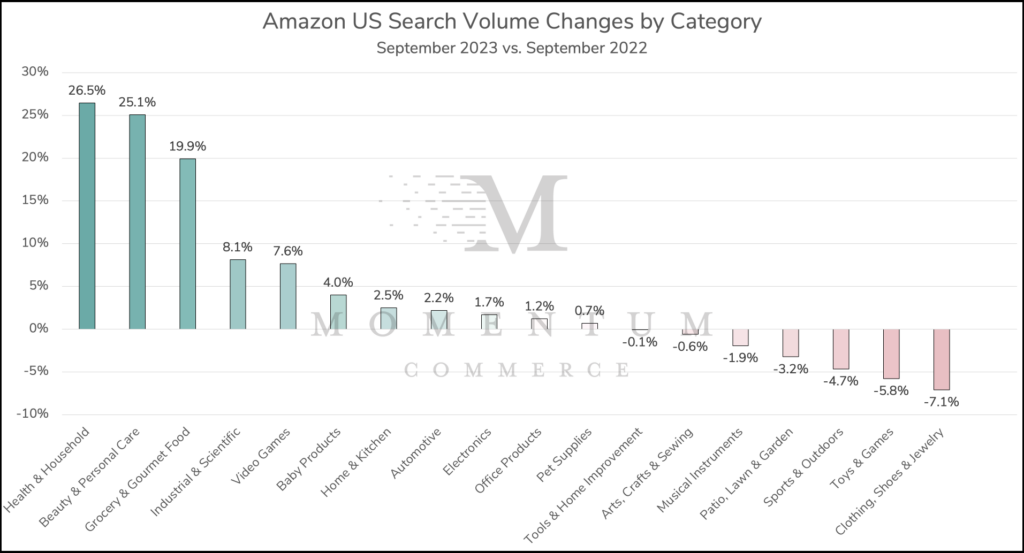

Amazon US Search Volume Climbs 4.2% Year Over Year in September 2023

Search volume across Amazon US rose by 4.2% YoY in September 2023 – the first time Momentum Commerce has cataloged a YoY traffic increase on the site since December 2022. Similar to previous months in 2023, the biggest gains continued to be driven by CPG categories.

Biggest Takeaways for Brands

- CPG category growth on Amazon shows no signs of slowing down

- This is the third consecutive month where both the Health & Household and Beauty & Personal Care categories posted YoY search volume gains of more than 20%

- In a slight shift, Health & Household having the highest YoY growth rate breaks a string of five straight analyses from Momentum Commerce where Beauty & Personal Care exhibited the largest YoY search volume increase of any category on Amazon US

- Alongside the continued ascendance of Grocery & Gourmet Food on Amazon, It’s abundantly clear that consumers are going to the retail site significantly more often when it comes to buying CPG products

- Brands in these categories should see this as a major opportunity to grow sales efficiently through intelligent product content and advertising management

- This is the third consecutive month where both the Health & Household and Beauty & Personal Care categories posted YoY search volume gains of more than 20%

- This shift towards CPG is coming at the expense of hardlines categories

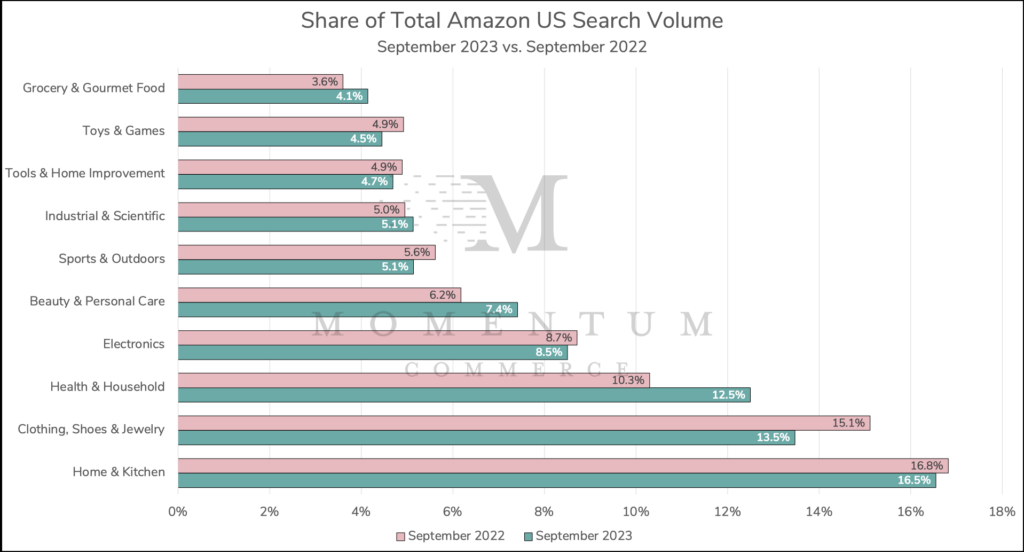

- The latest jump in Health & Household’s share of total Amazon US search traffic puts the category just 1 percentage point below that of Clothing, Shoes & Jewelry

- Clothing, Shoes & Jewelry experienced a 10.8% YoY decline in share of Amazon US search – that follows a 8.2% YoY drop in August, and a 10.3% YoY loss in July

- Toys & Games is also under significant pressure, with the category’s share of search dropping significantly YoY for the third straight month

- The 9.6% YoY decline in search volume follows a 13.2% drop in August and a 8.7% YoY share loss in July

- For brands operating in these verticals, decreased traffic will likely make search advertising more expensive on key search terms, increasing the importance of maintaining a clear focus on adapting to changes in consumer trends and performance metrics

- The latest jump in Health & Household’s share of total Amazon US search traffic puts the category just 1 percentage point below that of Clothing, Shoes & Jewelry

Methodology

Data included in this analysis is based off of search volume estimates across the top 1,000,000 search terms on Amazon during September 2022 and September 2023. Search terms were categorized based on the top-level category associated with the majority of products appearing on the corresponding search results pages.

These models reflect the updates Amazon has made to their own search volume methodologies within Search Query Performance metrics. This includes all historical search volume estimations within this analysis.