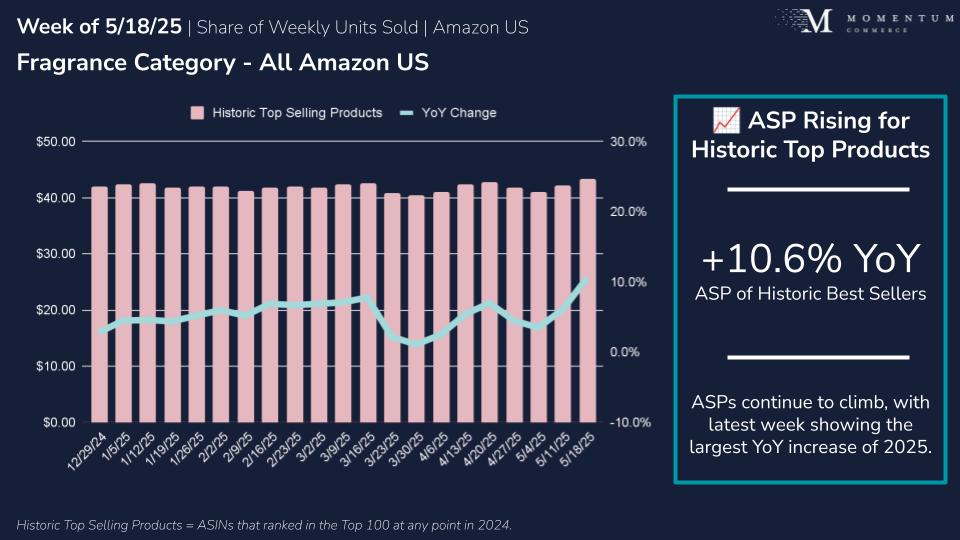

On the other end of the spectrum is Fragrances. Historic top-selling products have continually gotten more expensive, with the latest +10.6% YoY increase being the sharpest of this year. This increase, combined with the decline in weekly top-seller ASPs, widens the gap between how top sellers are priced and what consumers are reaching for most often in the category.

Key Lessons for Brands

Don’t Assume, Know What’s Happening in Your Category Specifically

- While Amazon-wide trends can be a helpful gut-check, any strategic shifts need to reflect the on-the-ground realities within your category

- As Prime Day approaches, brands should calibrate pricing strategies based on category-specific demand elasticity, not broader Beauty & Personal Care averages

- Consider tactics like tracking the ASP of top BSR products over time, along with paying close attention to changes in conversion rates across your premium, mid-tier, and entry-level products

Be Prepared to Adjust as Consumer Sentiment Shifts

- With temporary stability around tariffs, it’s worth reassessing demand planning and promotions given the state-of-play of consumer behavior in your category

- If there are pockets of your catalog that have more inventory and/or margin flexibility, examine where promotions are likely to drive the most uplift so deploying any discounts or additional advertising is as precise as possible