The 5 Key Types of Sellers on Amazon

Like many of you, long before I started working in the Amazon space I was an Amazon shopper first.

The key features I cared about to make my purchasing decisions were (and still are!) primarily:

- Relevancy of the product to what I was searching for

- Count of reviews and avg. rating to vet quality

- Ship timing

- Price

While I generally understood that some products were sold directly by Amazon and others were sold by third-party sellers, beyond that I didn’t really know or care where the products I ordered were coming from or who was selling them as long as they met my criteria.

However, as professionals working in the space, understanding the dynamics of seller types on Amazon can be critical to brand success and they aren’t always obvious or straightforward.

To help explain this, we’ve grouped Amazon sellers into 5 main types:

- Manufacturer & Direct-To-Consumer (DTC) Brands

- Produce their own products and sell them under their own brand name

- Private Label Brands

- Sell products manufactured by a third party or contract under a different brand name

- Factory Brands

- Brands sourced from (often overseas) factories that cut out intermediaries and go direct to global consumers with often lower prices

- Resellers

- Buy products in bulk and often sell them at a higher price to make a profit. Act as a broker between manufacturers/suppliers and the end consumer.

- Aggregators

- Companies that purchase multiple Amazon brands with the purpose of consolidating and growing them.

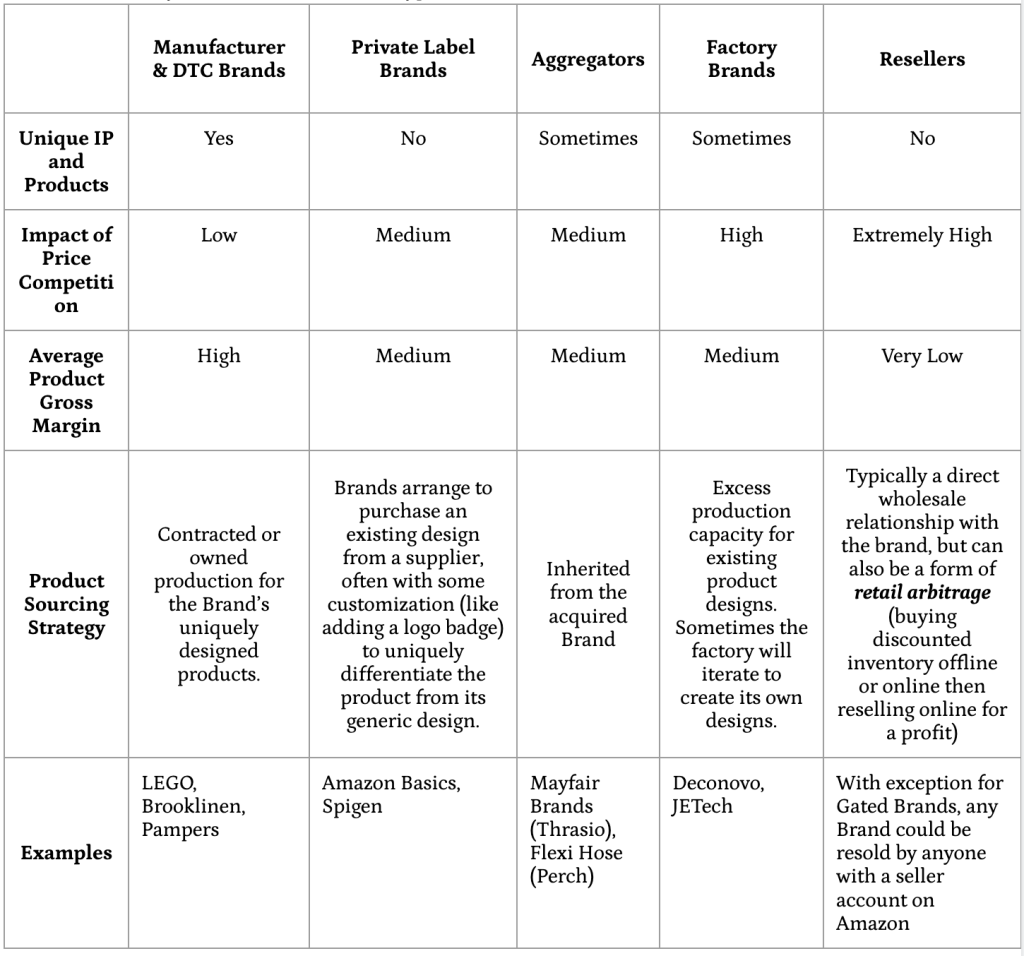

Below are some key differentiators for these types of sellers:

Call-out: Review Performance & Revenue: A Key Success Factor

Understanding the relationship between customer reviews and revenue is crucial for all seller types on Amazon. Our analysis shows several key patterns:

- Sellers with higher review counts typically generate more substantial yearly revenue, likely due to increased customer trust and visibility

- Recent review activity (within 30 days) often correlates with revenue growth, indicating the importance of sustained customer engagement

- Review impact varies by seller type – while high review counts generally benefit sales, factors like product category, competition, and pricing strategy play significant roles

- Geographic location influences review-to-revenue ratios, with U.S.-based sellers typically showing stronger review-to-revenue correlation than international sellers

This dynamic particularly affects private label and factory brands, who must work harder to build trust through reviews compared to established manufacturer brands.

Call-out: Understanding Seller Rankings

Amazon’s marketplace seller rankings are primarily determined by 30-day review volume. While only 1-5% of customers typically leave reviews, these responses significantly impact seller standing. Review rates vary by:

- Product category

- Price point (higher-priced items often generate more reviews)

- Product type (specialty items tend to receive more feedback than commodities)

This ranking system affects all seller types but can particularly impact new entrants working to establish their marketplace presence.

The 5 Seller Types Continued

For the 5 seller types outlined above, it is important to note that these sellers use either 1st or 3rd-party methods (or in some cases both) to sell their products. These 5 types of sellers do not necessarily only sell on the 3P marketplace.

First-party sellers (1P) sell wholesale to Amazon and Amazon acts as the retailer selling to customers.

Third-party sellers (3P) sell directly to customers via the Amazon Marketplace.

Why Should I Care?

Seller dynamics have shifted enormously over the years. Amazon was founded in 1994 and the 3rd party seller marketplace was launched in 1999 back when Amazon was still focused on selling books and music.

The original goal of the 3rd-party marketplace was to help consumers access used, speciality or rare products but it has expanded to be so much more.

62% of goods sold on Amazon are now sold third-party through the marketplace.1

This percentage has almost doubled over the last 10 years.

1 https://www.marketplacepulse.com/marketplaces-year-in-review-2020

DTC & Manufacturer Brands

Traditionally the DTC model is one where the brand sells straight to the consumer via their own storefront or website, avoiding distribution through wholesalers and retailers. A DTC brand does not manufacture their own products.

- A key benefit to selling directly to the consumer is that you no longer share your margin with a third-party retailer.

Many brands that started as pure DTC are now selling their products on Amazon due to the size and opportunity of the platform. One could argue that if a DTC brand, like Brooklinen, sells their products via the 1P solution on Amazon that they are no longer technically considered DTC since they are using Amazon as a retailer.

However, if that brand sells their product 3P through the Amazon Marketplace since the consumer receives their product directly from Brooklinen it could still be considered DTC.

Manufacturer Brands produce and sell their products, either through wholesale, retail or specialty retail. An example of a manufacturer brand that sells on Amazon is LEGO.

LEGO manufactures their products, sells them in retail locations like Toys R Us and Amazon (as a 1P vendor), and also sells their products in their own brick and mortar stores – an example of the specialty retail model.

Both DTC and manufacturer brands spend time and money on creating unique branding and promoting their products.

Private Label Brands

The big pros of private labeling are control and not having to produce the product yourself. It allows you to:

- Build and customize your own brand

- Set your own pricing

- Differentiate against sellers selling the same product, reducing your competition

However, it can take time to create consumer engagement and loyalty with a new brand and the product you are selling isn’t actually unique.

Being successful requires ensuring that:

- The quality of your products is high – private label products can have a reputation with consumers as being low quality

- Close management of your minimum order quantities (MOQs) to ensure you don’t over-purchase and carry dead stock or undersell

Private label brands are typically created with the intent of distributing their products through a specific retailer like Amazon but don’t promote them elsewhere such as on social media or sell them in stores. This differs from DTC and manufacturer brands where the distribution is generally much broader.

The most notable example of a private label brand is Amazon Basics. Amazon now has >22,617 products from 111 private label brands across most categories – 3x the private label brands they had in 2018.4, 5

Amazon claims that only 1% of their total sales come from their private label brands but this varies a lot by category.

75% of Amazon’s private label brands are in fashion6 and fashion private label sales account for 9% of total fashion 1st party sales (see chart below). This creates increased competition for brands in this category.

Below is an example of a private label brand, Amazon Basics, selling AA batteries alongside other notable brands Energizer and Duracell.

Factory Brands & Overseas Suppliers

This group, particularly factory brands based in China, is growing rapidly.

Sellers based in China represented 75% of sellers in Jan ‘21 whereas that figure was only 47% the prior year.2

Using our Amazon Brand Index tool, we were able to see that in the Women’s Dresses category, a particularly competitive one, 83% of the top brands noted are based out of China.

My colleague Ryan wrote about how to compete against this seller type here that is worth a read, especially if this is a key issue for the category that your brand competes in.

Aggregators

This seller type has seen huge growth over the last two years and it is a relatively new model in the history of Amazon selling.

Almost $1B in new capital was invested in 2020 by firms to acquire Amazon sellers and brands.3 This is serious investment and was accelerated by increased spending on Amazon during the pandemic.

3 https://www.marketplacepulse.com/marketplaces-year-in-review-2020#selleracquirers

Thrasio, one of the largest Amazon aggregators, has a $1B valuation and its pitch to sellers on its website is “Sell your business. Celebrate a lucrative exit. Continue to profit as your brand grows with us”.

It’s a very attractive offer for small sellers that have seen success growing on Amazon but don’t have the tools, expertise or resources to take sales to the next level and want to stop running it all on their own, all while making more money.

Trailbuddy is an example of a Thrasio-acquired brand that was grown strategically on Amazon.

The way that products are sold on Amazon has shifted rapidly over the years and we expect continued evolution over the next decade. For specialized advice on navigating these shifts for your brand, feel free to reach out to us at hello@momentumcommerce.com.

2 https://www.marketplacepulse.com/articles/75-of-new-sellers-on-amazon-are-from-china

4 https://coresight.com/research/inside-the-world-of-amazons-private-label-offering/