Tariff Impact Analysis: Home & Kitchen on Amazon US

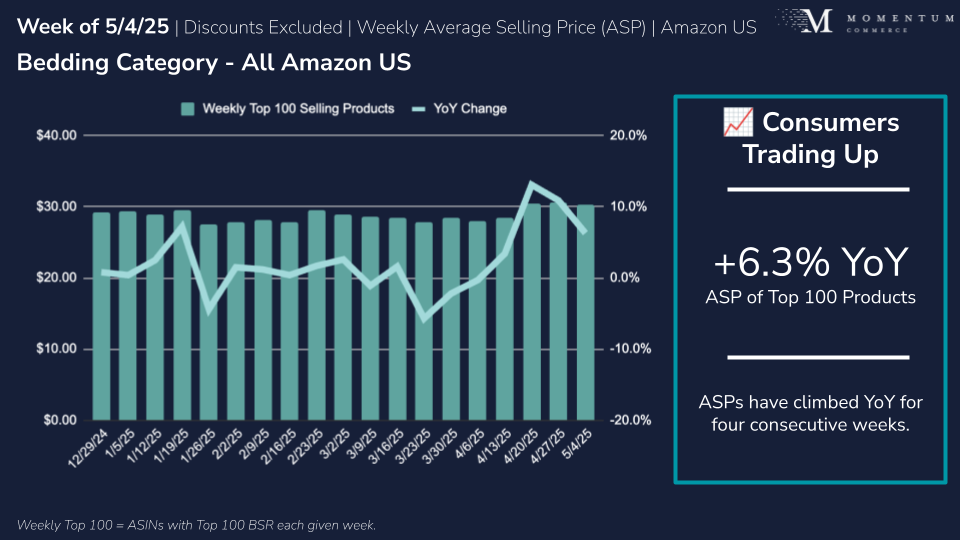

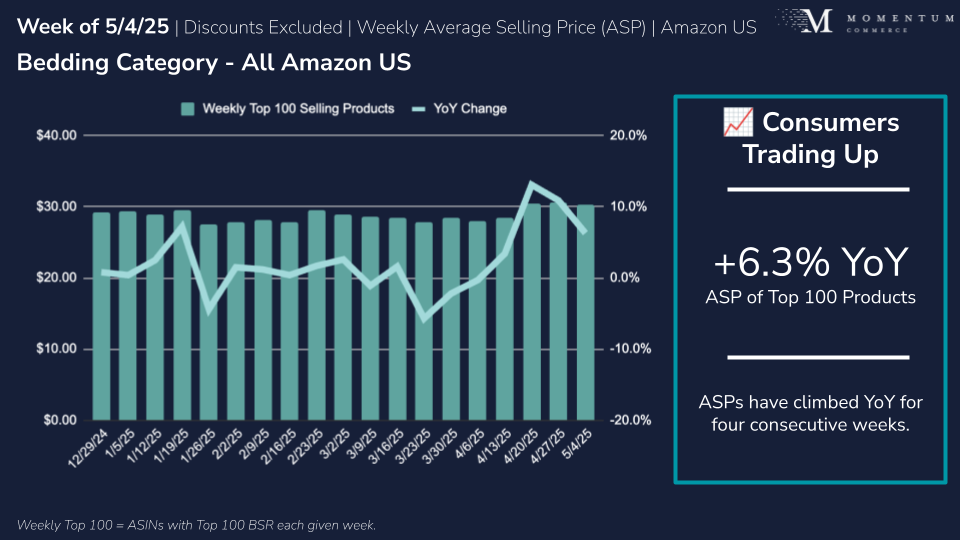

Amazon pricing data reveals contrasting trends across Home & Kitchen subcategories, with consumers trading down in categories like Furniture while trading up in others like Bedding. While some historic top products have seen price decreases, others show significant price increases across subcategories.

With the recent 90-day pause for the bulk of tariffs on Chinese goods, ASPs for historic top products are less prone to spike over the short term, but given supply chain and inventory lead times further, shallower increases are likely. Whether consumers see the pause as a positive economic indicator and begin reaching for higher-priced products more often remains a trend to watch.

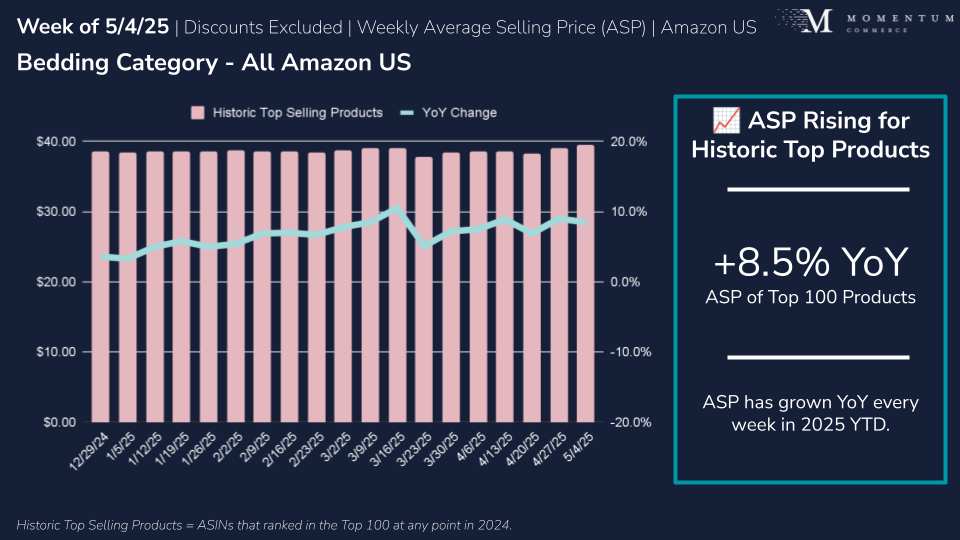

Pricing Strength in Bedding Stands Out

According to Momentum Commerce’s analysis, the average selling price (ASP) of the weekly 100 most popular Amazon US products in the Bedding category rose +6.3% year-over-year (YoY) for the week starting May 4, 2025.

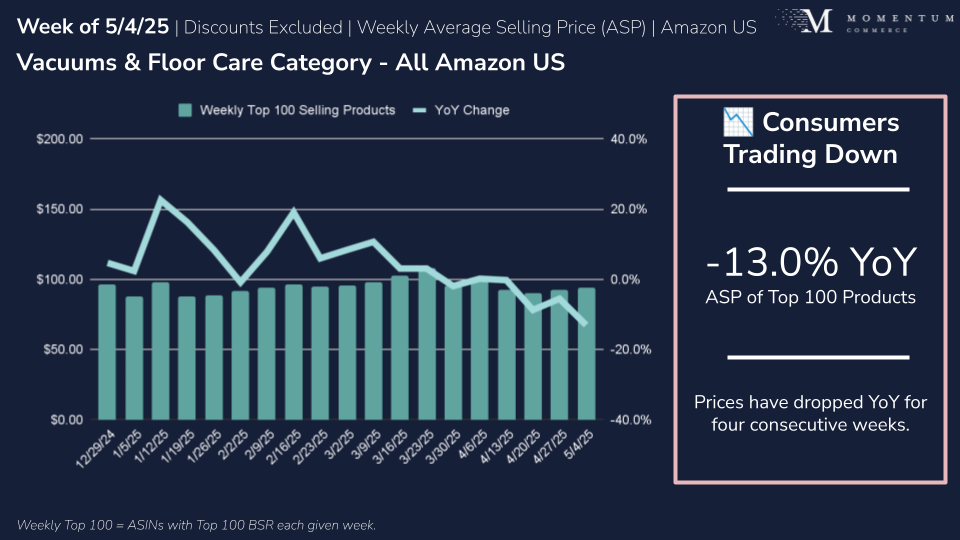

That compares to -16.9% in Furniture and -13.0% in Vacuums & Floor Care. This means that while consumers are actively trading down to less expensive options in the latter two categories, the average buyer is willing to pay a higher price in bedding, potentially hinting at this category being an ‘affordable luxury’ in the face of economic uncertainty.

Rising Prices for Historic Top Sellers Create ‘Double Whammy’

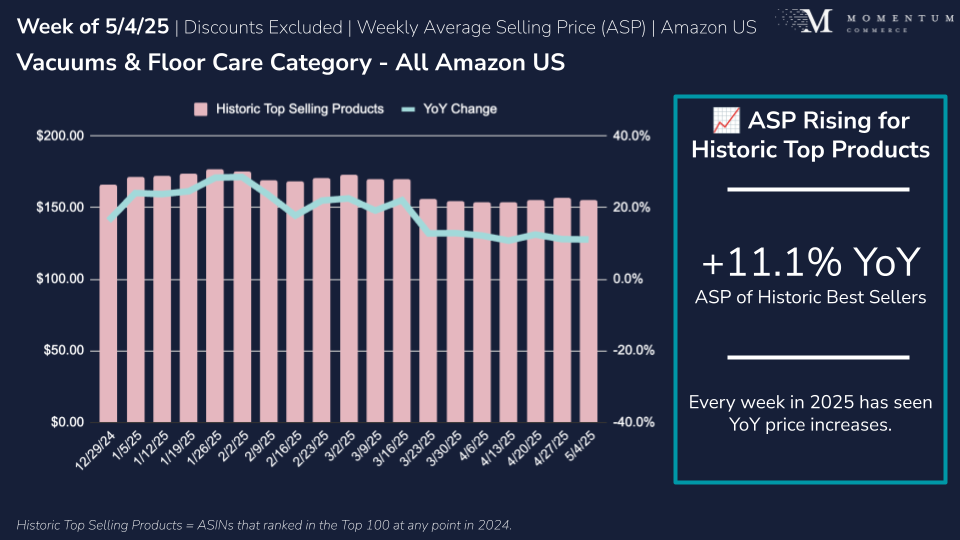

While consumers are choosing less-expensive Vacuum & Floor Care products, historic top selling products in the category are growing progressively more expensive. Across a consistent basket of products that achieved a top-100 BSR at any point in 2024, ASPs rose +11.1% YoY for the week starting May 4, 2025 in Vacuums & Floor Care.

This creates a significant challenge for Vacuum & Floor Care brands: they must maintain market share while consumers seek lower prices and their existing top products become more expensive.

The trend is a bit more nuanced in Furniture and Bedding. In both of those cases, historic top seller ASPs have tracked a bit more closely to the trends observed for the current top sellers. This has resulted in the delta in price between these two figures remaining largely unchanged over time, keeping historic top-selling products price competitive.

Key Lessons for Brands

Don’t Assume, Know What’s Happening in Your Category Specifically

- While Amazon-wide trends can be a helpful gut-check, any strategic shifts need to reflect the on-the-ground realities within your category

- Particularly with Prime Day on the horizon, brands should calibrate pricing strategies based on category-specific demand elasticity, not broader Home & Kitchen averages.

- At a base level, consider tactics like tracking the ASP of top BSR products over time, along with paying close attention to changes in conversion rates across your premium, mid-tier, and entry-level products

Tracking Consumer Sentiment is Critical Going Forward

- While brands may have limited control over Amazon pricing, any reduction in consumer trade-down behavior would significantly impact demand planning and promotional strategy

- Finding pockets of value early (e.g. trending, relevant keywords, doubling down on campaigns yielding higher than expected conversion rates) is what will separate winners from losers in this challenging environment