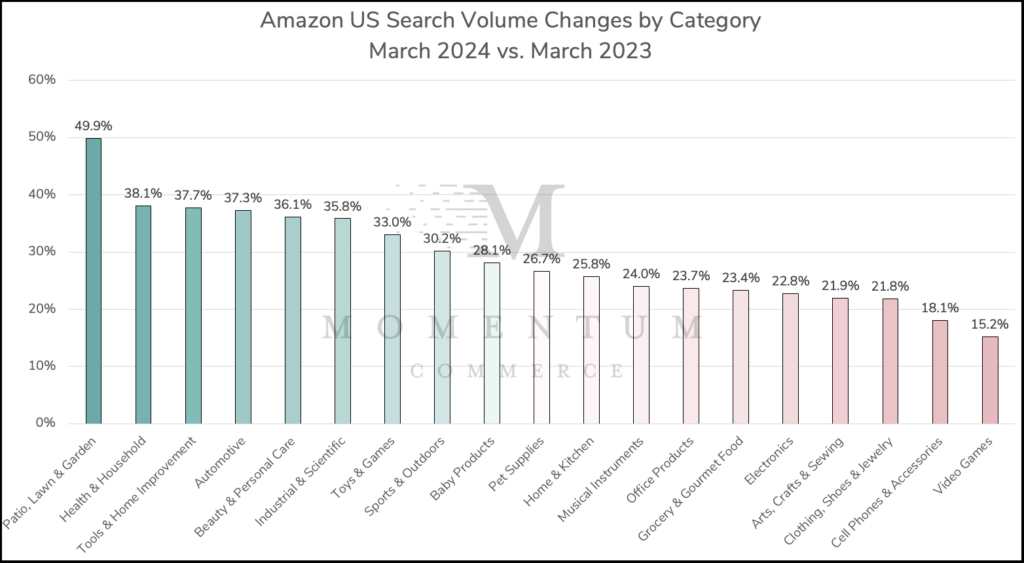

Amazon US Search Volume Climbs 29.2% YoY in March

Amazon US search volume climbed by more than 29% year-over-year in March 2024 – the seventh -consecutive analysis by Momentum Commerce showing a year-over-year (YoY) traffic increase. The +29.2% figure is also the largest YoY increase measured to date, beating the +26.6% YoY tally from the previous month. March also makes four straight analyses where every category studied posted a YoY traffic increase. While the annual search volume increases were large, there was a more modest 1.6% month-over-month gain compared to February 2024.

Biggest Takeaways for Brands

- Despite the growth of emerging platforms like TikTok Shop, Shein and Temu, Amazon is still drawing consumers in to search the site at an increasing rate

- This emphasizes the staying power of Amazon for US consumers, and the need for brands to test new platforms carefully before committing significant resources

- In a number of seasonal categories, activity appears to be stronger in 2024 compared to 2023

- On top of the expected month-over-month seasonal bump (+45.1%), Patio Lawn & Garden posted the largest YoY search volume increase of any category at +49.9%

- In the wake of the easter holiday, Toys & Games drove a 33% YoY increase – the first time in the past three months the YoY change for the category hasn’t lagged well behind the whole-site average

- This may be a top-line indicator that US consumers are turning increasingly to Amazon for seasonal purchases

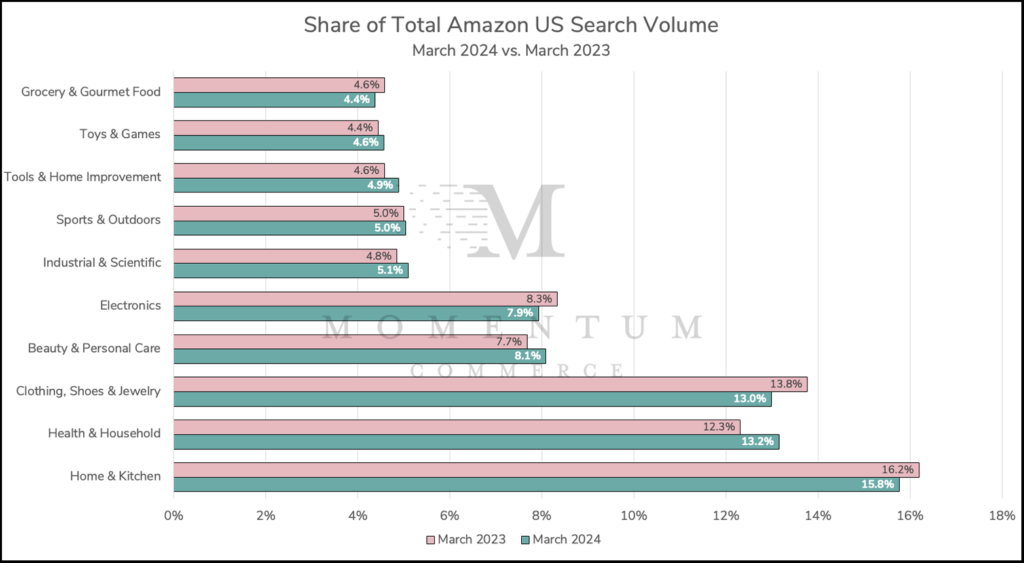

- Grocery shows its first signs of slowdown on Amazon US

- Grocery & Gourmet Food now represents just 4.4% of all Amazon US search traffic, down from 4.6% in March 2023

- This is after months of Grocery & Gourmet Food posting YoY search volume gains that were well ahead of the Amazon US average

- It’s possible that with food inflation cooling since the start of 2024, consumers are transitioning more of their food shopping to physical stores and away from Amazon

- Non-grocery CPG categories remain strong

- Beauty & Personal Care and Health & Household both drove substantial traffic increases in March 2024 – continuing a long string of months where both categories were top traffic gainers

- Given that the summer months have specific seasonal trends associated with each category, it will be worth watching whether these long-standing growth trends continue or moderate

Methodology

Data included in this analysis is based off of search volume estimates across the top 1,000,000 search terms on Amazon during March 2023 and March 2024. Search terms were categorized based on the top-level category associated with the majority of products appearing on the corresponding search results pages.

These models reflect the updates Amazon has made to its search volume methodologies within Search Query Performance metrics. This includes all historical search volume estimations within this analysis.