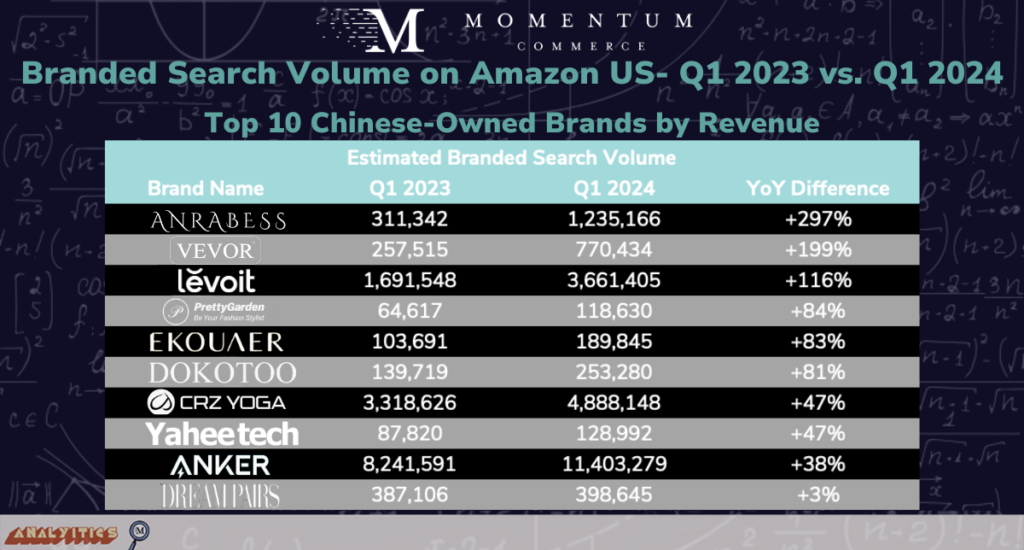

Chinese Brands Have Become Name Brands on Amazon

In Q1 2024, 9 of the top 10 Chinese brands by revenue grew their branded search volume by more than 30% year-over-year (YoY). These brands paced well ahead of the ~25% search volume increase seen across Amazon US as a whole over the same period, and underscores how formerly “no name” Chinese brands are gaining real name recognition and consumer loyalty on Amazon, likely due to social media.

A few of these Chinese brands actually drove millions of branded searches over the Q1 period. Beyond category leaders like Anker, examples like CRZ Yoga are instructive in terms of how Chinese brands in hyper-competitive spaces are carving out meaningful levels of brand loyalty. In CRZ Yoga’s case, searches including their brand name happened nearly 2X as often in Q1 2024 as those for the viral shoe brand Hoka. This is likely in large part due to the popularity of the brand on TikTok and other similar platforms, with many of the videos explicitly mentioning Amazon as where they got CRZ Yoga attire.

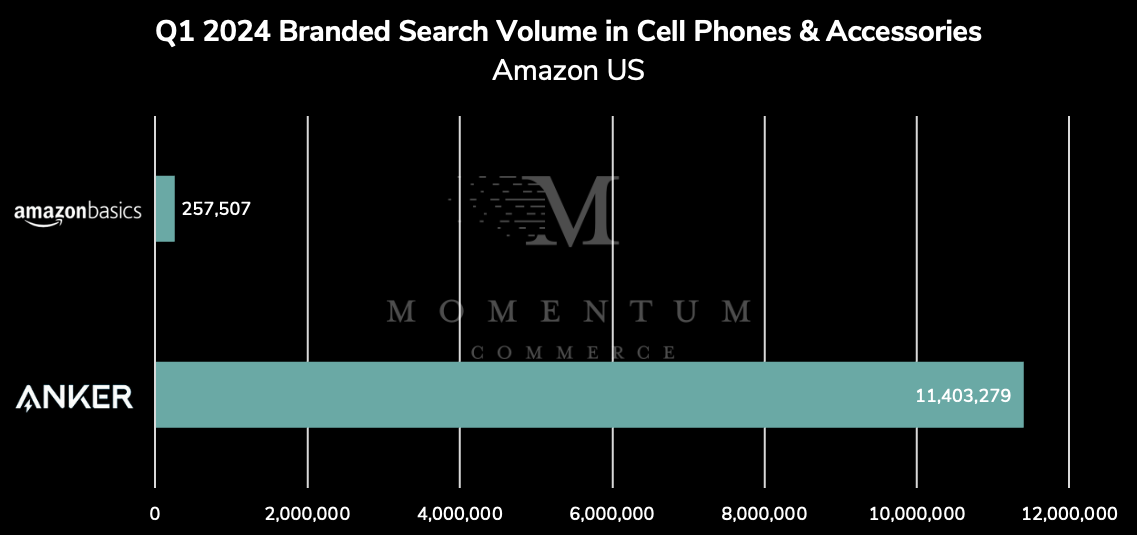

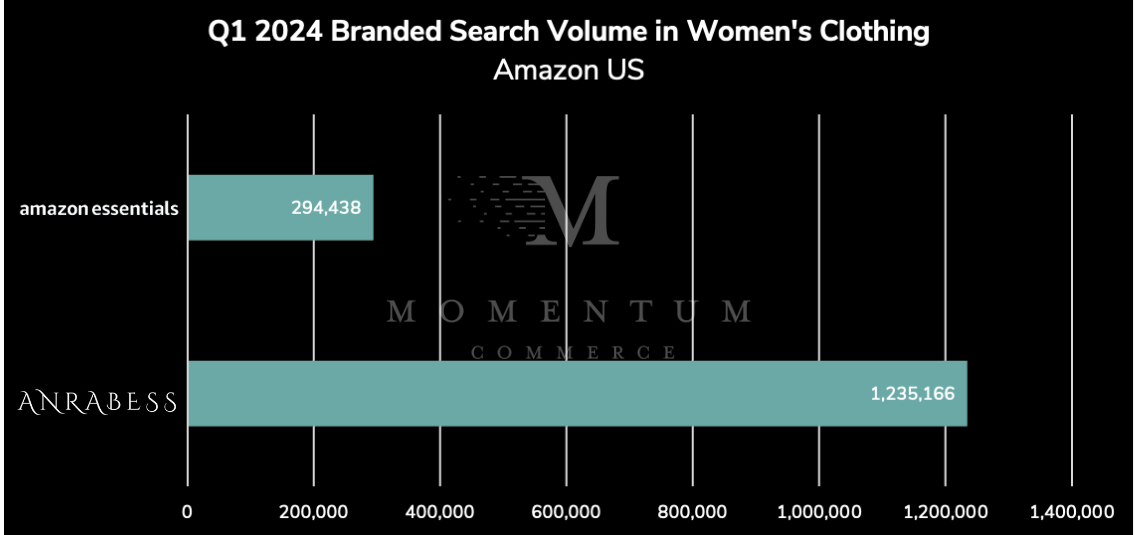

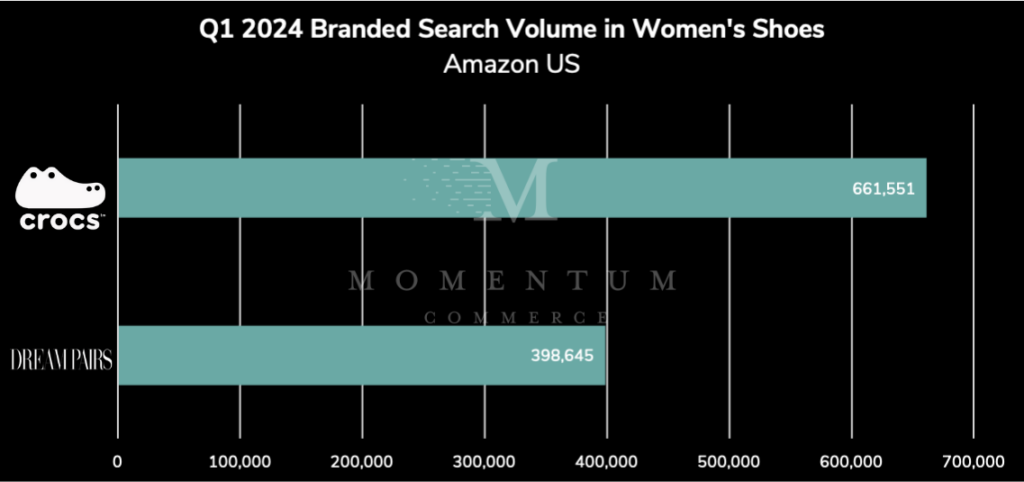

In these and other cases, relevant branded searches for top Chinese brands in the category significantly outpace or are meaningfully close to top US brands, as seen in the examples below.

Biggest Takeaways for Brands

- This analysis is yet another reminder that your brick-and-mortar competition can differ significantly from your competitors on Amazon

- In most cases, these Chinese brands on Amazon have little to no brick-and-mortar presence in the US and potentially don’t even sell under the same name on other online platforms, if at all

- Being fixated on beating known competitors can leave large blind spots on Amazon US

- Brands need to keep close tabs on the products appearing alongside their own on the search page and use that as an evolving competitive set to strategize against

- If you have larger Chinese competitors in your category, they’re likely getting branded search activity

- Don’t fall into the trap of believing that consumers don’t pay attention to the brands they buy from on Amazon when they are looking for lower-cost options

- Keeping an eye on trends across TikTok and other platforms related to your product category may help you zero in on new challengers sooner

- If you see a brand rising in your category from a share of voice or revenue perspective, assume they are also getting an increasing amount of branded search traffic

- These terms could be ripe for conquesting with paid search advertising as long as you can effectively emphasize the quality or value of your own product (e.g. via Sponsored Brands or Sponsored Brands Video)

- Don’t fall into the trap of believing that consumers don’t pay attention to the brands they buy from on Amazon when they are looking for lower-cost options

- Differentiating your products beyond price is important given Chinese brands’ growing popularity

- The fact that these likely lower-cost brands have an increasing number of consumers seeking them out specifically further emphasizes how winning consumers over requires a more concerted effort around selling your specific value proposition – being a ‘name brand’ isn’t enough

- This can be via subjective product content around features or quality, or more objective like badges, which we know impact overall sales performance

- The fact that these likely lower-cost brands have an increasing number of consumers seeking them out specifically further emphasizes how winning consumers over requires a more concerted effort around selling your specific value proposition – being a ‘name brand’ isn’t enough

Methodology

Momentum Commerce utilized third-party revenue estimates to determine the highest-grossing brands on Amazon US over the course of Q1 2024. The top 10 Chinese-owned brands were segmented out for the purposes of this analysis. Monthly estimated search volumes were then calculated across all searches that included those brands’ names within the search query itself across the comparison periods of Q1 2024 and Q1 2023.