Momentum Commerce Category Deep Dive: Amazon US Skincare Category Revenue Grows 21% YoY in 2024

With Amazon’s US skincare sales growing 21% YoY in 2024, social media-driven brands are finding new ways to challenge established players. Here’s how they’re turning viral moments into market share.

The battle for Amazon’s skincare market is intensifying, with both legacy players and emerging brands vying for dominance. While seasonal patterns like holiday gift-giving continue to drive predictable spikes in demand and certain search terms, social media is creating new opportunities for challenger brands to gain market share.

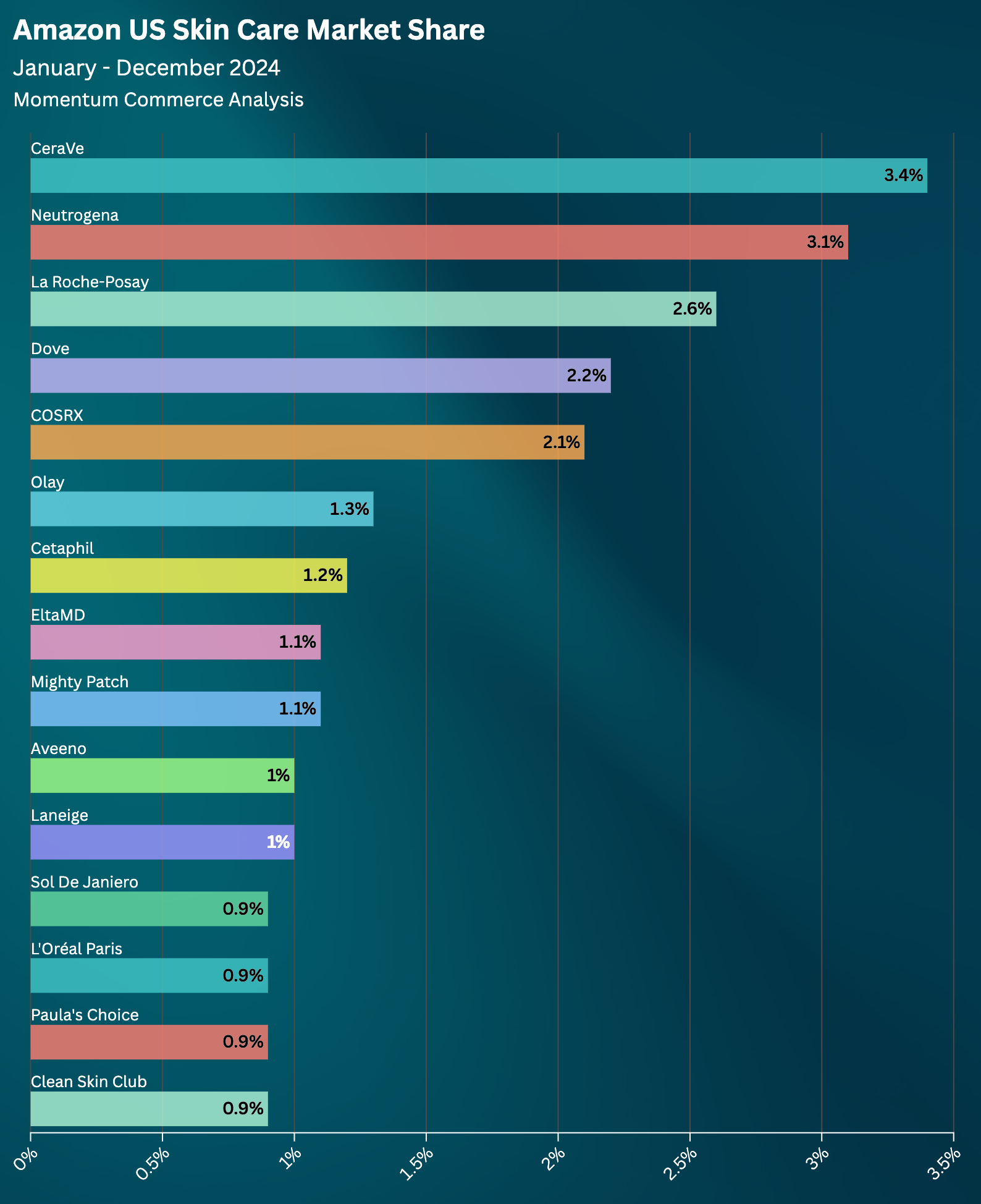

Overall, the competitive landscape saw significant shifts throughout 2024. Despite slight YoY drops, legacy, multinational brands like CeraVe and Neutrogena held their positions as top market share leaders in 2024. However, there was a great degree of volatility below these leading brands. YoY market share gains were sharpest across La Roche-Posay (+0.5%), while independent brand COSRX saw a steep -0.5% drop over the same period.

Meanwhile, a number of newcomers spent periods of time amongst the top market share leaders, piquing our interest for a deeper analysis.

The most searched niches in the skin care category across the entirety of 2024 were mixed between very specific branded search topics and more generic, use-case oriented product searches. This underscores how the skin care category is driven both by clear consumer needs – where legacy brands have a clear advantage – and social-media fueled brand discovery – where independent brands can make their mark.

A New Competitive Playbook: The Laneige Case Study

While established brands like Neutrogena and CeraVe maintained their market leadership through traditional advantages in advertising, visibility, and pricing, Korean beauty brand Laneige demonstrates how social media popularity can be strategically leveraged into marketplace success. Their growth through 2024 offers valuable insights into the evolving dynamics of Amazon’s beauty category.

The TikTok-to-Amazon Pipeline

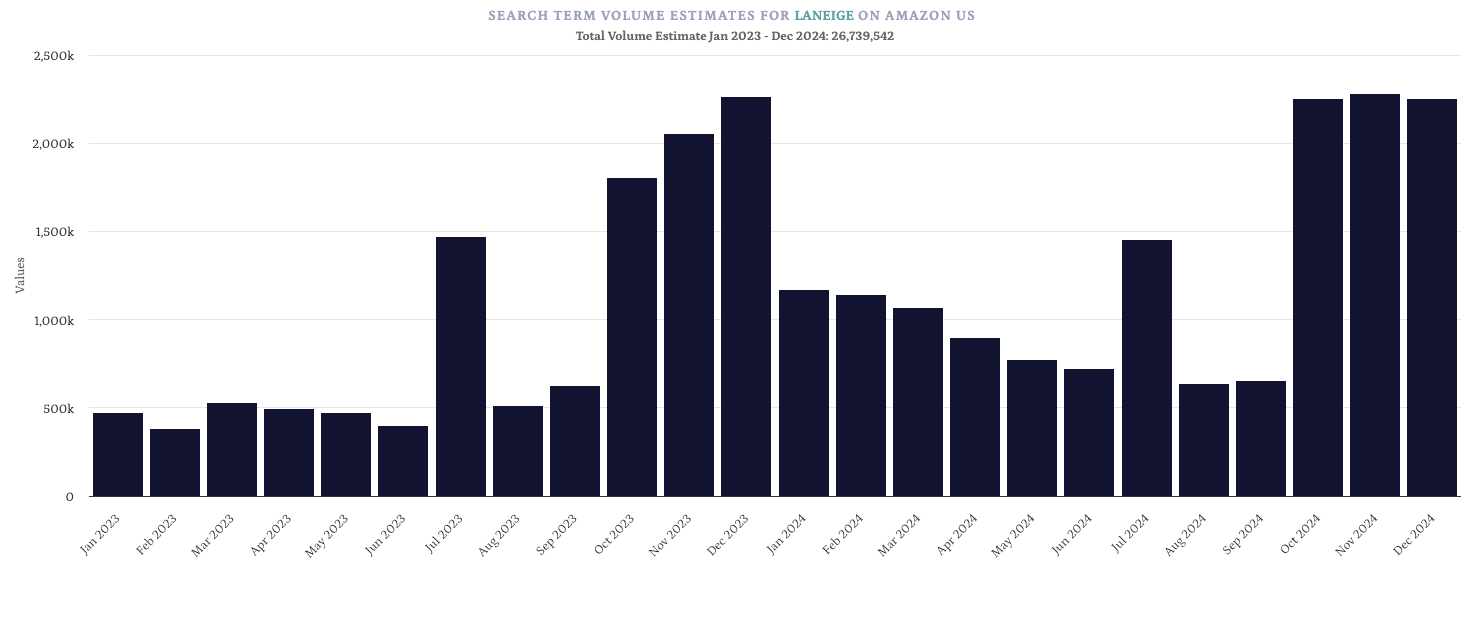

Laneige’s success in 2024 demonstrates how social media momentum can translate into marketplace performance when properly leveraged. Three key elements defined their strategy:

- Converting Social Buzz to Search Demand

Laneige generated three consecutive months of record-breaking branded search volume on Amazon

- This surge coincided with significant TikTok visibility for their products

- The brand protected its advantage through comprehensive branded search advertising

- Strategic Seasonal Execution

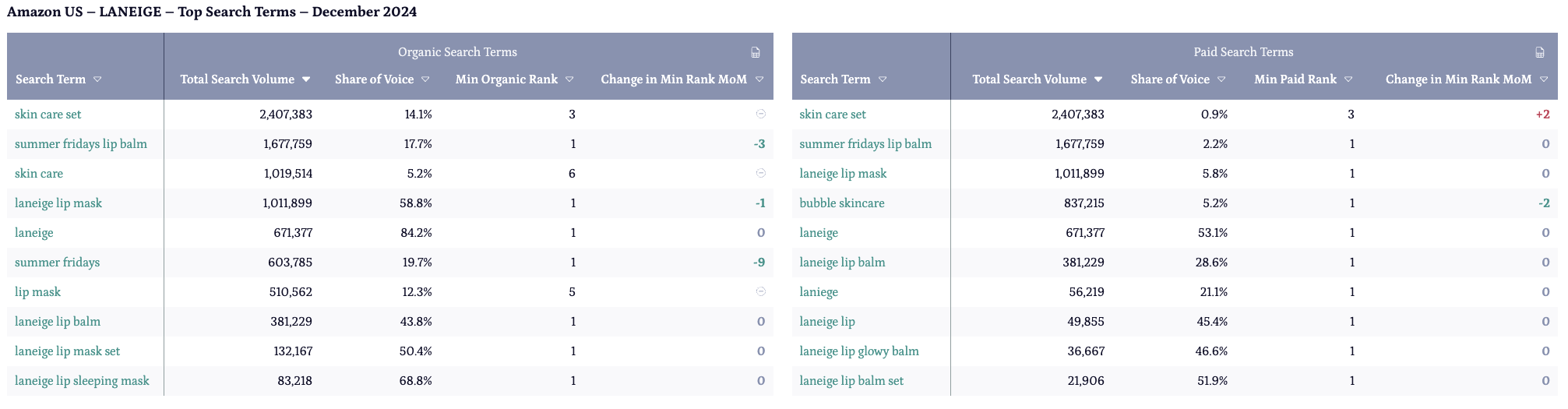

During the critical December shopping period, Laneige demonstrated sophisticated marketplace tactics:

- Secured top paid placement for high-volume seasonal terms like “skin care set”

- Converted this paid visibility into organic success, climbing to the 3rd organic position

- Successfully executed conquest strategies against competitors like Summer Fridays

- Even achieving a top organic rank on that same competitor term during the month, likely in part due to significant sales velocity driven by the paid placement

- Converting Visibility into Sales Velocity

The brand’s paid search strategy created a virtuous cycle:

- Paid placements drove initial sales velocity

- Increased sales improved organic rankings

- Better organic visibility led to sustained performance even after reducing ad spend

Key Lessons for Brands

- Connecting Social Media to Retail Strategy

- Viral moments create opportunities but require immediate action on marketplaces

- Brands must protect their branded search terms when social media attention spikes

- Regular monitoring of both organic and paid placements is crucial (tools like Velocity can help track these metrics)

- Strategic Resource Allocation

- Emerging brands should focus on surgical precision in their marketplace approach, and be willing to double down when performance indicates additional running room

- Key areas for investment include:

- Strategic paid search campaigns during periods of high social media visibility

- Optimization of product detail pages for both search and conversion

- Careful monitoring and defense of branded search terms once those terms are driving significant search volume

- Playing to Strengths

- Instead of trying to match established players on price or product breadth, emerging brands should:

- Focus on the brands unique value proposition and ensure that’s reflected lovingly in product content

- Capitalize on social media momentum when it occurs with increased paid search ad investments

- Promote newer- or higher-margin products on branded terms, trending or popular products on competitor or generic terms

- Build strong brand recognition through consistent marketplace presence

Looking Forward: The Growing Importance of Data-Driven Partnership

As Amazon continues to evolve, the complexity of adjusting tactics and strategies based on changing competitive dynamics has increased exponentially.

Success in this environment increasingly depends on two critical factors:

Real-Time Data Intelligence

- The ability to spot emerging trends before competitors

- Sophisticated tracking of competitive positioning across both paid and organic placements

- Granular analysis of category-specific seasonal patterns and promotional effectiveness

Experienced Strategic Support

- The landscape has become too complex for most brands to navigate alone

- Leading brands are partnering with agencies that combine:

- Deep marketplace expertise and category-specific knowledge

- Advanced data analytics capabilities

- Proven track records in translating consumer behavior changes into marketplace success

- Teams experienced in executing rapid response strategies during crucial moments

Brands that pair their internal capabilities with the right agency partner are best positioned to win in this new environment. At Momentum Commerce we offer both sophisticated data insights and experienced marketplace execution, positioning our brand partners to capitalize on opportunities as they emerge.

Interested in learning more about your brand’s performance, and your best, specific opportunities for growth? Let’s schedule a time talk.

This is the first in an ongoing series of monthly reports across key Amazon US subcategories. To view all reports as they are published, click here.