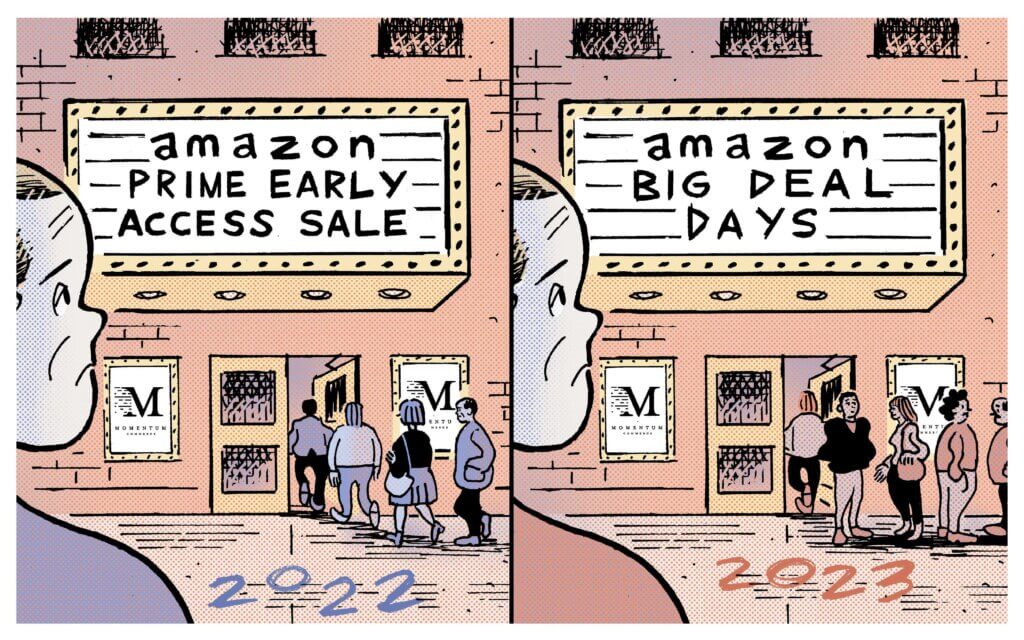

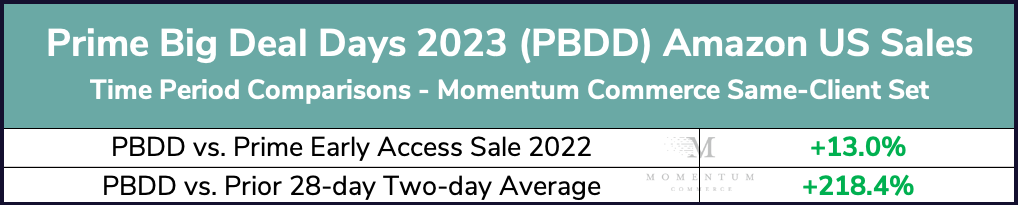

Prime Big Deal Days Sales Outpace PEAS 2022 by 13%

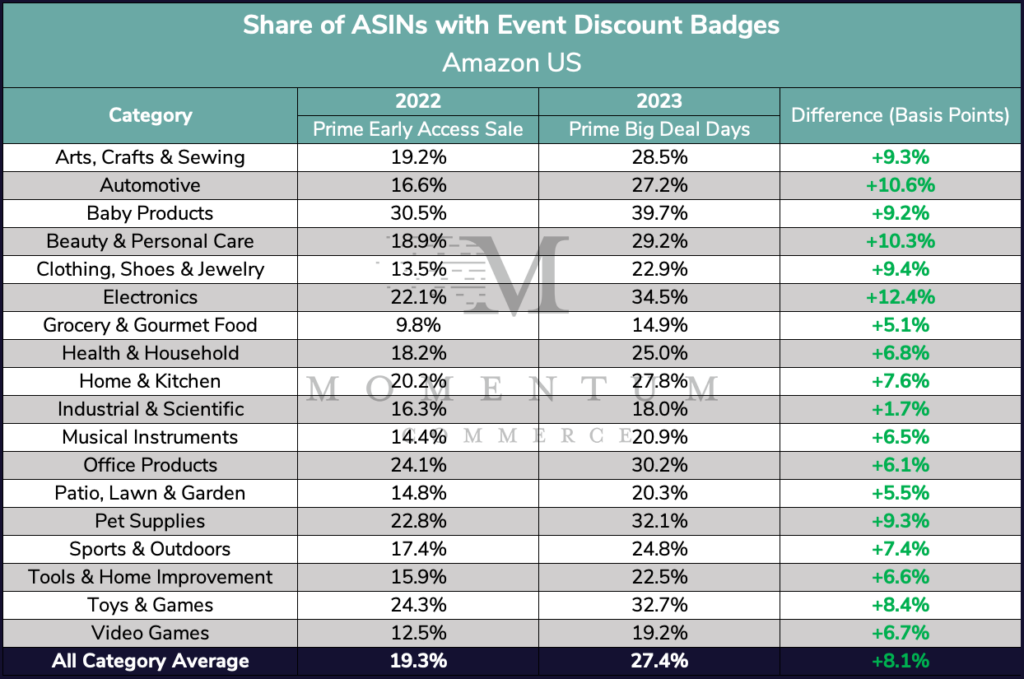

Across Momentum Commerce’s clients on Amazon US, there was a 13% improvement in sales for the 2023 Fall Prime Big Deal Days (PBDD) event compared to last Fall’s Prime Early Access Sale (PEAS). This growth came with the majority of clients opting to focus on more deal participation and less on ad investment during the latest sale event. More broadly, the frequency of discounts offered across Amazon US rose dramatically from PEAS 2022 levels for every major category.

The Data

- Across a consistent set of Momentum Commerce clients, Amazon US sales were 13% higher during PBDD as compared to the PEAS 2022

- These sales figures were more than 218% better than the preceding 28-day two-day average, but remain well behind July 2023 Prime Day sales

- Compared to PEAS 2022, event deal badges and the accompanying discounts were more prevalent across Amazon throughout every top-level category during PBDD

- There were particularly sharp increases in the discount frequency across the Electronics, Automotive, and Beauty & Personal Care categories

Biggest Takeaways for Brands

- Initial sales data supports the idea that PBDD was much more successful than PEAS 2022 for many brands

- This is an encouraging sign for Amazon moving forward, as they want to continue shifting demand earlier in the holiday season with these types of events

- The positive traction on Amazon’s end in 2023 means this sales event is almost assuredly here to stay, with potentially more efforts by Amazon next year centered around increasing brand participation in discounts and promotion

- Discounts are going to be important moving forward with these Fall sales events

- A majority of Momentum Commerce clients decreased their ad spend relative to PEAS 2022, but still saw better sales metrics during PBDD. This is a positive sign in terms of how Amazon was able to drive more customers to the site during this latest sale event

- Outside of the aggregate metrics, you can see how discount rates manifest for individual brands within thousands of categories on our Amazon Brand Leaderboard. Discounting activity was in some cases even higher than what a brand offered during Prime Day.

Methodology

For all sales-related figures, Momentum Commerce examined the Amazon US sales performance across a consistent set of 3P clients during the periods of September 12 through October 9, 2023, October 11-12, 2022 (PEAS), and October 10-11, 2023 (PBDD). For discount-related figures, Momentum Commerce analyzed the presence of sales event discount badges on individual ASINs appearing across the top one million search terms on Amazon during the October 11-12, 2022 (PEAS), and October 10-11, 2023 (PBDD) time periods. Figures are expressed as a share of the total ASINs analyzed that had each respective sales event badge.