Smaller Brands on Amazon: Product Launch Success is About Search Visibility – Not Discounts

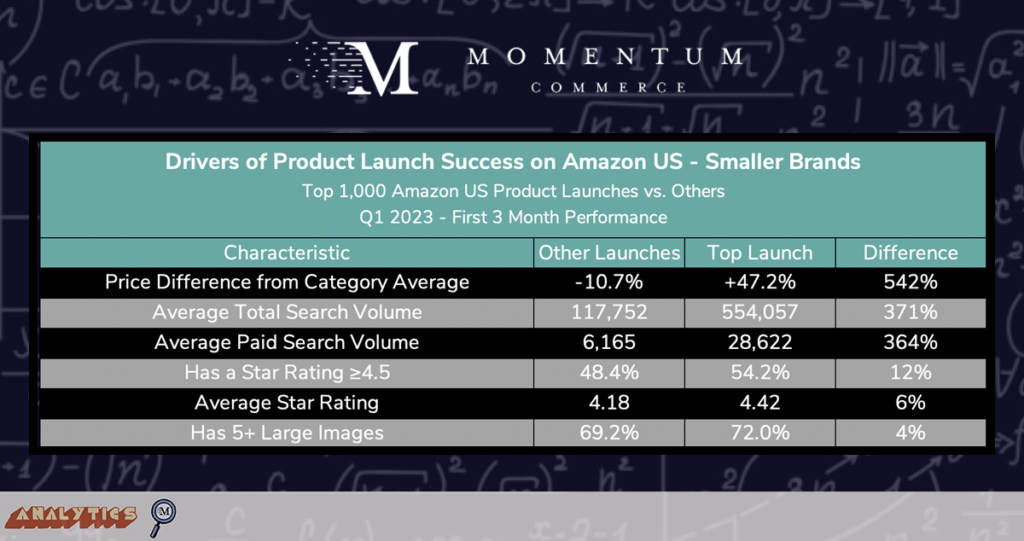

Our earlier study examining the top product launches across Amazon US in Q1 2023 found that products with a large total and paid search presence, higher star ratings, and sold by the top 1% of brands by revenue were more likely to generate higher sales in their first three months on Amazon. That last fact in particular was greeted by a collective shrug from many readers on LinkedIn – the rich get richer, to no one’s surprise. But after taking a look specifically at the top product launches from smaller brands, the other takeaways are largely the same. The most successful product launches from the bottom 99% of brands by organic search appearances across Amazon US:

- Were priced roughly 47% higher than their respective category average

- Non-top 1,000 launches were priced about 11% lower than the category average

- Appeared in page 1 search results roughly 4X more often

- Appeared in page 1 paid search results roughly 3.5X more often

- Were 12% more likely to hold a 4.5 or better star rating

- Had an average 4.42-star rating vs. a 4.18-star rating for non-top 1,000 launches

- Were 4% more likely to have at least 5 large images on the PDP

While bigger brands may have an advantage in aggregate when launching products on Amazon, this latest study shows how even smaller brands can find a path to success. Particularly for these emerging brands, product launch strategies should focus on maximizing product visibility, both organically and via advertising, alongside maintaining higher star ratings. When done correctly, these brands can fund the additional costs associated with the strong content and advertising push through a higher price and corresponding larger margins.

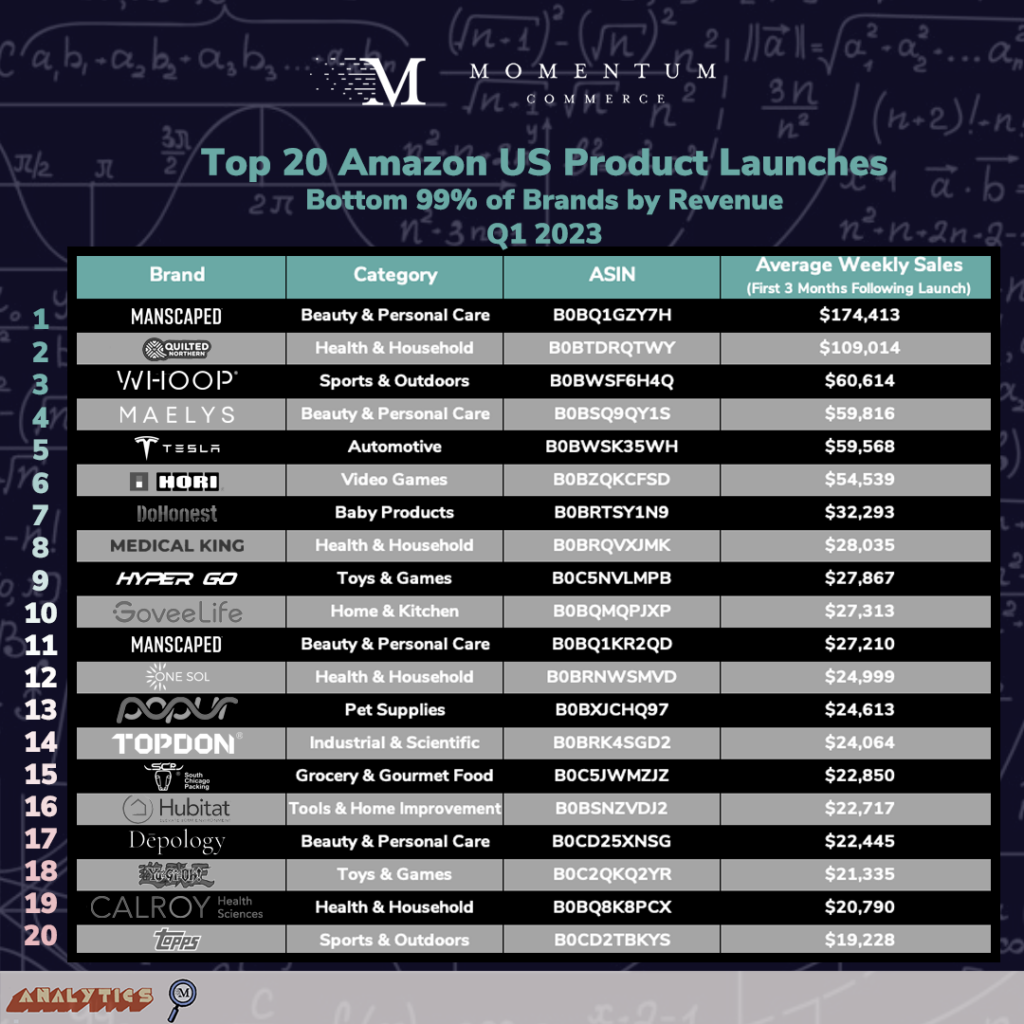

Some of the products from smaller brands that generated the most revenue over their first three months on Amazon US include:

Biggest Takeaways for Brands

- Avoid leaning on discounts as a key lever in your product launch strategy on Amazon

- The starkest difference between the most successful product launches and those that weren’t as successful was the price – top launches tended to be priced 47% higher than the category average

- Consumers clearly won’t typically ‘take a chance’ buying a new product if it’s priced well below the competition, which may be due to perceived quality

- Brands should instead use the additional margin afforded to them by not dropping prices to further invest in search visibility via advertising – a factor closely associated with top product launches

- High-volume terms are worth the advertising investment for new products

- Achieving significant search visibility is a pillar of top product launches regardless of brand size, and the quickest way to do that is by focusing advertising spend on the most searched and highly relevant generic keywords in the new product’s category

- You can use Momentum Commerce’s Amazon Brand Index and Search Trends Tool to clearly identify these terms

- 3P brands can gut-check the opportunity of a given term by examining the click share of the top of search results for that term over time via Amazon’s Search Query Performance tool

- In cases where a large percentage of clicks are captured by the first three results, that term is likely to be the most lucrative in terms of attracting sales with top-of-search ad placements

- Achieving significant search visibility is a pillar of top product launches regardless of brand size, and the quickest way to do that is by focusing advertising spend on the most searched and highly relevant generic keywords in the new product’s category

- Don’t sweat lower review counts initially – focus on maintaining high star ratings

- There was no significant relationship between review counts or review velocity (how fast reviews are coming in) for the success of a new product in the first three months

- While we know higher review counts than a product’s direct competitors does impact a given product’s performance over time, it simply isn’t a driving force early in a product’s lifecycle on Amazon

- Brands instead need to get new products in front of receptive customers that will ideally rate them highly – versus going for scale

- One major stop in reaching this goal is ensuring that product content aligns with actual product features so consumers know exactly what they are getting

- Additionally, brands can target subsets of receptive users (e.g. D2C loyalists, previous purchasers) with links directly to the new product page on Amazon

- There was no significant relationship between review counts or review velocity (how fast reviews are coming in) for the success of a new product in the first three months

Methodology

Momentum Commerce analyzed thousands of products that debuted on Amazon US between January and March 2023, examining the average weekly sales for the first three months following the launch date. To ensure a more standardized sample, products that are no longer available on Amazon US as of 2024 (e.g. due to limited availability, limited release, or delisting by Amazon) were excluded. Additionally, new child ASINs under existing parent ASINs were excluded from the analysis to ensure more meaningful comparisons. The specific date range was selected to remove the impact of Prime Day on performance data. For this analysis specifically, only products from brands in the bottom 99% by organic search appearances were included.