Premium Priced Products Win Across 15% of Amazon Subcategories

Amazon’s sprawling marketplace naturally has developed pockets where consumers are more prone to spend top dollar, alongside budget-minded categories. After looking across the top 1,500 level 3 and 4 subcategories by monthly search volume, roughly 15% had a majority of top 50 BSR products priced above the median price for that category – a rate that stays largely consistent even after splitting up categories by median price.

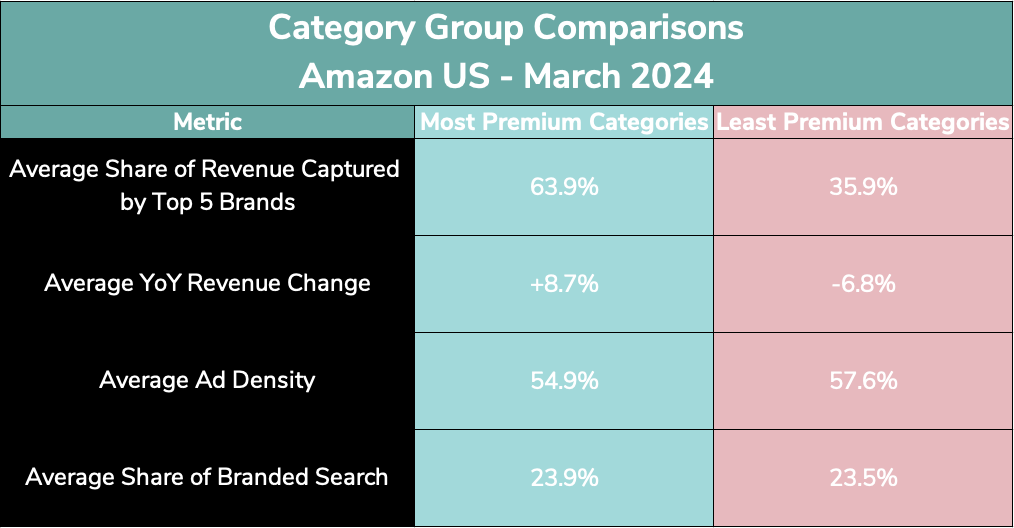

There are a few clear, sizable differences separating the most premium categories from the least premium categories. Specifically, the most premium categories listed above have a much larger share of overall category revenue captured by the top five brands (also called Market Shape) and sported much higher year-over-year (YoY) revenue growth in March 2024. Notably, there weren’t large differences in terms of page one ad density and average share of searches that include a brand name.

Biggest Takeaways for Brands

- Brands entering premium categories are going to be challenged

- The low degree of revenue fragmentation gives existing, large brands a significant advantage in these promising markets

- New entrants will need to put a significant focus on branding and driving upper-funnel demand to give them the best chance to grow given these market dynamics

- Premium brands can cultivate a rich brand presence on the site through programs like the Brand Store page, enhanced product page content, and video, while also driving demand through top-of-funnel advertising tactics

- There is a significant runway for premium brands on Amazon to thrive

- There are a sizable number of categories where consumers gravitate towards higher-priced vs. budget options

- Amazon is where a large share of consumers visit on their buying journeys and premium brands need to be where their customers are in some fashion

- Once a brand reaches a level of popularity, consumers will search for it on Amazon regardless of whether or not the brand sells there. Any sales naturally go to competitors

- Before entering any new category on Amazon US, understand the market dynamics to price effectively and choose the optimal assortment

- Many premium brands that achieved success on Amazon US did so through a focused assortment strategy

- Often, this has taken the form of offering entry-level or the most popular products on Amazon, reserving new or top-end products for the D2C site

- While being a lower-priced option can be helpful, this analysis underscores that in certain circumstances being priced below the competition may be a hindrance

- Be sure to account for the median price across top sellers at the deepest relevant subcategory possible to better shape your overall strategy

- Many premium brands that achieved success on Amazon US did so through a focused assortment strategy

Methodology

Momentum Commerce analyzed products on Amazon US associated with subcategories nested three to four levels below top-level categories (e.g. Beauty & Personal Care > Makeup > Makeup Remover). Products had to have appeared on search pages ranking within the top 1 million search terms on Amazon over the month of March 2024, with the majority of products on a given search page associated with a given category. Best Seller Ranks from April 1, 2024, were used for the purposes of this analysis to segment ‘top 50 products’ in a given subcategory from others in the sample.