Are Amazon’s Search Results Getting Worse? Consumers Only Click on a Product 27% of the Time

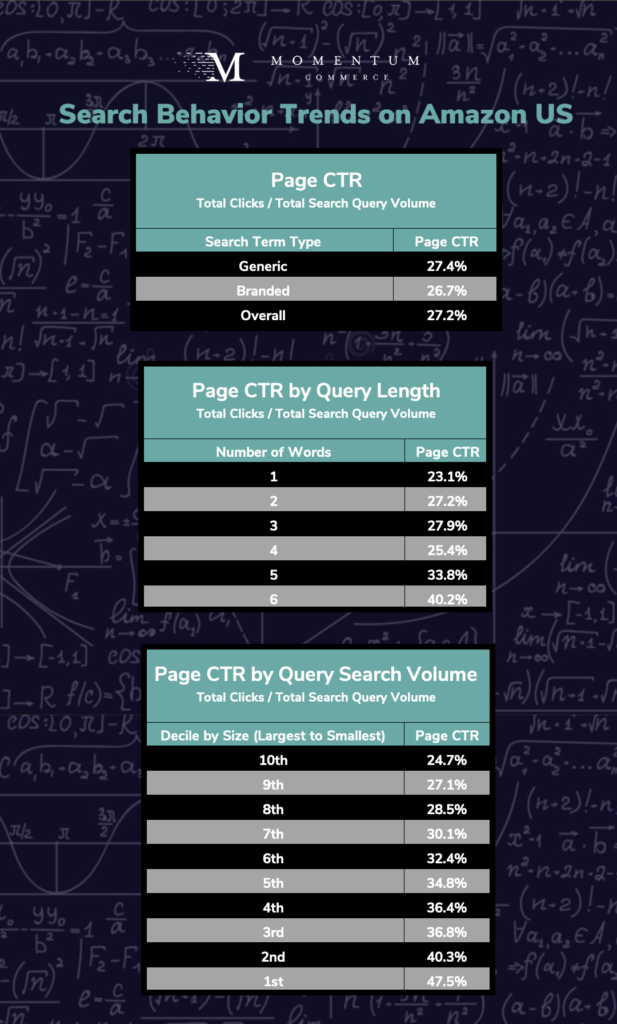

On Amazon, search traffic and particularly branded search traffic are often major KPIs that every brand values. But the latest research by Momentum Commerce across more than 10,000 search terms shows that in aggregate, consumers actually click on a search result just 27.2% of the time, with branded search terms resulting in a click just 26.7% of the time. Additionally, there are diminishing returns between the amount of volume that a search term generates and how many clicks are generated from that search term.

To conduct this analysis, we examined data sourced from Amazon’s own Search Query Performance (SQP) tool from January through December 2023. Terms were categorized as branded or generic based on the presence of a given brand’s name in the search query itself, or lack thereof.

Some of the most surprising findings:

- Page CTR (total clicks / total search query volume) for the studied terms averages 27.2%

- Generic terms actually have a slightly higher page CTR than branded terms (27.4% vs 26.7%)

- As search terms get longer, page CTRs generally rise as well

- When cohorting search terms by number of words, terms with six words generated a click 40.2% of the time, a rate that largely ticks downwards as the query length shortens

- More popular search terms deliver diminishing returns on clicks

- As the popularity of a search term rises, page CTRs decline

So what’s behind the relatively low click rates generally? There are a number of likely drivers to users searching but not clicking on a result on Amazon, including:

- Search Query Refinement: User searches for a broad term, looks at the results and then refines the search one or more times before clicking through (e.g. sizing, color, etc.)

- Search Results Refinement: User searches and then filters the results based on features they care about (e.g. Prime status, brand, price range, etc.)

- Price Comparison: User is in a store and is quickly price-comparing a given item to Amazon and doesn’t need to click through

- Cluttered or irrelevant search results: User searches, doesn’t see what they are looking for, and bounces.

For popular brands generating branded searches, the above filtering and refinement activities may be more pervasive, particularly if they sell a wide variety of products. For example, even though a user has a brand in mind when searching for ‘Panasonic TV’, they will likely do multiple searches and/or filter down several times before they zero in on a particular size and model that suits their needs.

Biggest Takeaways for Brands

- Even extremely popular brands cannot stay complacent when it comes to leaning on branded search

- These findings emphasize that as your brand grows, in product assortment and search frequency, you may see diminishing returns when it comes to clicks and subsequent conversions

- This phenomenon necessitates a careful, continuous assessment of performance across branded terms to influence decision-making around advertising investment, discounts, and product detail page merchandising tactics and strategy

- Branded search still matters as a KPI, but use search volume and click rates (via SQP) to help illuminate the typical consumer journey, and expected value, and invest accordingly

- All brands should, at a minimum, set a baseline of how their branded search traffic converts by checking the average click rate on branded terms and comparing those to your top contributing generic terms

- Use volume and CTR data along with your own sales figures to back into expected value metrics

- High-volume search terms are likely still a worthwhile investment despite the lower page CTR

- Investing in AMC is particularly worthwhile to better inform tactical and strategic changes

- AMC helps smooth some of the path to purchase tracking that is missed by relying solely on last-click attribution

- For example, a user may watch a Sponsored Brands Video ad – not click – but then do a subsequent branded search for that brand’s product. AMC can tie these actions together while traditional Amazon reporting will not

- Having this wider scope on typical buyer journeys makes it much easier to zero in on the pockets worth investing in to drive the greatest return, including branded search

- AMC helps smooth some of the path to purchase tracking that is missed by relying solely on last-click attribution