2024 Prime Day Sales Shifted Significantly Towards Day 2

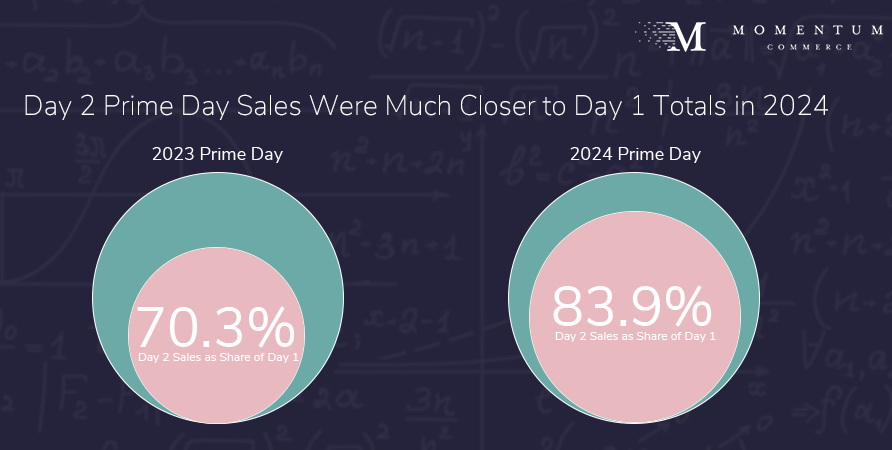

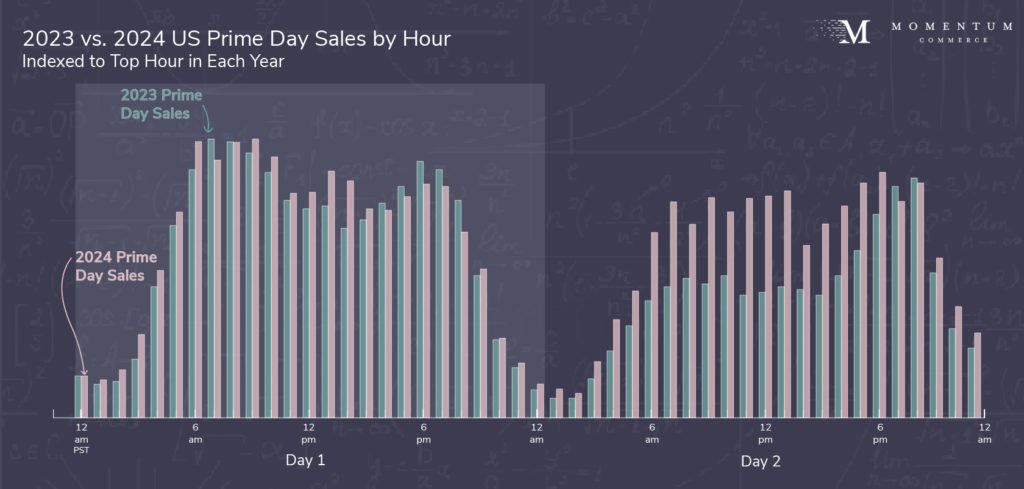

Our initial hourly view into Prime Day sales showed how in 2023, sales were significantly weighted towards day 1 of the event – something brands had largely come to expect from Prime Day as a whole. For the 2024 event, with sales up roughly 14% year-over-year, the first day was still larger, but the gap between day 1 and day 2 shrank significantly. Median day 2 sales in 2024 were 83.9% of the day 1 figure – in 2023, that number was only 70.3%.

This change manifested at an hourly level with a much stronger start to the second day of the sale event, despite the evening peak being around the same level as 2023.

Biggest Takeaways for Brands

- Changes in what consumers buy on Prime Day is impacting when they buy

- In 2024, an increasing percentage of Prime Day sales went to household, clothing, and back-to-school categories which differ from ‘big ticket’ items whose deals may be more limited in number and sell out quickly

- Relatedly, more discounts were present across the site as a whole, which likely also helped sustain higher sales throughout both days

- In 2024, an increasing percentage of Prime Day sales went to household, clothing, and back-to-school categories which differ from ‘big ticket’ items whose deals may be more limited in number and sell out quickly

- The increase in day 2 sales makes it even more critical to retain budget flexibility throughout Prime Day

- The overall jump in 2024 Prime Day sales may have pushed brands to exhaust much of their ad budgets on day 1, potentially hampering their day 2 trajectory

- Given that more shopping is shifting to later in the event, brands need to either reserve more ad budget towards day 2 or preferably, have the flexibility to increase budgets when performance dictates

- The latter case is made possible through Amazon’s new hourly data feed (with the latest round of technical difficulties hopefully being ironed out by 2025)