Amazon Prime Big Deal Days 2023 Recap

|

Data Science

News & Press

Retail Strategy

October 13, 2023 · 2 min

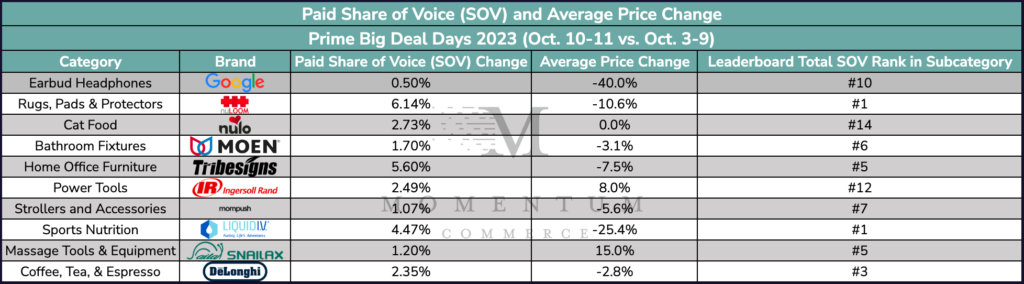

Amazon Prime Big Deal Days have concluded, achieving higher sales than last year’s Early Access Event, but falling short of the scale seen during July’s Prime Day. Earlier this week, we highlighted some of the ‘early winners’ from Day 1 in terms of their Paid Share of Voice (SOV) gains and corresponding price adjustments. Now, let’s check our Amazon Brand Leaderboard to discover how these brands fared by the conclusion of Day 2.

The Data

- Google focused heavily on price, taking the back seat when it came to advertising during this Prime event.

- Liquid I.V. dominated the Sports Nutrition subcategory by pairing massive price cuts with an increase in paid ad placements.

- Snailax was among the top five in terms of Total SOV within their subcategory despite only slightly increasing ad activity and being one of the few on our list to increase price during the Prime event.

Other Notable Subcategory Competition

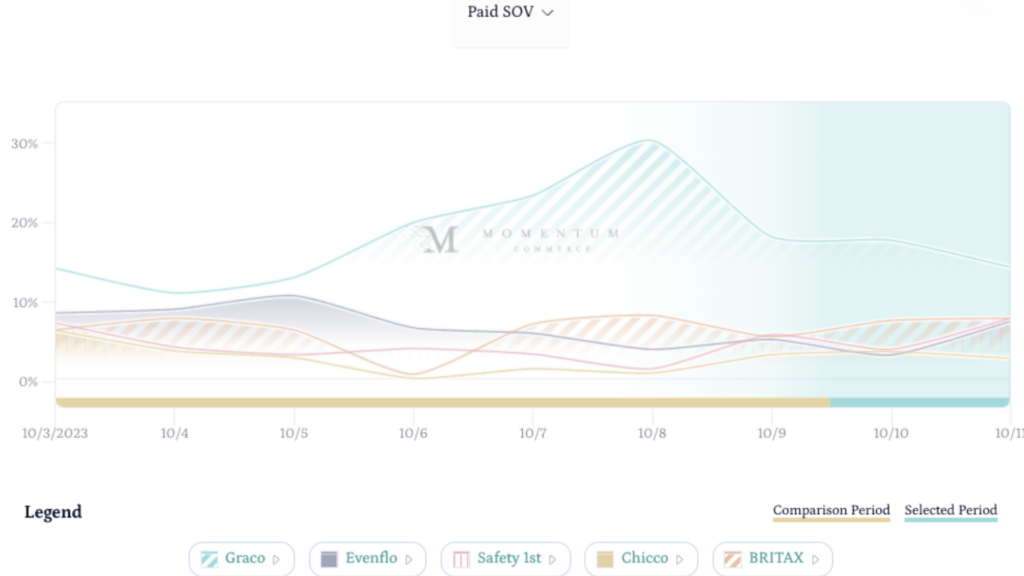

- Car Seats & Accessories: This subcategory had an interesting dynamic in Paid SOV efforts over the days leading up to and during Prime Big Deal Days. Graco dominated paid placements, holding 30.5% of Paid SOV at the beginning of the week, and maintaining the lead throughout the Prime event. Evenflo seemed to take a discount-only approach, reducing the price by 24.66% in the given period, focusing less on their paid placements.

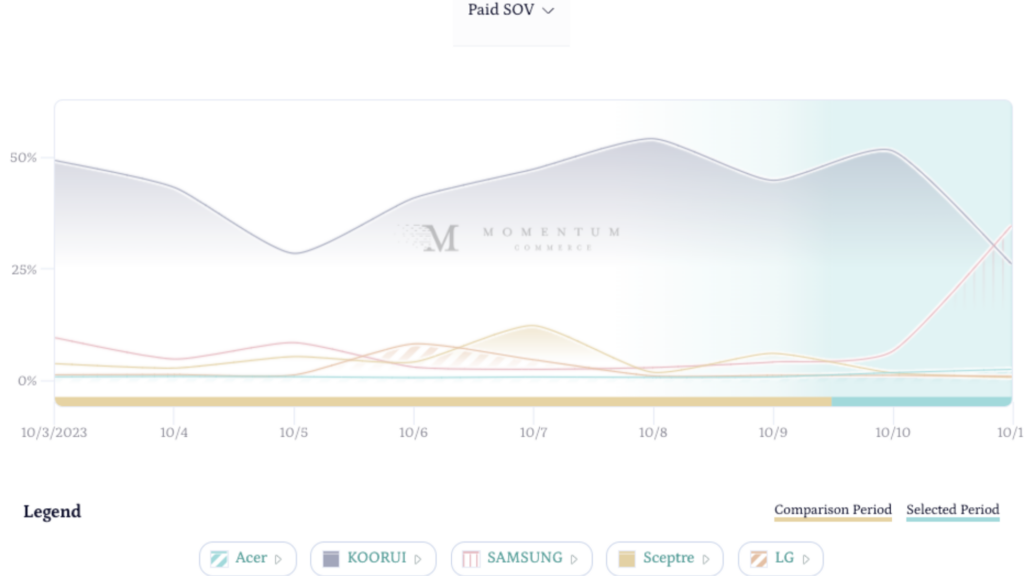

- Computer Monitors: Acer, Sceptre, LG, and Samsung were in relatively similar positions through Prime Big Deal Days, allowing KOORUI to achieve Paid SOV dominance in the subcategory. While KOORUI focused more on paid placements, Sceptre (-19.69%), and Samsung (-38.27%) focused on providing greater price reductions.

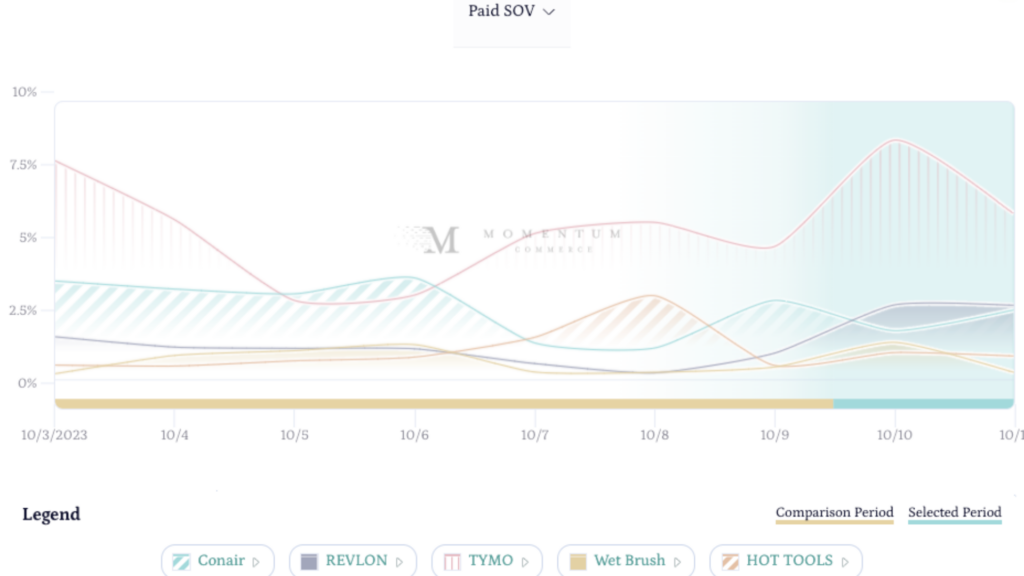

- Hair Styling Tools & Appliances: TYMO maximized its strategy within the Hair Styling Tools and Appliances subcategory, dominating paid placements while also slashing prices by 20.48%. Other brands like Revlon (-11.53%) and Hot Tools (-9.94%) placed less emphasis on ad placements and more on discounting.

Stay tuned for additional insights from Prime Big Deal Days! In the meantime, head over to our free Amazon Brand Leaderboard to see the results of your category!