3P vs. Distributorships: Avoiding Pitfalls

A brand endures countless decisions before finally selling on Amazon — choosing a seller plan, solidifying a fulfillment method, listing products — the list continues. But one early decision many overlook could have a decided long-term negative impact on the business. A number of businesses choose to tap distributorships, granting them the power to sell the brand’s products on Amazon. While this can drive a short-term cash infusion, it likely also means losing out on upwards of millions of dollars in revenue versus choosing to sell 3P on Amazon themselves.

The Story

Distributorships can be a very attractive arrangement for up-and-coming businesses. Third-party resellers offer a large paycheck with minimal stress to sell a brand’s products on Amazon. Brands often believe that choosing this option will give them more leeway to focus on D2C selling while their Amazon sales are being managed.

However, by accepting the large upfront payment, brands could be sacrificing profit in the long term. There is more margin to be gained from a brand selling 3P themselves on Amazon, and even if the decision to sell 3P is made later on, once a brand sells their products to a distributorship, any lingering inventory of gray market products make selling on Amazon much more difficult for the brand themselves.

We’ve dealt with this phenomenon across a number of brands we work with at Momentum Commerce. Buy Box win rates become tenuous, necessitating further promotions and erosion of margin, and this cuts into advertising success as well.

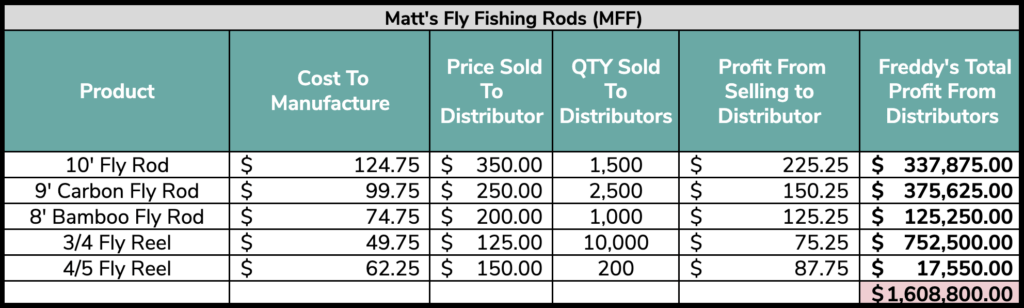

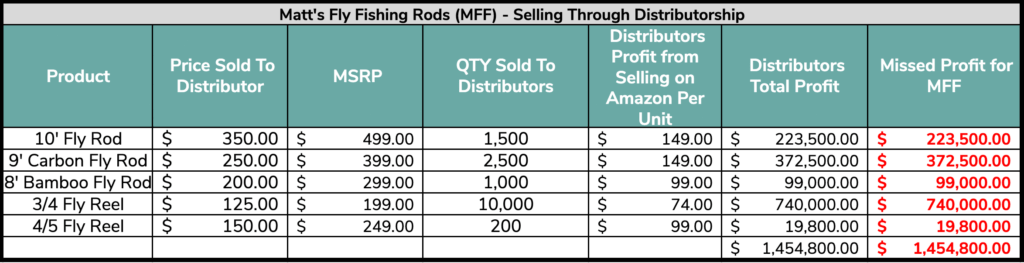

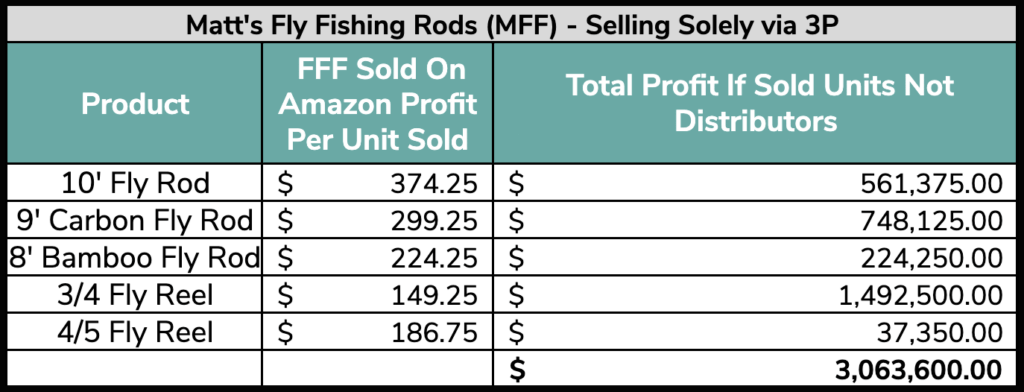

To help illustrate why brands need to tread carefully before entering into distributorship agreements for Amazon, the team at Momentum Commerce analyzed real data over a given quarter, as well as a yearly view. We anonymized the data and changed prices by equal percentages so you can understand the costs associated with a brand selling third party, versus selling to a middleman and granting them the power to sell.

The Research

- In a quarterly view, MFF missed out on almost $1.5 million in revenue by selling 3P themselves.

- In a yearly view, MFF could have earned about 80 million in revenue but lost out on 13.7 million by selling 3P ‘in-house’.

- Freddy’s missed out on selling about 135,000 units of product in the yearly view.

- By electing a distributorship, about 75,000 units that did not sell on Amazon could have been sold to brick and mortar stores within the year.

- This creates a long-term issue with gray market products in the market, potentially competing with MFF on Amazon for years to come – whether or not they stick with the distributorship arrangement

Biggest Takeaways for Brands

- Generally, if your brand has higher-priced products, it is less beneficial to have a distributorship, as the additional potential margin has more dramatic knock-on revenue effects (e.g. gray market resellers)

- Products with tighter margins or lower price points generally may get more net benefit from leveraging a distributor who will need to deal with the challenges selling on Amazon with less room for error

- Allowing resellers to sell your product gives them complete control over pricing and PDP content. Brands should keep this in mind when factoring in profits from distributors.

- Overall, each brand has its own unique needs. There is no ‘one-size-fits-all’ when it comes to selling 3P versus distributorships

- We’ve helped brands newer to Amazon navigate this question using hard data and longer-term planning – if you’re interested in learning more about what we’ve done here, shoot us a note at hello@momentumcommerce.com

- For more information on selling on Amazon, including sample P&L statements that can help contextualize this for your own business, visit our 2023 ‘How to Sell & Win on Amazon’ guide.