Top Best Seller Ranks on Amazon US are Pretty Unstable for Most Categories

Achieving a top best-seller rank (BSR) on Amazon is what every brand selling on the site strives for. An earlier study of ours found that a #1 BSR is worth 41.5% more units sold per week.

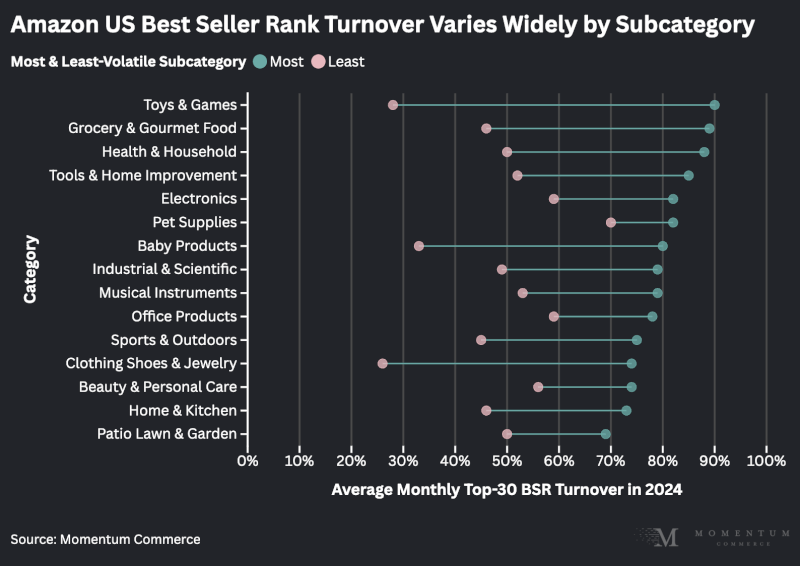

But holding that rank over time presents its own set of challenges, with different categories exhibiting varying rates of stability. Looking across second- and third-tier categories (e.g. Home & Kitchen > Vacuums & Floor Care), it’s pretty clear that top 30 BSRs are generally volatile, underscoring how brands need to maintain a high degree of vigilance to maintain a high rank even after doing the work necessary to achieve it.

To study BSR survivability over time, we analyzed the top 30 products by BSR for all tier-2 and tier-3 level categories for each month in 2024, calculating the share of those products that maintained a top-30 ranking in the subsequent month.

Across all subcategories studied, the average monthly BSR turnover in 2024 was 63%. Looking across the sample, what becomes clear is that there are relatively few ‘stable’ subcategories in terms of BSR survivability.

To illustrate, below is the subcategory for each major category with the highest and lowest degree of average top BSR volatility over the course of 2024:

While the figures highlight how top Amazon US BSRs generally exhibit high degrees of turnover, there are some qualities that tend to separate more volatile from less volatile categories:

- Higher turnover: More fragmented market share, less brand affinity, more importance on specs and product details

- Lower turnover: Less fragmented market share, more brand affinity, less importance on specs and product details

Key Lessons for Brands

- Track your BSR, by any means necessary

- There has been some noise around Amazon suppressing BSR stats on some product detail pages

- You can still track this metric using other data sources as a proxy, so its worth creating some redundancies in case Amazon continues or expands this practice

- When expanding into a new category, know what you’re up against

- This goes beyond understanding the biggest brands in a given market

- As part of due diligence, it’s worth studying BSR turnover rates to give you a clearer picture of consumer buying behavior in the category and how vulnerable existing players are

- Even after ‘climbing the proverbial mountaintop’ to achieving a top BSR, resist the urge to be complacent or not refresh your tactics and strategy

- Maintain vigilance in terms of identifying relevant keywords rising in popularity and working those into your product content and advertising strategy

- Leverage tools like AMC and employ full-funnel tactics to better reach and value customers throughout the purchase journey

- Conduct consistent competitor research to make tactical or strategic adjustments based on what may be working for other brands (e.g. new product imagery or ad creative, new keywords in product content, increased discounting, etc.)