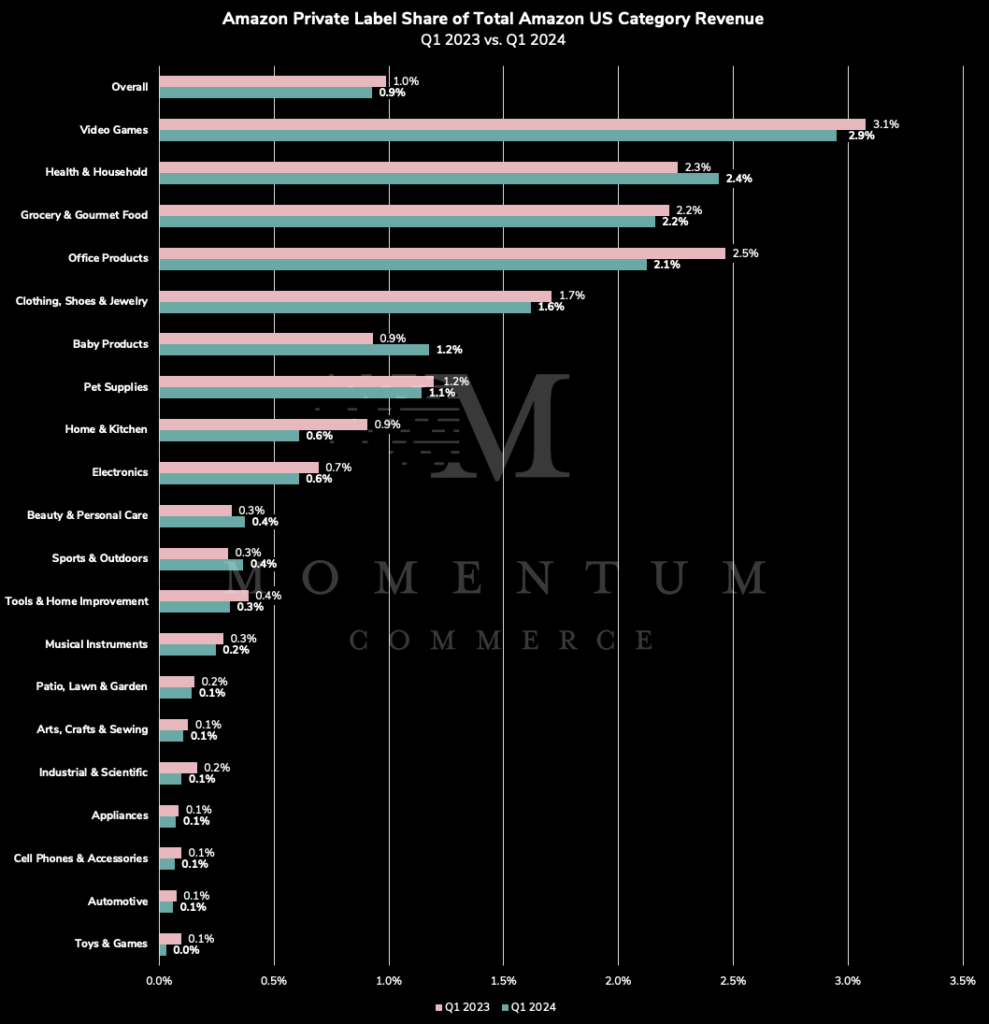

Amazon’s Private Label Market Share Shrinks by 6% Year-Over-Year in Q1 2024

After years of brands and legislators alike expressing their concerns around Amazon Private Label brands, an analysis of Q1 sales and badging activity shows that Amazon’s pullback in this area that began in earnest in 2023 is truly starting to express itself in the marketplace. Overall, Amazon Private Label sales reached more than $1B in Q1 2024 – roughly the size of Samsung on the site. However, between Q1 2023 and Q1 2024, the collective share of Amazon US retail revenue going to the retailer’s private label brands shrunk from 1.0% to 0.9%, with declines occurring across 16 of the top 20 physical goods categories.

The notable exceptions to Amazon Private Label’s overall downward trajectory are in the Health & Household, Baby Products, Beauty & Personal Care, and Sports & Outdoors categories.

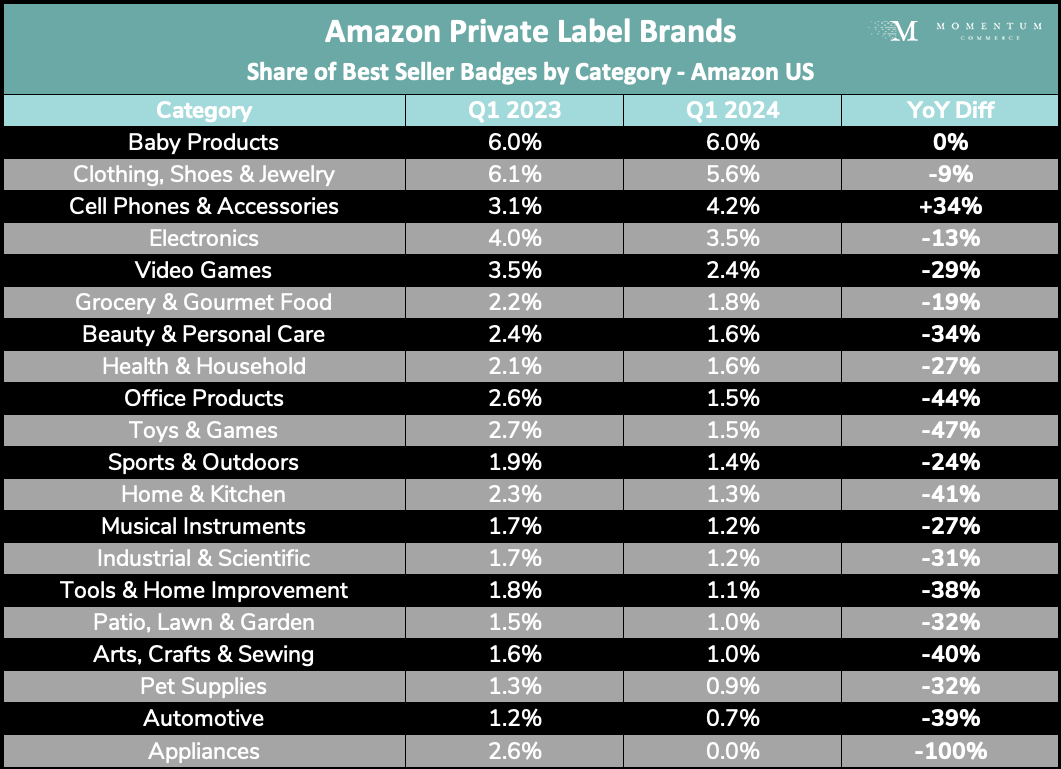

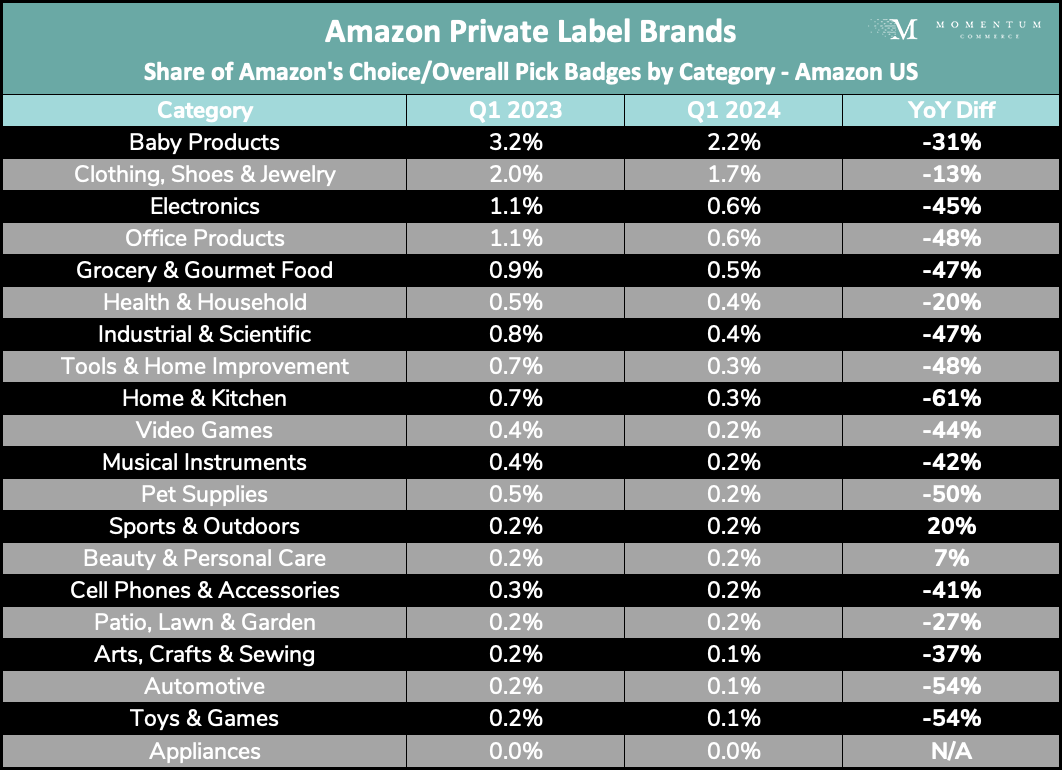

Over the same period, Amazon Private Label brands captured significantly lower shares of key Best Seller and Amazon’s Choice/Overall Pick badges across the site. Only in a few cases did the share of badges not decline YoY.

Biggest Takeaways for Brands

- Category dynamics around search-specific badges have changed markedly

- Just two years ago, Amazon’s Private Label brands captured large shares of Amazon’s Choice badges across a number of categories – those numbers have dropped precipitously

- This waning influence of Amazon’s Private Label brands – which tended to be lower priced and optimized for search visibility – opens up a clearer path to attaining an ‘Overall Pick’ badge across a wide range of search terms

- Achieving faster sales velocity through paid and organic means should be a focus here, as these badges are likely awarded based on some combination of price, sales history, reviews, and relevance.

- In most cases, the threat of an Amazon Private Label brand dominating a given category has passed

- For a number of years, Amazon Private Label was viewed as a sort of boogeyman by brands, with the knowledge that if they entered your market it was incredibly hard to compete with them across a range of areas

- This latest analysis makes it clear that Amazon’s Private Label revenues are declining across a majority of categories

- Amazon’s current private label catalog is largely centered around less differentiated goods (e.g. basic collared shirts, basic exercise equipment, baby essentials, etc.) rather than more niche product varieties

- With this in mind, even for brands still competing against Amazon Private Label, you can effectively differentiate your products from a marketing and content perspective by focusing on a product’s quality, unique features, and use cases

Methodology

Badge data in this analysis is reflective of products and associated badges appearing on page one across the top one million Amazon US search terms. Both search and revenue data are drawn for the period between January 1 and March 31, 2024, along with January 1 and March 31, 2023, for period-over-period comparisons. Amazon Private Label breakouts encompass the collective revenue or badges associated with products sold by brand names owned and operated by Amazon. Categorization of the terms is based on the top-level category attached to a majority of products appearing across a given search results page.