Amazon Mythbusters: “New Brands Can’t Succeed on Amazon – it’s Too Saturated”

With the (purported) imminent return of noted Amazon holdout Nike to Amazon US, it’s a good time to revisit a common trope that brands that aren’t currently selling on Amazon should stay away from the marketplace. The theory here is that for new brands, with no sales history on Amazon, success will be unattainable due to the saturation of existing brands with millions of dollars in Amazon sales, thousands of reviews, established share of voice, etc.

Channeling our inner Adam Savage and Jamie Hyneman we can test this myth with actual historical sales data. Specifically, we examined the 1H 2024 Amazon US revenue of more than 3,000 brands that began selling on the retail site after January 2023.

Overall, 78% of the brands studied had already driven more revenue through the first five months of 2024 than the entirety of 2023, and 11.2% have already sold more than $1M on the US site in 1H 2024.

One caveat is that a sizable percentage of these brands are Chinese sellers, who typically have the distinct cost advantage of shipping directly from a manufacturing warehouse to Amazon.

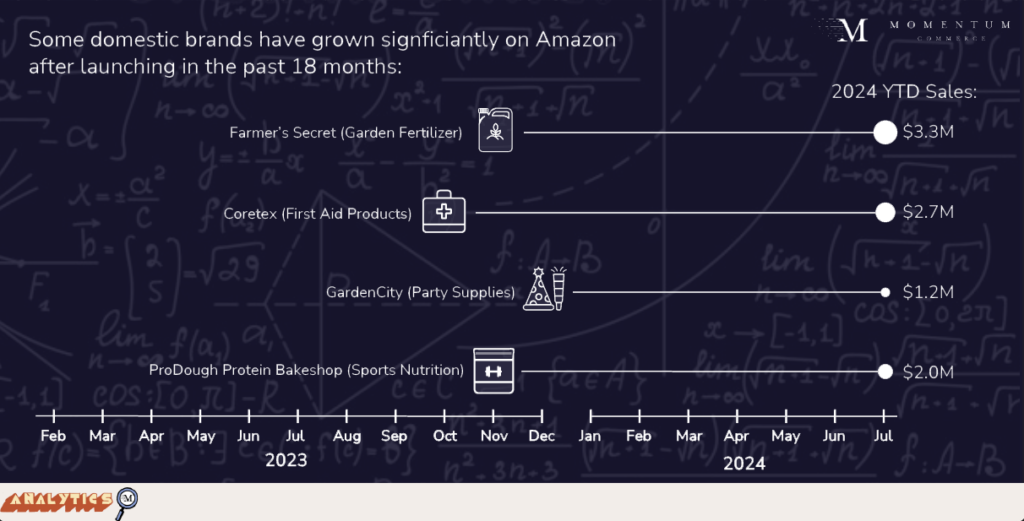

However, there remain plenty of domestic brands, like the examples below, that have grown significantly on Amazon after launching in the past 18 months.

Looking a bit deeper, the fast-growing new Amazon brands displayed significant differences from their declining counterparts across two key areas.

Biggest Takeaways for Brands

- The myth that new brands on Amazon can’t succeed is busted

- You don’t even need to beat potential competitors on price to win on Amazon as a new brand

- Top-performing new brands are generally priced around the category average

- If your brand has a flourishing D2C presence, it’s particularly well positioned to succeed on Amazon

- Branded search is a key element of product success on Amazon, particularly for new brands that get the most marginal utility out of any increases in branded search

- In many cases, brands that don’t sell on Amazon still get branded search traffic on Amazon – with Nike, Lululemon, and Birkenstock being some of the biggest examples

- Once you begin selling on Amazon, you can immediately take advantage of this traffic (rather than allowing competitors or resellers to own top search results)