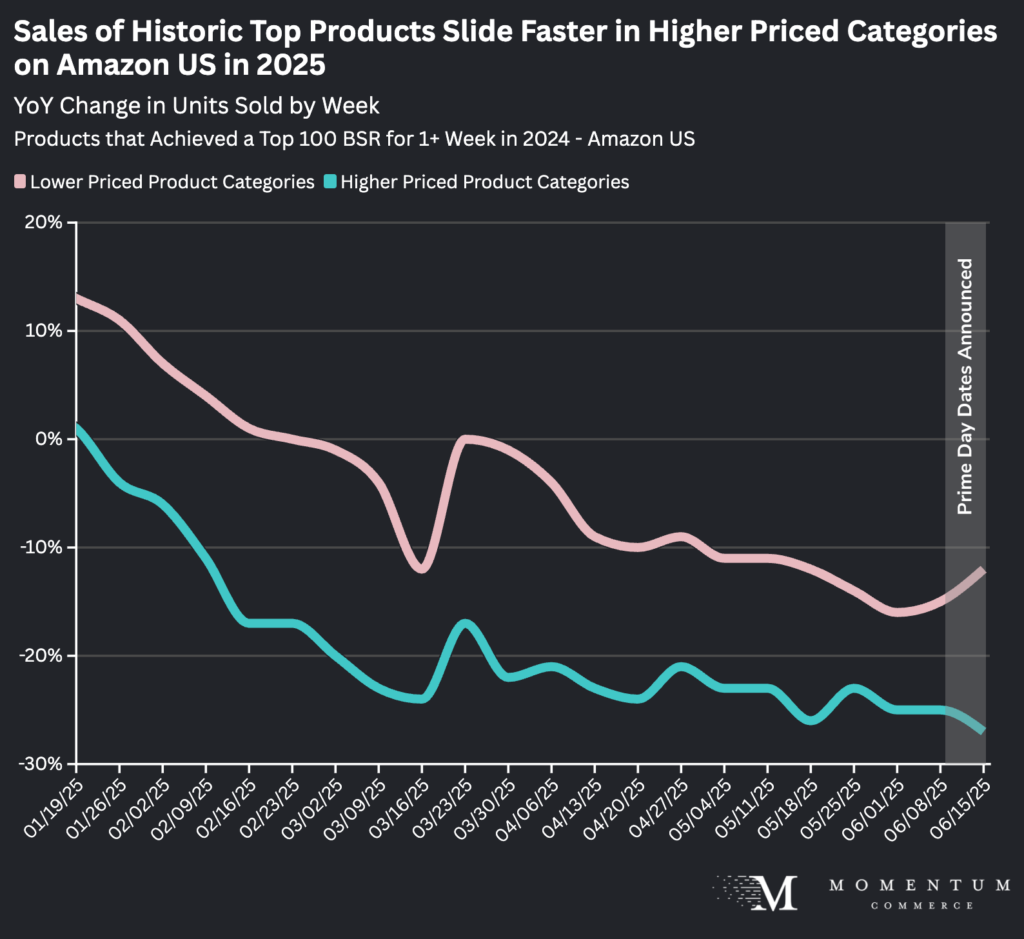

Sales Fall 27% YoY for Top Products in Higher Priced Categories as Prime Day 2025 Approaches

On June 17, 2025 Amazon officially announced the dates of Prime Day 2025 as July 8-11. That same week, higher priced categories saw unit sales for historic top sellers drop year-over-year (YoY) at the sharpest rate seen in 2025. This emphasizes consumers are holding off on bigger purchases ahead of the sale event, similar to what occurred earlier this year with the Big Spring Sale.

After examining a consistent basket of products that achieved a top 100 best-seller rank for at least one week in 2025, it’s clear that sales for these historically top products have dipped YoY in 2025. However, the fall has been sharper in higher-priced categories, hitting a low point in the most recent week.

For categories with ASPs more than 1 standard deviation above the Amazon US average, units sold numbers the week ending June 21, 2025 dropped -27% year-over-year across historic top sellers. Meanwhile, for categories with ASPs more than 1 standard deviation below the Amazon US average, units sold in the week ending June 21, 2025 dropped just -12% year-over-year across the same cohort.

A similar dip was seen prior to the Big Spring Sale in late March, and sales did rebound on a YoY basis the week of the sale event. This hints at the potential of Prime Day to reverse some of the downward trend in 2025, but given the longer-term market dynamics longtime top products have their work cut out for them to drive sales growth.

Key Takeaways for Brands

- People may be holding out for Prime Day, but top brands can’t stay passive

- Consider investing in programs like Amazon Vine as part of launch marketing expenses

- Understanding category averages in review counts prior to launch can help set a realistic goal of doubling or tripling that figure over the first 90 days

- Brands in higher-priced categories need to make some tough decisions around deal participation

- Consumers are trading down and being more value conscious generally on Amazon US, while the prices of long-time top products have risen steadily

- We know from the past that pairing relatively aggressive discounting with more search advertising exposure results in the best short- and long-term revenue performance over Prime Day

- Longtime top brands may have trouble from a margin perspective to thread this needle, but it essentially is the ‘cost of doing business’ for an event like Prime Day

- On Amazon, past performance doesn’t dictate future success, so act accordingly

- Even if your product vaults into a top BSR position for a week or two, the Amazon marketplace is dynamic enough that you cannot rest on your laurels

- BSR is volatile generally, and staying at the top requires a concerted effort to constantly monitor the competitive landscape and make adjustmentswilling to pay for quality, even for new products

- Most brands can’t compete with foreign counterparts on price, and the data shows that low pricing shouldn’t be a primary goal for new products on Amazon

- Instead, use limited-time discounts and similar promotions to drive early sales without cutting your baseline price