Looking Back at 2022’s Prime & Early Access Sale Champions

July Prime Day is quickly approaching, and Amazon recently confirmed a Fall Prime Early Access Event. Last year, July’s Prime Day Event marked the biggest Prime Day in Amazon’s history with over 300 million items purchased in a two-day span. The Fall Early Access Event was set to mirror the exciting levels of Black Friday and Cyber Monday, yet didn’t quite achieve those levels. So, who were some major players and how did they achieve success during these events? Using our new Digital Shelf Analytics platform, Velocity by Momentum Commerce, we can drill down on specific metrics attributed to the success of two brands, Instant Pot and DEWALT.

Prime Day: July 12-13th, 2022

The Story

Instant Pot, a sub-brand of Instant Brands, produces a variety of multicookers that aim to consolidate the cooking and preparing of food to a single appliance. In July of 2022, our Brand Insights tool within Velocity reported that Instant Pot had an estimated $31 million in Home & Kitchen category revenue, up 269% from the year prior.

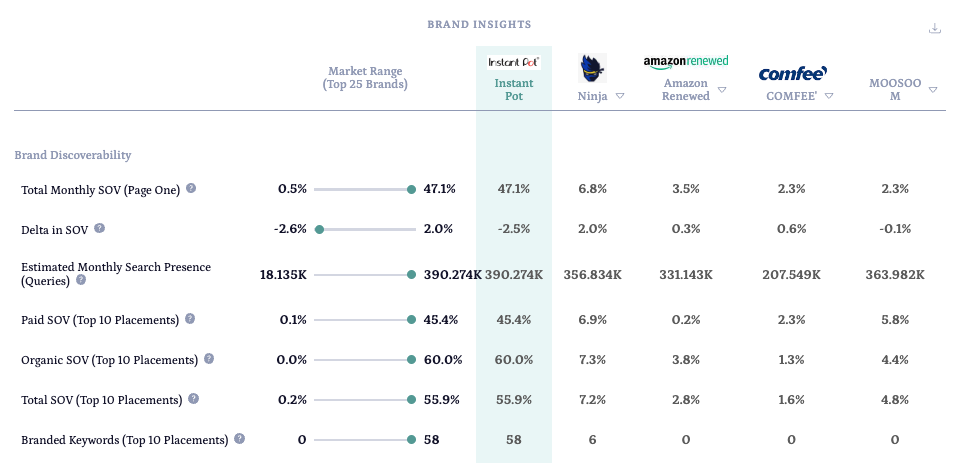

Not only did Instant Pot make impressive strides within the Home and Kitchen Category, they completely dominated the Electric Pressure Cookers subcategory during the month of July. Over the course of the month, Instant Pot achieved:

- 47.1 % Total Monthly SOV vs, next best competitor Ninja at 6.8%

- 60% Organic SOV in Top 10 Placements

- 58 Branded Keywords in Top 10 Placements, up 8.6% from 50 Branded Keywords in June ‘22

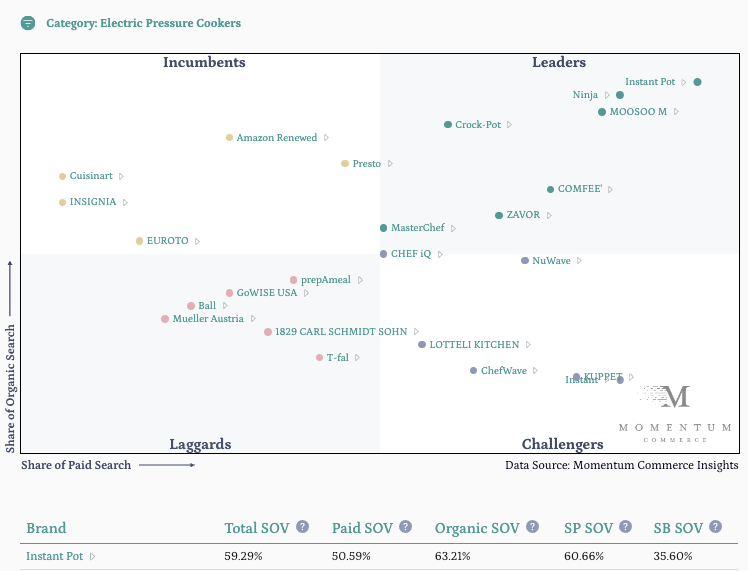

Instant Pot took an aggressive approach to Prime Day, running multiple deals on select ASINS that were also heavily advertised. Ad density within the Electric Pressure Cooker Category rose from 24.25% the week prior to Prime Day (7/3/22-7/9/22) up to 31% the week of, largely driven by Instant Pot and evident in the Amazon Brand Index graph below. During the week of Prime Day, Instant Pot held a 60.6% Sponsored Product SOV along with a 35.6% Sponsored Brand SOV. The Instant Pot Duo 7-in-1 and Instant Pot Duo Crisp 9-in-1 with Air Fryer ran a 12% and 8% discount respectively. The additional discount combined with the dominating ad presence gave Instant Pot a distinct advantage over Ninja, whose closest competitive product averaged $282 at that time.

Instant Pot crafted its recipe for success through a few different strategies. During Prime Day, their premium-priced products reached a point where discounts and ad spend could be comfortably supported while still retaining margin. Instant Pot’s biggest competitor, Ninja, seemingly took a more passive approach to the event, thus leaving more room for Instant Pot to execute. It is also important to note that Instant Pot operates in a category that is more prone to ‘deal hunters’ who are eager to scour deals on items like small kitchen appliances.

Prime Early Access Sale (PEAS): October 11-12th, 2022

The Story

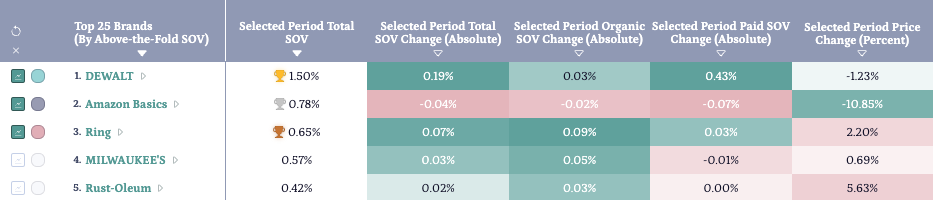

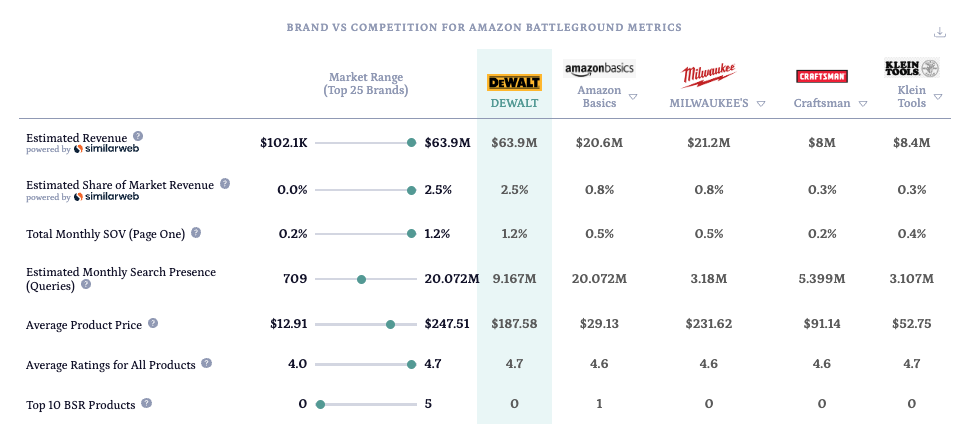

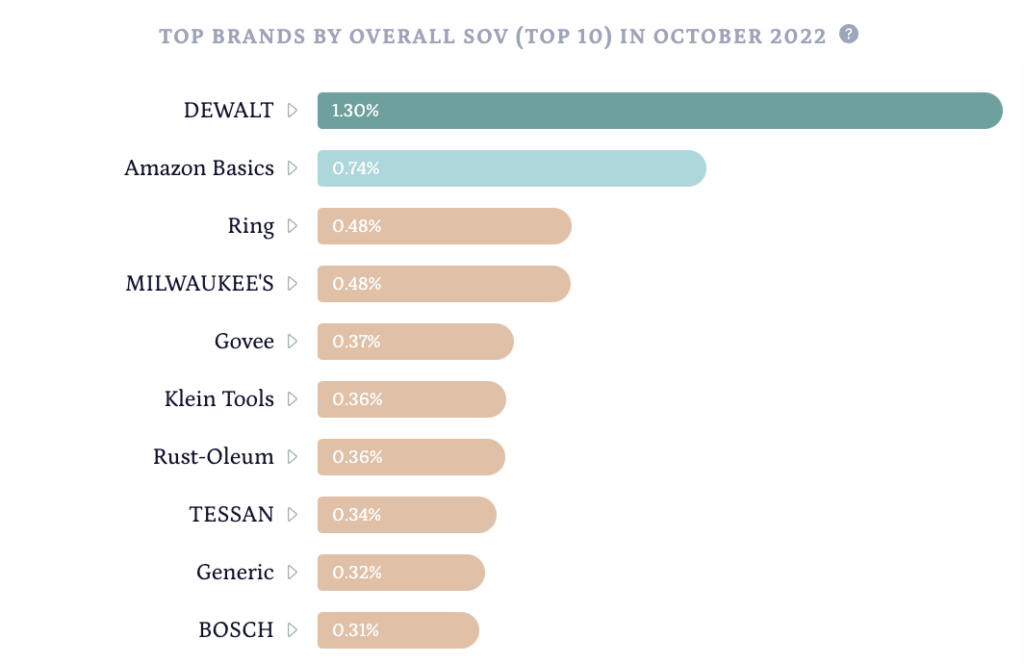

DEWALT, an industrial tool company and a subsidiary of Stanley Black & Decker, saw great success during the Fall Early Access Sale. Their Total SOV for the two-day sale was 1.5%, taking the lead in the Tools & Home Improvement Category on our Amazon Brand Leaderboard illustrated below.

Similar to Instant Pot, DEWALT also ran many deals during the Early Access Sale on power tools, hand tools, lawn equipment, and workshop tools. In October ‘22 DEWALT conquered the Tools and Home Improvement Category by achieving:

- Over $63M In Category Brand Revenue

- 2.5% Estimated Share of Market Revenue

- #1 Brand by Overall SOV with 1.3%

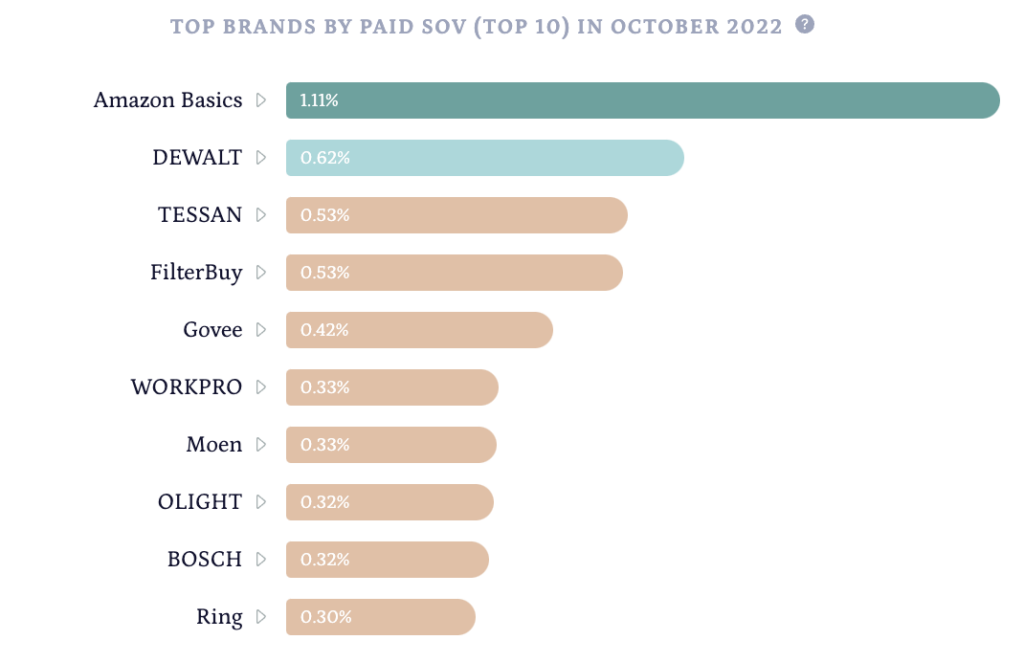

- #2 Brand by Paid SOV with 0.62%

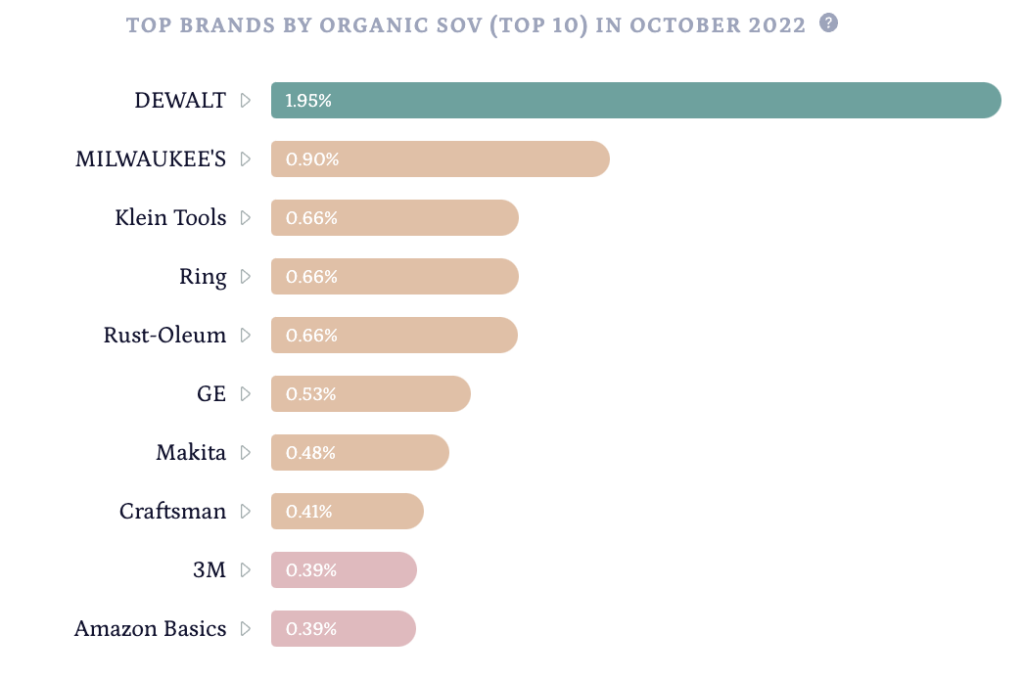

- #1 Brand by Organic SOV with 1.95%

Ad density the week prior to the sale (10/2- 10/8) was 40.78% and rose to 46.38% the week of (10/9- 10/15). In a similar manner, DEWALT took charge of the Amazon Brand Leaderboard most notably in Sponsored Brand SOV with 1.64%. In the case of both Instant Pot and DEWALT, a successful strategy was to increase ads while simultaneously running deals on products.

Key Takeaways for Brands Ahead of Prime Day Events

- Consider starting ad campaigns prior to the commencement of the event. Gaining traffic and top-of-mind awareness among consumers can benefit Prime Day performance.

- Review prior year performance reports- identify your brand’s high-performing products, and analyze improvements that can be made to low-performing products.

- Consider using our free Amazon Brand Leaderboard with pre-set filters established for Prime Day as well as the Early Access Sale to gain valuable insights for your brand.

- Take a look at our free Amazon Search Trends Tool. Identify key terms from any given subcategory relating to a specific brand, and use those terms to target competitors, create targeted ads, or include them within your own content.

- If you are a subscriber to Velocity by Momentum Commerce, you also get access to Portfolio Insights, for a product-by-product competitive analysis across a range of criteria