Momentum Commerce 360: Pet Supplies Category Breakdown

The Pet Supplies category on Amazon is strong and fast-growing, with revenue up 20.7% year-over-year – but there are nuances. Using our Digital Shelf Analytics Platform, Velocity by Momentum Commerce, we did a deep dive into specific Pet Supplies subcategories to demonstrate just how different market dynamics can be within the same top-level category. With growing numbers of pet owners turning to Amazon for supplies, emerging and legacy brands need to focus on the areas that matter to effectively capture market share in order to be successful.

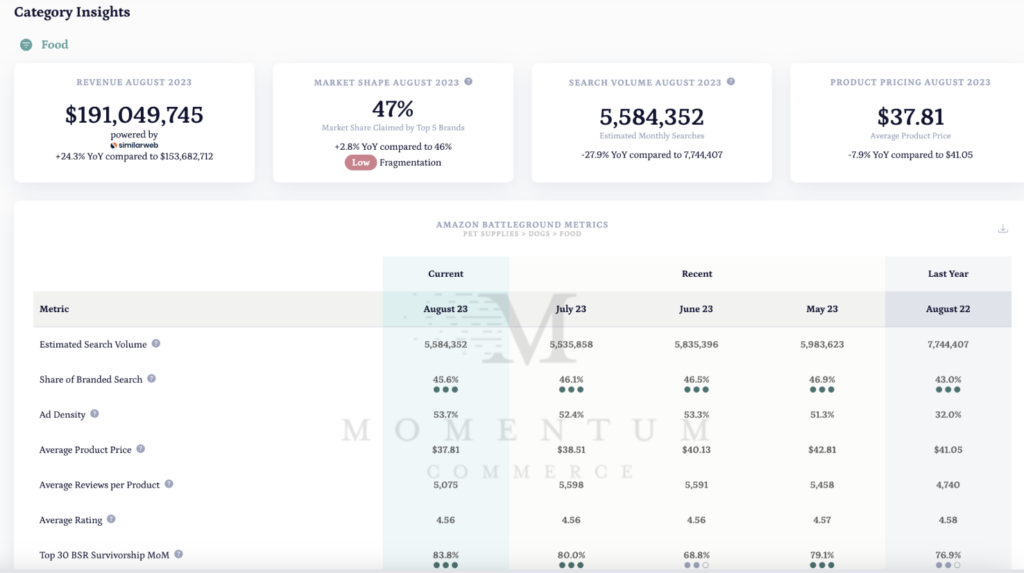

Pet Supplies> Dogs>Food

- Revenue is up 24.3% in August 2023

- 47% of the subcategory revenue is claimed by the top 5 brands

- Estimated Search Volume is down 27.9% in August 2023

- Ad Density is up to 53.7% from 32% the year prior.

- Top 3 Brands by Overall SOV:

- Purina Pro Plan= 8.37%

- Hill’s Science Diet= 8.34%

- Blue Buffalo= 8.28%

The Takeaway

Dog Food’s GMV is up YoY while average product price is down about 7.9% in August 2023. With 47% of the revenue owned by the top 5 brands, rising ad density, and an almost 28% decline in search volume, any new brands looking to enter the market on Amazon might find it difficult to compete cost-effectively.

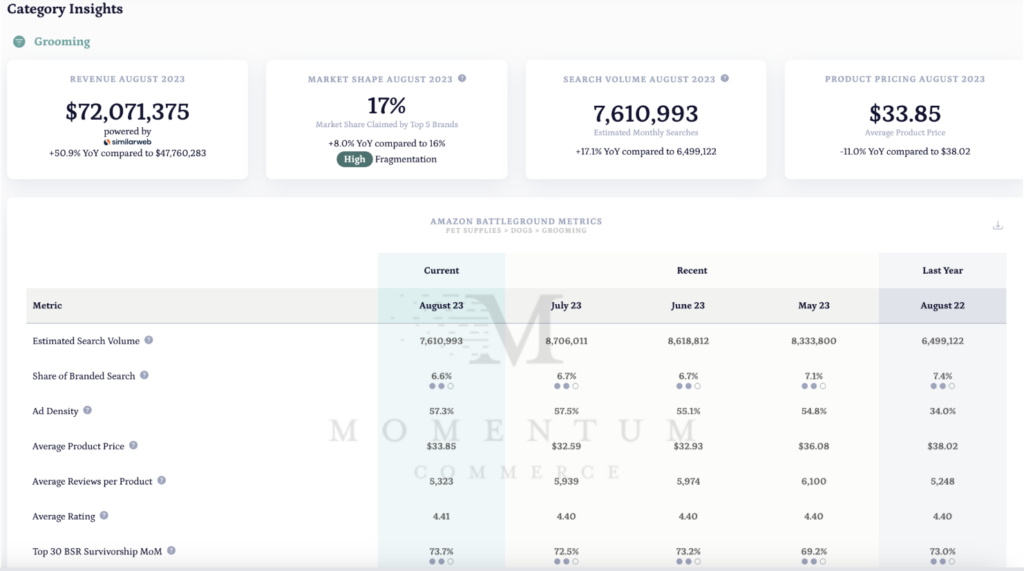

Pet Supplies> Dogs>Grooming

- Revenue is up 50.9% in August 2023

- 17% of the subcategory revenue is claimed by the top 5 brands, increasing 8% in the last year.

- The estimated search volume is up 17.1% YoY.

- Ad Density is up to 57.3% from 34% the year prior.

- Top 3 Brands by Overall SOV:

- oneisall= 1.94%

- WAHL= 1.7%

- Burt’s Bees= 1.09%

The Takeaway

The Dog Grooming subcategory is hot, and it’s a relatively welcoming option for potential new entrants. The market revenue is a bit more fragmented across brands, and overall revenue is continuing to grow year over year. Search volume related to the subcategory is growing, signaling more interest on Amazon.

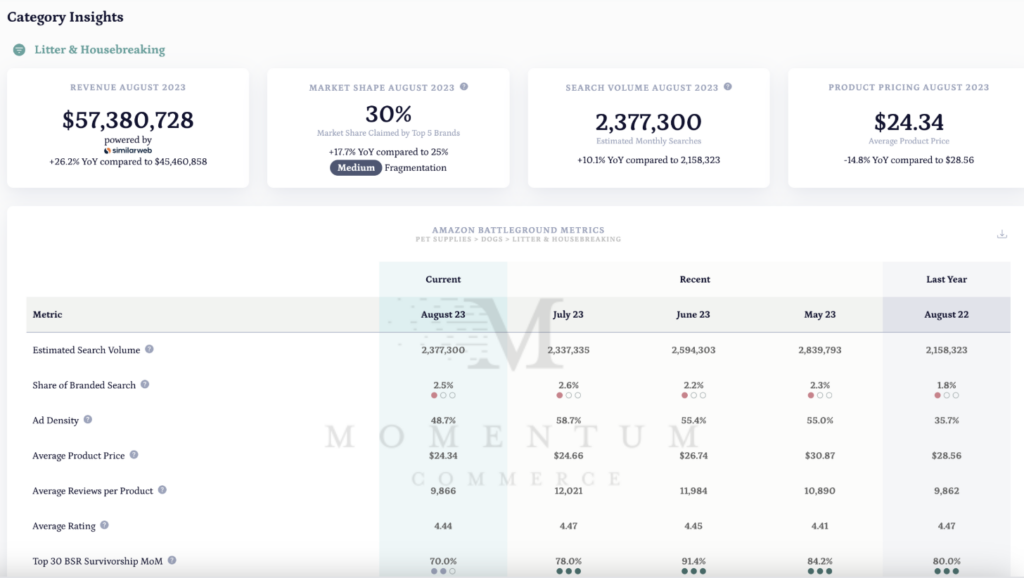

Pet Supplies> Dogs>Litter & Housebreaking

- Revenue is up 26.2% in August 2023

- 30% of the subcategory is claimed by the top 5 brands, increasing 17.7% in the last year.

- The estimated search volume is up 10.1% YoY.

- Ad Density is up to 48.7% from 35.7% the year prior.

- Top 3 Brands by Overall SOV:

- Amazon Basics= 3.62%

- Earth Rated= 2.94%

- PET N PET= 2.64%

The Takeaway

This subcategory may be a challenging one for potential new entrants. 30% market share claimed by the top 5 brands, ad density is rising, while average price is declining. Despite those challenges, there remain areas of opportunity for brands that aren’t as well established in this subcategory. Search volume and revenue are up, and branded searches are a relatively small portion of overall traffic, meaning consumers aren’t usually shopping with a brand in mind initially.

Explore more of our free tools, like our Amazon Brand Index for more SOV data, or our Amazon Search Trends Tool. Feel free to contact us at hello@momentumcommerce.com for any questions related to your brand’s category or subcategories!