Sponsored Brands Video Ads Appearances up 34% Year-Over-Year on Amazon US

Over the past year, Sponsored Brands Video (SBV) ads have taken up substantially more placements across the first page of search results on Amazon US, including overall top-of-search results on the site. This increases the importance of these units for brands, and correspondingly the importance of testing and having the data necessary to maintain efficiency and growth goals in the face of rising advertising inventory.

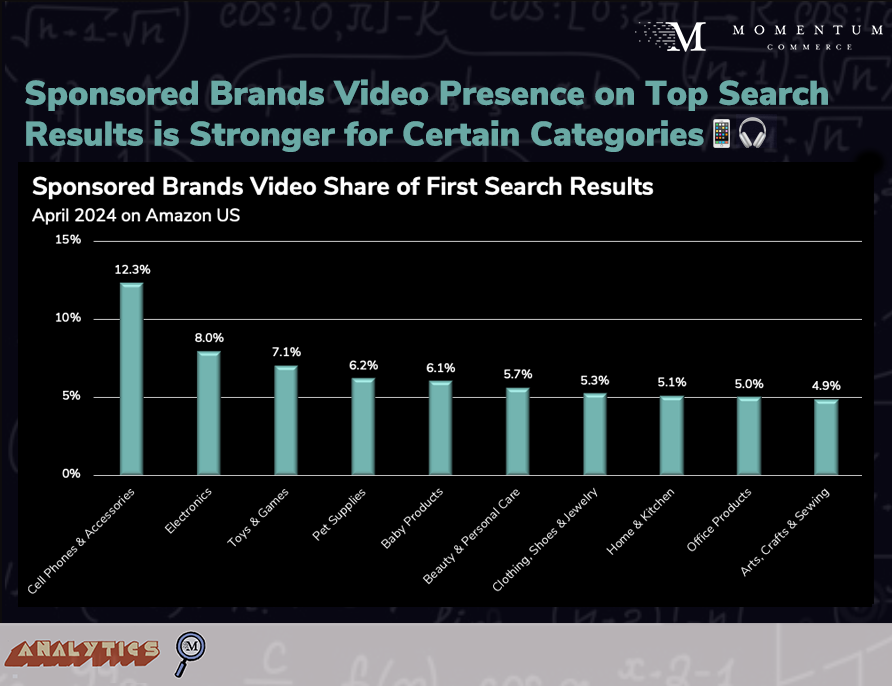

Across Amazon US, SBV now constitutes 3.5% of all top-20 placements, a figure that’s up 34% year-over-year.

These units are also taking up increasing amounts of top-of-search real estate. SBV ads showed up as the first result 5% of the time in April 2024 – a figure that was <0.1% from April 2023 through January 2024.

For number one placements specifically, the prevalence of Sponsored Brands Video ads can vary significantly for some categories. Cell Phones & Accessories, Electronics, and Toys & Games had notably higher rates of top placements being Sponsored Brands Video.

Biggest Takeaways for Brands

- Plan to test static versus video Sponsored Brands creative if you haven’t already

- While video can be engaging and drive consumer interest, every market is different

- When testing SB creatives with clients, there have been instances where static ads do better than video

- Be sure to test creative type (e.g. video vs. static) along with creative style (e.g. lifestyle imagery vs. product shots) before forging ahead with a large budget commitment

- Proper testing methodologies can include rolling out video ads to select, similarly performing static image campaigns

- While video can be engaging and drive consumer interest, every market is different

- Aim to get a handle on impression-level value from Sponsored Brands Video

- Because video ads autoplay within the search results page, it’s reasonable to assume that video views may influence consumers if they briefly stop scrolling – even if they don’t click

- Assuming you are bidding on the units via CPC vs. CPM, view-through attribution isn’t tracked by Amazon, but there are other ways to approximate the value of video views only

- For example, brands could use the unit to promote a single, discrete product on generic or competitor search pages and measure any change in the Amazon US search volume for queries including that product name