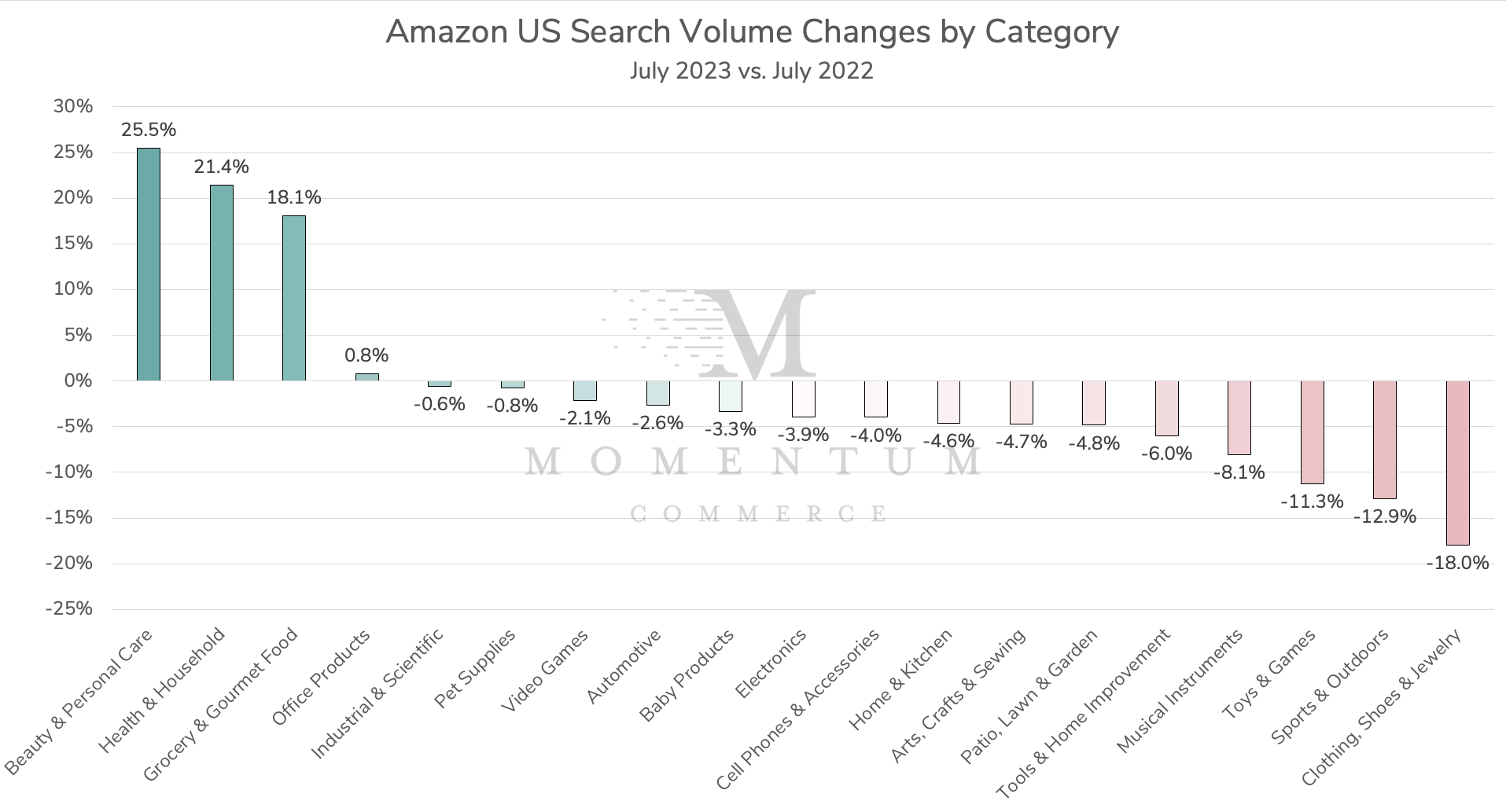

Amazon US Search Volume Drops 2.4% Year Over Year in July 2023

Amazon US search volume continued its gradual downward YoY trend observed across multiple Momentum Commerce analyses, dipping by 2.4% in July 2023. However, big traffic gains by CPG categories in particular demonstrate how the strengths of Amazon are shifting despite the larger traffic decrease. Meanwhile, bigger-ticket categories still dominate the Prime Day period, helping make for a historically strong sale event on the site.

Biggest Takeaways for Brands

- Beauty & Personal Care continues its ascent on Amazon US

- This latest July analysis is the fourth-straight period analyzed by Momentum Commerce where Beauty & Personal Care posted the largest YoY search volume increase of any category on Amazon US

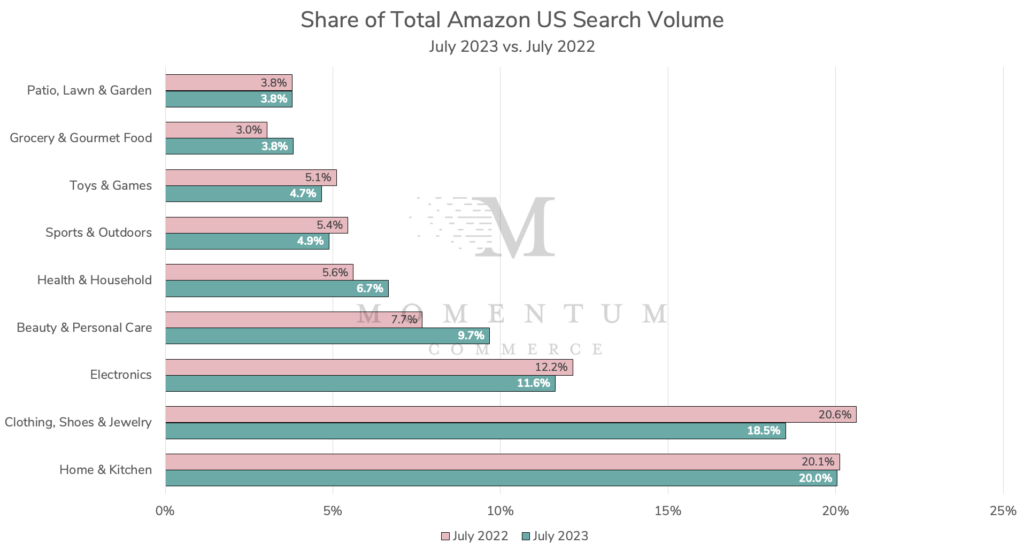

- The Clothing, Shoes & Jewelry category is under pressure

- The -18% YoY decrease in search traffic pushes Clothing, Shoes & Jewelry behind Home & Kitchen – the new most-searched category on Amazon

- While Clothing, Shoes & Jewelry search volume had held largely steady in past analyses, this latest dip points to a decided consumer pullback by consumers within the category

- How this trend develops in the fall and winter will be worth watching to demonstrate whether this was more than just a momentary dip in activity in the summer months

- CPG generally is becoming a source of strength on Amazon

- The Beauty & Personal Care (+25.5%), Health & Household (+21.4%), Grocery & Gourmet Food (+18.1%) categories have seen the sharpest percentage increases in their share of total Amazon search volume over the past year

- These categories now account for a collective 23% of Amazon search volume – up from just 18.3% one year ago

- Grocery & Gourmet Food now commands the same share of Amazon US search traffic as the Patio, Lawn & Garden category

- The Beauty & Personal Care (+25.5%), Health & Household (+21.4%), Grocery & Gourmet Food (+18.1%) categories have seen the sharpest percentage increases in their share of total Amazon search volume over the past year

- This shift underscores how consumers are slowly shifting what they shop for on Amazon US

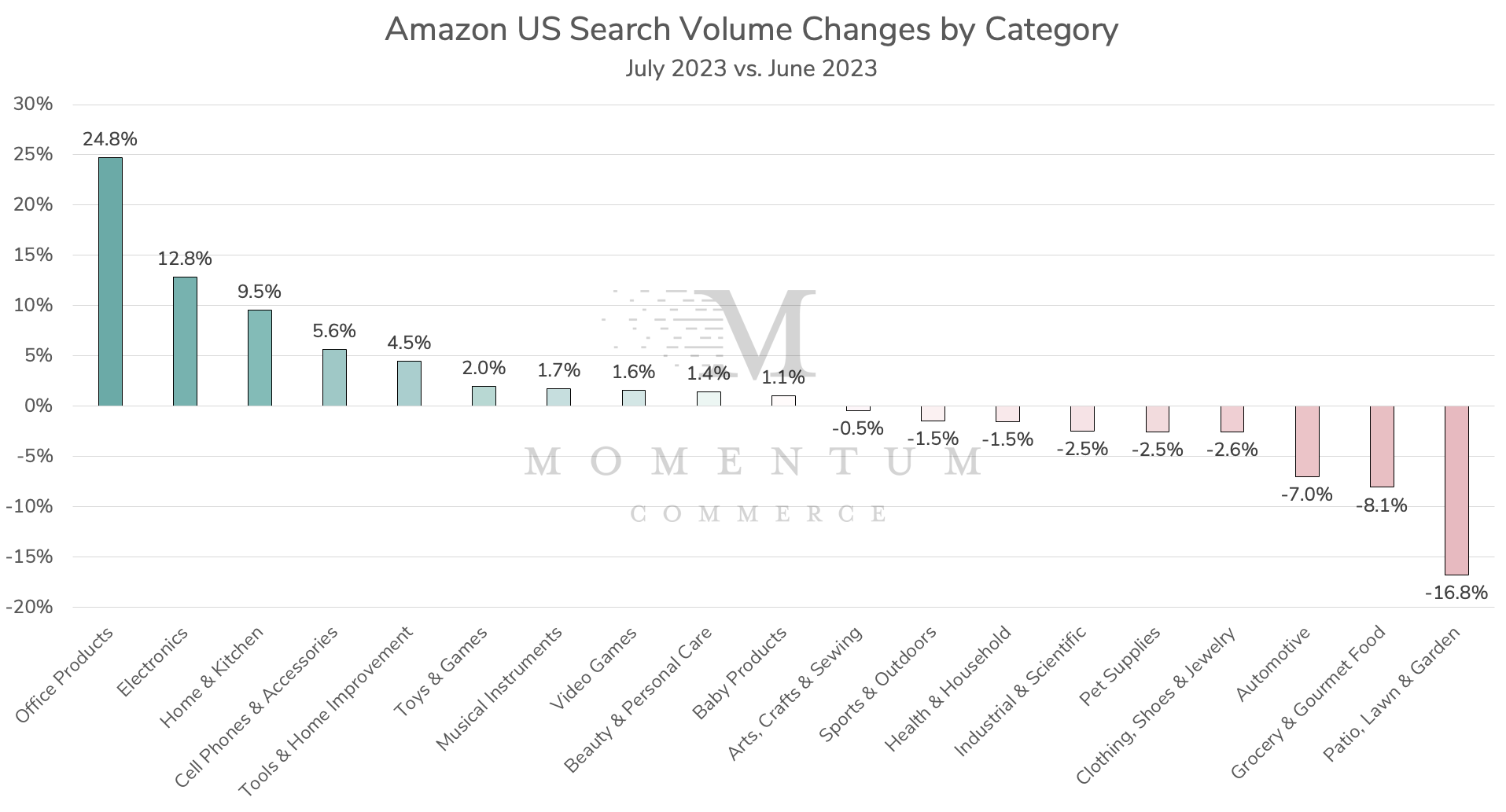

- Month-over-month (MoM) data shows search volume increases for ‘bigger-ticket’ categories generally associated with Prime Day – Office Products (+24.8%), Electronics (+12.8%), and Home & Kitchen (+9.5%)

- Yet, on a YoY basis, Electronics (-3.9%) and Home & Kitchen (-4.6%) search volumes underperformed Amazon US as a whole

- Given recent trends, it’s reasonable to expect search volume within Beauty & Personal Care to surpass Electronics within the next year

Methodology

Data included in this analysis is based off of search volume estimates across the top 1,000,000 search terms on Amazon during July 2022, July 2023, and June 2023. Search terms were categorized based on the top-level category associated with the majority of products appearing on the corresponding search results pages.

These models reflect the updates Amazon has made to their own search volume methodologies within Search Query Performance metrics. This includes all historical search volume estimations within this analysis.