More Search Volume is Flowing to ‘Long Tail’ Terms on Amazon

The most popular terms on Amazon continue to drive a significant percentage of the overall search volume on the retail site. But over the past year, as overall search volume on Amazon rose across the board, a noticeably greater share has shifted towards terms with lower search frequency ranks (SFR). While the degree of these changes naturally fluctuates within any individual category, the upshot for brands is that in order to maximize growth and revenue they need to meaningfully focus beyond solely top 100,000 SFR terms.

The Research

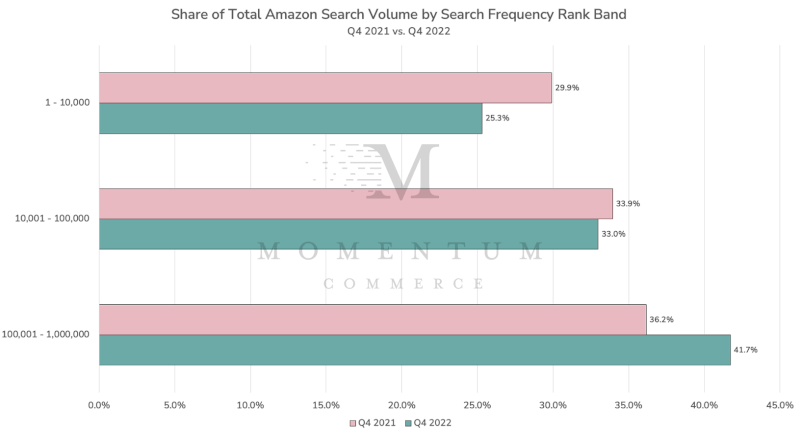

Momentum Commerce analyzed search volume estimates across the top 1,000,000 search terms on Amazon during both Q4 2021 and Q4 2022. Volume estimates were then split into bands based on search frequency rank (SFR) to illustrate the share of overall search volume attributable to various tiers of search term relative popularity on Amazon.

The Story

- Overall estimated search volume on Amazon across the top 1,000,000 terms rose by approximately 11% year-over-year in Q4 2022

- This increase appears to be driven by long-tail searches – rather than the most popular group of terms

- Top 10,000 SFR searches made up 25.3% of Amazon search traffic across the top 1,000,000 terms in Q4 2022 – down from 29.9% in Q4 2021. This was the largest decrease of any band studied

- Meanwhile, searches with SFRs between 10,001 and 100,000 made up 33.0% of the total in Q4 2022 – down slightly from 33.9% in Q4 2021

- Search terms with SFRs between 100,001 to 1,000,000 captured a 41.7% share of top 1,000,000 searches in Q4 2022 versus 36.2% one year prior – an increase of an estimated 660M searches

Biggest Takeaways for Brands

- Consider being more aggressive when it comes to committing budget or content optimizations on relevant terms with monthly SFRs below 100,000

- However, keep in mind that top 100,000 SFR terms continue to drive a majority of Amazon search volume and deserve the commensurate time and investment

- Also remember that in terms of share of voice, all searches are not equally important. Even though more volume has shifted to the long tail, the combined volume across the top 10,000 search terms isn’t that much lower than the combined volume of the 900,000 terms between 100,000 and 1,000,000

- Categories with less brand loyalty and wider product assortments are more likely to have a wider distribution of overall search traffic

- In these categories, these sub-100,000 terms will likely take on more importance

- One good exercise is an audit your own brand’s performance on a search-term level to identify keywords with increasing year-over-year or quarter-over-quarter click and conversion volumes

- As Amazon continues to evolve, it’s worth having processes in place to unearth relevant keywords rising in popularity via research tools that rely on competition-aware data (one example is our own Amazon Search Trends Tool).