Study: Leading Brands’ Market Share Aligns with Generic Search Dominance on Amazon

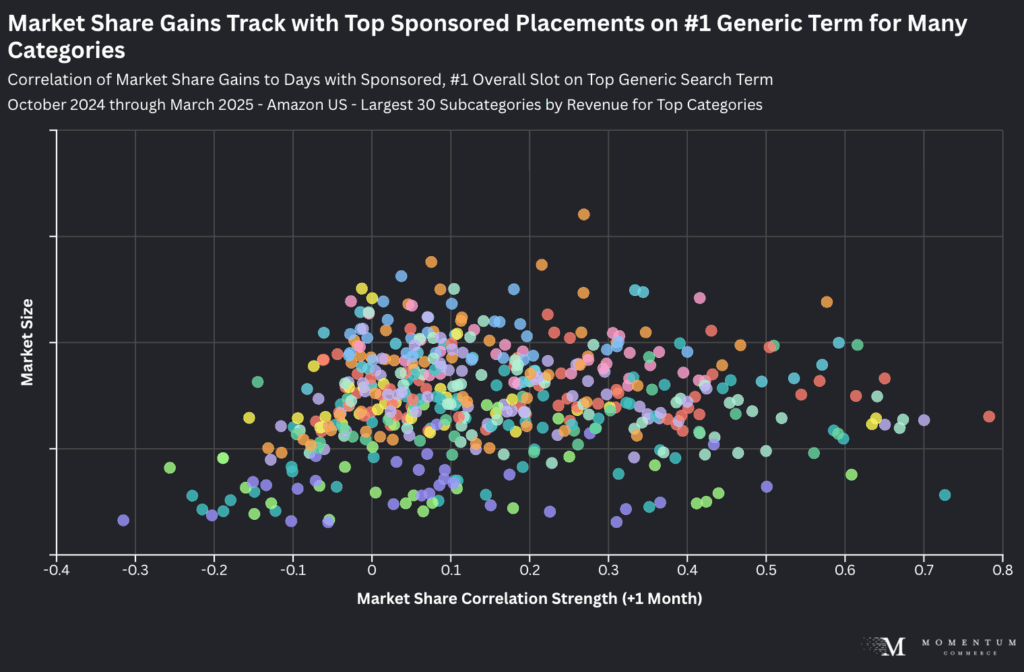

In many product categories, market share gains are strongly correlated with brands that attain a #1 sponsored placement on the top generic search term in that category. Any concerns around high CPCs for those top generic terms should be largely dismissed – the likely market share gain makes it worthwhile. However, this phenomenon varies significantly depending on the category, underscoring how brands should carefully calibrate their approach to achieve market share gains in the most efficient means possible.

The Longstanding Debate Over Efficiency

In this era of tightening budgets and increasing competition, even major brands tend to shy away from high CPCs on highly-searched generic search terms. This drive for efficiency is often supported by comparatively low conversion rates on those terms. The counter to that thinking rests on two key aspects of modern eCommerce buying behavior:

- Consumers often conduct multiple product searches before ultimately making a purchase decision, and this would particularly be true of top generic search terms that naturally are high level. This consequently lessens the overall importance of conversion rate metrics on these terms

- With increasing appearance rates for Sponsored Brands and Sponsored Brands Video, Amazon has structured the top of search more towards brand building. These richer media units can help give consumers early exposure to a given brand and help shape subsequent search criteria (e.g. specific brands or features). This is particularly valuable on top generic searches where consumers are more likely to ‘come in blind’ in terms of what specific product or brand they are looking to purchase.

Quantifying the Relationship Between Market Share & Top Generic Sponsored Search

Momentum Commerce examined products and brands achieving both a sponsored placement and the #1 overall placement on the most searched generic search terms in a given category for each day within a given month. The time period examined was October 2024 through March 2025. This data was then supplemented with monthly, category- and brand-specific revenue data across Amazon US to calculate market share figures.

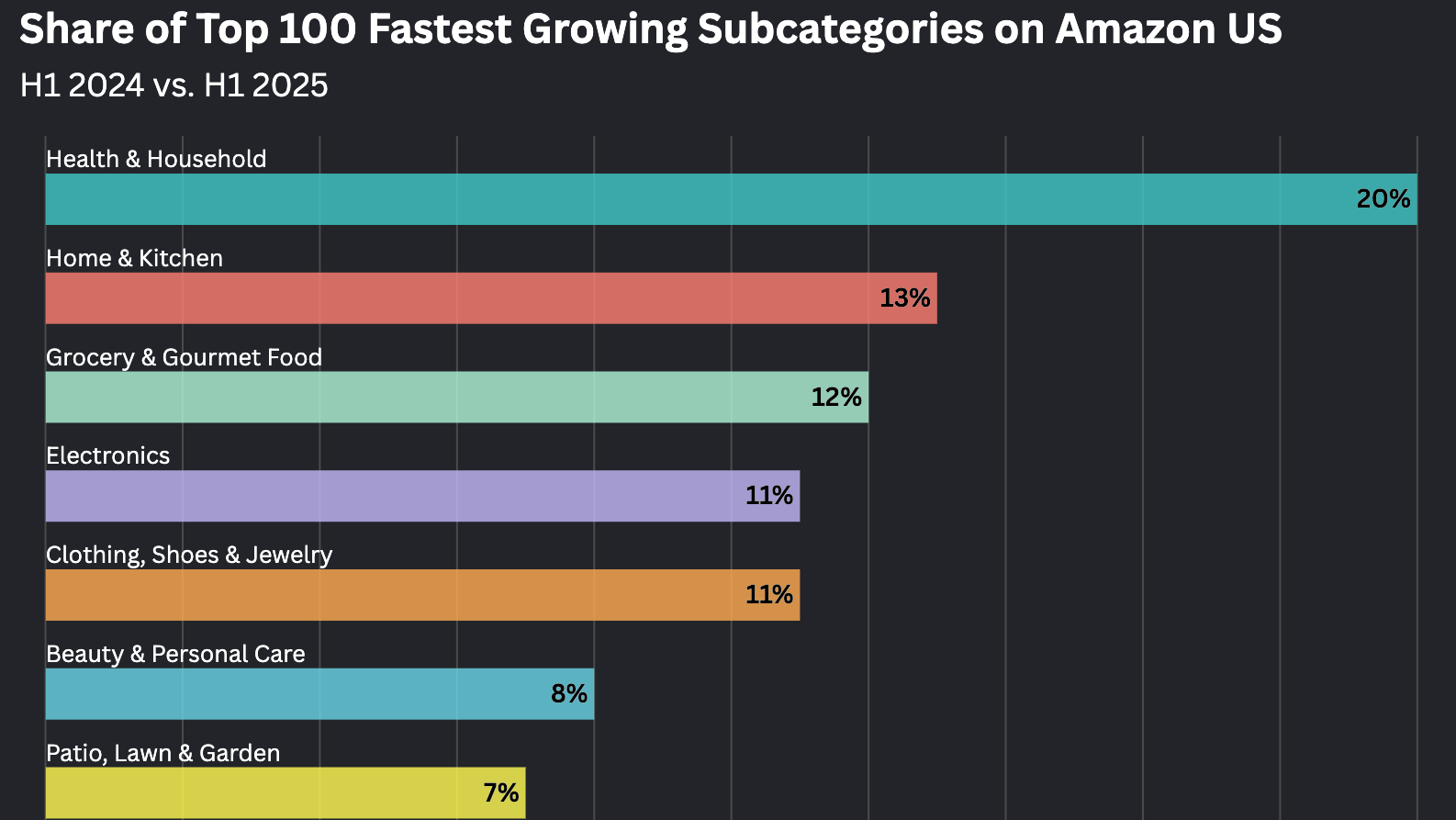

The results show how, across a number of categories, there is a strong relationship between paid, top-of-search appearances on these #1 generic search terms and market share one month later. This is particularly true in what could be described as ‘discovery-heavy’ subcategories, like those within Home & Kitchen and Toys & Games. These are areas where shoppers often browse without specific brands in mind.

This relationship is not ubiquitous across categories. There is weak or no correlation between paid, top of search placements on top generic terms in more technical or brand-heavy subcategories, like those in Apparel, Baby Products, and Tools & Home Improvement.

If you’re curious about a specific subcategory that isn’t shown in the above interactive visualization – shoot us an email at hello@momentumcommerce.com

Biggest Takeaways for Brands

- Know your category, and if appropriate, be willing to invest regardless of CPCs

- Generally speaking, categories that are less technical and less branded are better for this more focused, aggressive advertising on top generic search terms

- Metrics around the share of branded search volume in a category and how much total market share is consumed by the top 5 brands can act as good barometers here (both are tracked within Velocity)

- In the cases where a ‘top generic keyword’ oriented campaign is likely to be much more valuable, get your budget in place to make that investment over at least 1-2 months, either via reallocation or additional investment.

- Once the campaign is running resist the urge to judge the campaign on a CPC basis, at least in the near term

- Generally speaking, categories that are less technical and less branded are better for this more focused, aggressive advertising on top generic search terms

- Take a longer-term view in terms of TACOS

- Alongside the above, the success of a program focused on these top generic keywords will naturally be less immediate

- Outside of market share gains in the months following the start of the campaign, look for steady improvement in TACOS metrics over time as a signal of whether the strategy is having the desired effect