2023 Amazon Holiday Trends for Beauty & Personal Care: Category Revenue up 27.4%, COSRX’s “Snails’ Pace” Won the Sales Race

This is the first in a series of category-specific recaps focusing on this past 2023 holiday season.

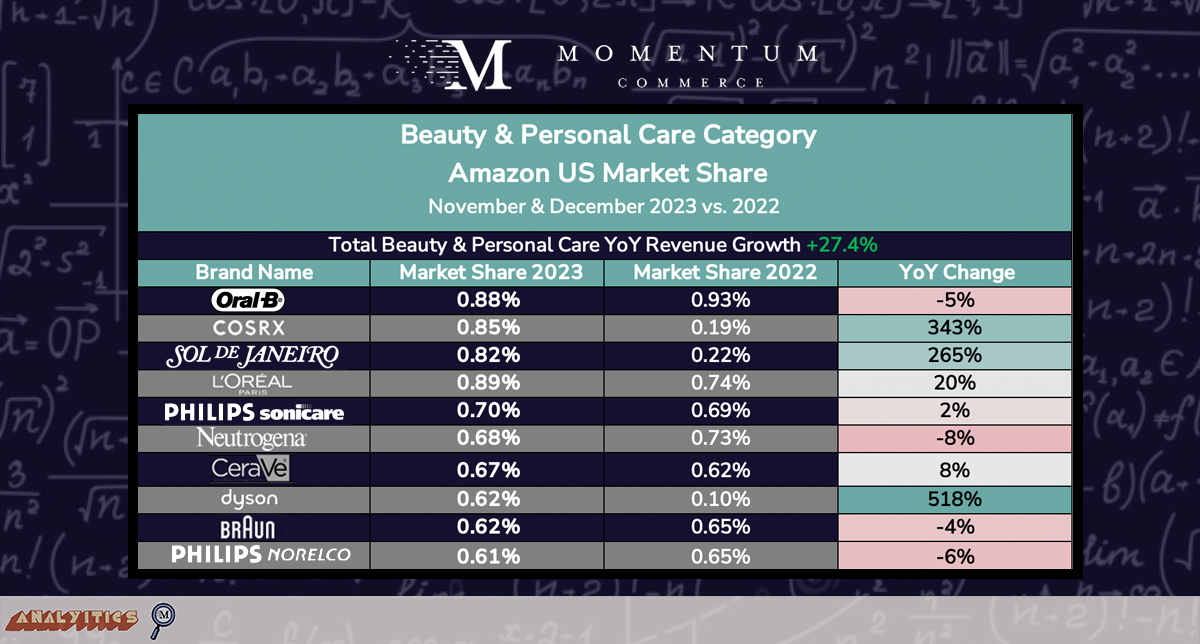

Across November and December 2023, Beauty & Personal Care category revenue grew by 27.4% year-over-year (YoY) on Amazon US, reaching $6.0B, up from $4.7B. The vast majority of top 10 brands in the category exhibited lower average prices than one year prior, speaking to discounts being widely utilized as a key lever for driving purchases this holiday season.

Beauty & Personal Care Amazon US Revenue & Market Share Trends

Looking across the top 10 brands by market share within the Beauty & Personal Care category on Amazon underscores how the breadth of the category naturally means no brand commands a dominating share of overall revenue. Within this context, there was a relatively high level of volatility in market share YoY during the holiday shopping period with multiple brands more than doubling their market share.

COSRX, Sol de Janeiro, and Dyson drove the most dramatic changes in market share YoY. Not surprisingly for this category, both brands have benefitted from social media-driven engagement, with videos featuring Dyson’s Airwrap styling tool accessory alone racking up more than 286M views on TikTok.

Biggest Takeaways for Brands

Volatility in Beauty & Personal Care is both a challenge and an opportunity for category brands on Amazon. The constantly shifting nature of trends and consumer preferences necessitates having the data and corresponding analysis on hand to confidently and quickly shift tactics and strategies, particularly around paid advertising investment, product content, and pricing.

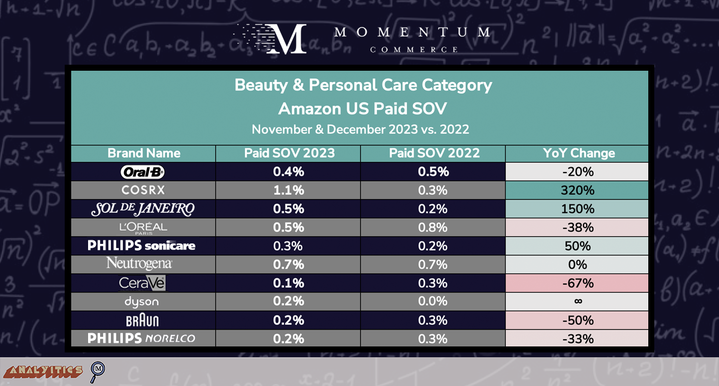

Beauty & Personal Care Amazon US Paid Share of Voice Trends

The paid presence of top brands on top category search terms was perhaps more volatile than the market share changes. Notably, all three of the top YoY market share gainers in COSRX, Sol de Janiero, and Dyson significantly increased their paid presence on category keywords over the same timeframe. While Paid SOV declined YoY for L’Oréal Paris and CeraVe, it’s striking that both brands still drove market share gains, indicating that the decrease in visibility was primarily across terms that were not critical to the health of each business.

Biggest Takeaways for Brands

Given the more branded nature of Beauty & Personal Care, brands gaining popularity are likely going to need to advertise more defensively. But particularly given that ad density in Beauty & Personal Care has declined slightly YoY in aggregate, it can be worth carefully testing pullbacks on branded terms and monitoring the sales impact.

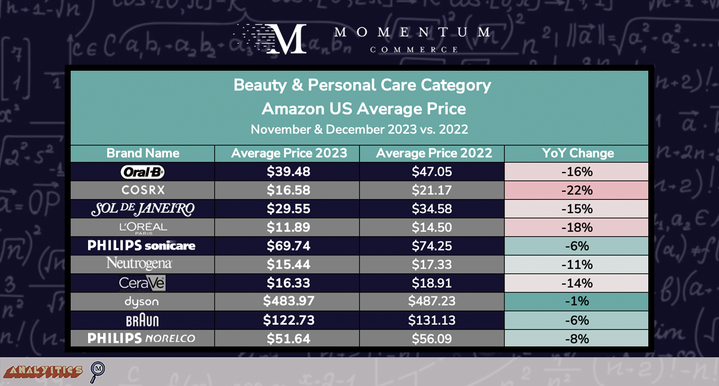

Beauty & Personal Care Amazon US Pricing Trends

Every one of the top 10 brands studied in the Beauty & Personal Care category on Amazon US had lower average prices YoY during the holiday shopping season. The steepest YoY drops came from COSRX (-22%) and L’Oréal Paris (-18%).

Biggest Takeaways for Brands

Despite the discounting across every top brand in the Beauty & Personal Care category, these brands’ most popular products still tend to be priced above their direct competitors in search – what we call a high relative price. This emphasizes how discounting during the holidays should reflect category dynamics, rather than be tied to an arbitrary figure. Tracking relative price, particularly across key products in your catalog, will help inform better decision making, including price elasticity testing, that can identify an ideal discount amount that will position the product well against competitors while not overly depressing margins.

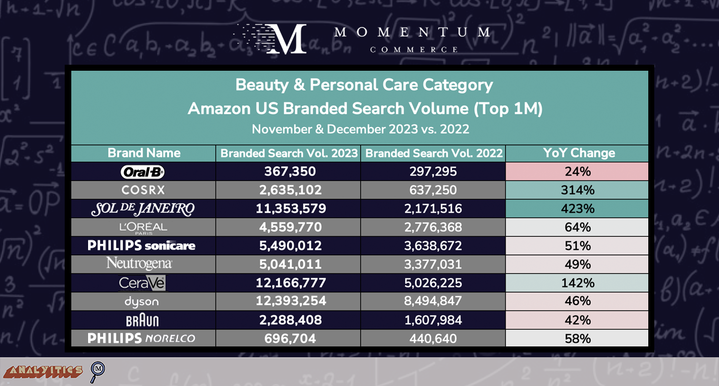

Beauty & Personal Care Amazon US Branded Search Volume

As seen within Momentum Commerce’s Velocity platform, Beauty & Personal Care searches include brand names more often than most categories. And across the top 10 brands by revenue, branded search volume across the top 1 million search terms rose YoY, although the largest gains were concentrated across a handful of brands studied.

Biggest Takeaways for Brands

The influence of social media on branded searches within the Beauty & Personal Care category is particularly strong. As one more example, TikToks featuring Cerave have close to 12B views cumulatively, boosting their branded search volume well into the eight-figure range. This dynamic has allowed Cerave to suffer a dip in Paid SOV but still grow their market share. Brands seeing similar rising trends between their social media attention and branded search traffic on Amazon should consider similar strategic tests around paid search to improve overall margins and potentially reallocate budgets towards top-of-funnel initiatives.