How We Predict Amazon Ad Spend by Brand

Knowing what your competitors spend on Amazon advertising can be a huge advantage when setting a cohesive strategy. We decided to tackle this challenge in 2024, and the result is a model that accurately assesses competitor spend across a large portion of brands selling on Amazon.

Amazon search advertising works on a cost-per-click (CPC) model, so getting a firm handle on predicting the numerator (in this case clicks) was crucial before making cost assumptions.

To do this, we used our clients’ collective data to feed in information such as date, brand, absolute rank, placement type, and monthly estimated search volume for all the terms where those brands ranked on the search page. We then identified 20 factors for training the model, incorporating Sponsored Brands and Sponsored Products placements, using a Random Forest methodology.

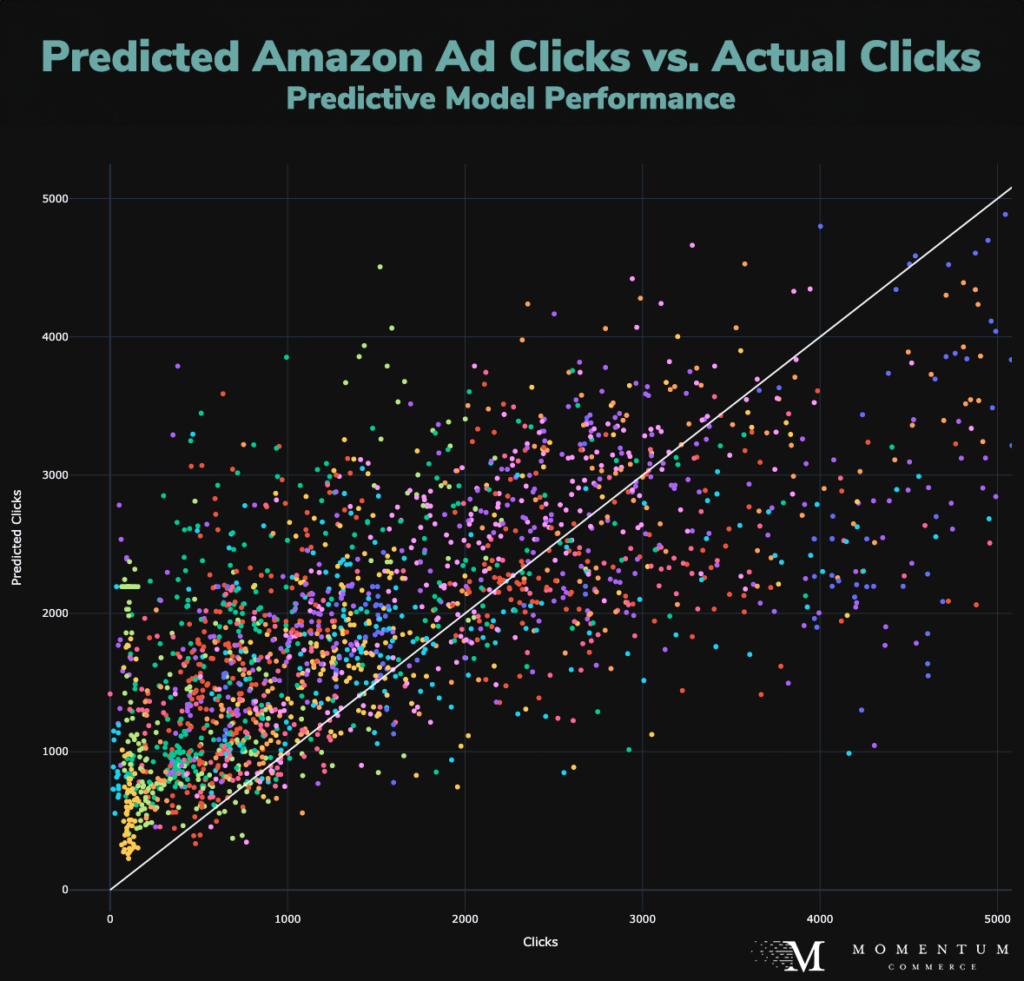

The model performed well against a subset of client brands we held out from the training set – particularly those generating between 1,000 to 3,000 ad clicks per day. While this represents a large share of Amazon brands, for those generating lower or higher volumes, we found the predictive ability isn’t quite as strong.

With this model in tow, alongside the array of marketplace data we collect multiple times per day, we can look across any brand on Amazon and have a reasonably trustworthy estimate of the clicks they are generating in a given week. By supplementing these estimates with CPC assumptions, this model has already helped us advise clients on the likely spend levels of competitors, and how they may want to counter given their business goals.

Biggest Takeaways for Brands

- This model for click estimation has a wide array of potential use cases – including ways to intelligently reduce ad spend

- This model allows you to look at your competition, get click estimates, and using CPC assumptions, discover how much more or less your competitor is spending

- Similarly, if your brand’s search ads are running at a prohibitively high TACOS by looking across competitors with this model, you can get a firmer handle on whether they are spending less, and where

- These estimates can also be a tremendous help for brands looking to enter new categories on Amazon or improve their Amazon Best Seller Rank (BSR)

- Before entering a new market, this model can give a good estimate of what it will take to compete in terms of how many clicks those brands are generating and how much they are likely to spend

- By zeroing in on competitors that are ahead of your brand from a BSR perspective in specific markets, you can get a clearer view into what those brands are doing but you are not (e.g. their spend rates and click volumes on specific terms)