Momentum Commerce 360: Amazon Grocery & Gourmet Food Category

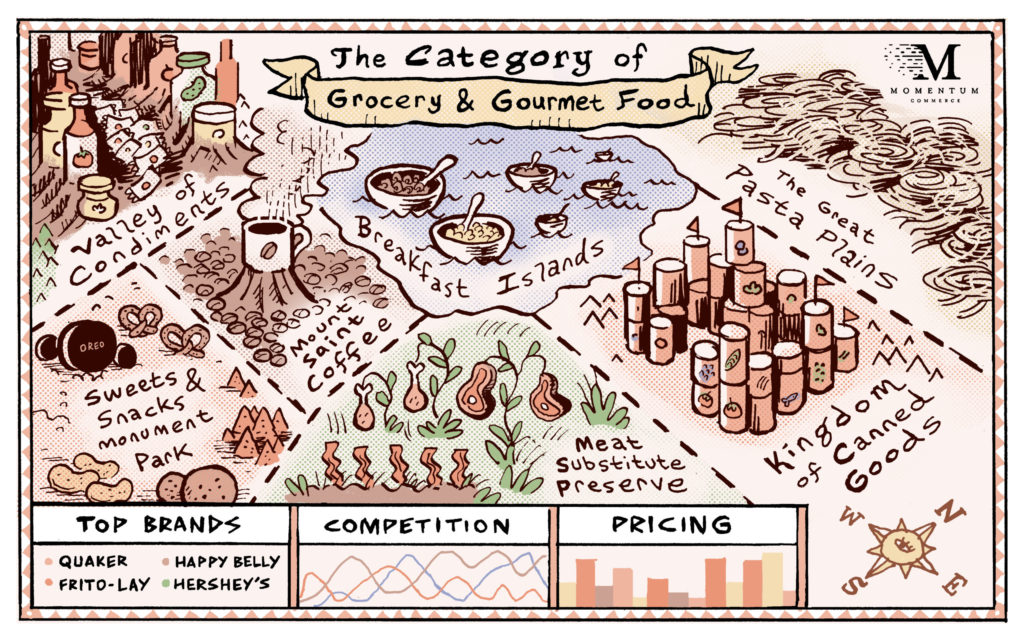

The Amazon Grocery & Gourmet Food category, which consists of shelf-stable grocery items shipped via the retailer’s more traditional warehouse model, experienced tremendous growth over the course of 2020 and 2021. However, with increased growth comes increased competition, and the latest benchmarks for the category and associated subcategories demonstrate how this is manifesting itself through two larger trends.

This Momentum Commerce 360 report outlines how large national and multinational food brands are expanding their paid advertising investments on Amazon and capturing larger shares of paid share of voice (SOV) across a number of categories. However, upstart and digital-native brands are having some success achieving organic SOV gains versus global brand name competition.

This dynamic underscores larger challenges for food brands selling on Amazon. Capturing top slots on popular, relevant search terms through Sponsored Products or Sponsored Brands will become increasingly, and possibly prohibitively, expensive due to growing spend by larger brands. This necessitates food brands taking a dogged focus to data-informed decision making around their advertising strategy and picking their spots effectively.

Finally, BSR survivorship, which measures how well a given product can maintain a top BSR over time, is remarkably stable in the Grocery & Gourmet Foods category. This indicates that brands newer to the Amazon Grocery & Gourmet Food category have a tougher time capturing market share from the existing competition on the retail site.

Fill out the form below to download the full report, and check out our Amazon Brand Index tool for even more SOV data.

What’s in the Report:

- Category and sub-category paid and organic SOV data

- March 2022 vs. September 2021 comparisons

- Top organic, paid, and fastest-rising brands by category and sub-category

- 3, 6, and 12 month BSR survivability rates in the Grocery & Gourmet Food category

- Key strategic and tactical takeaways from this data for Grocery & Gourmet Food brands