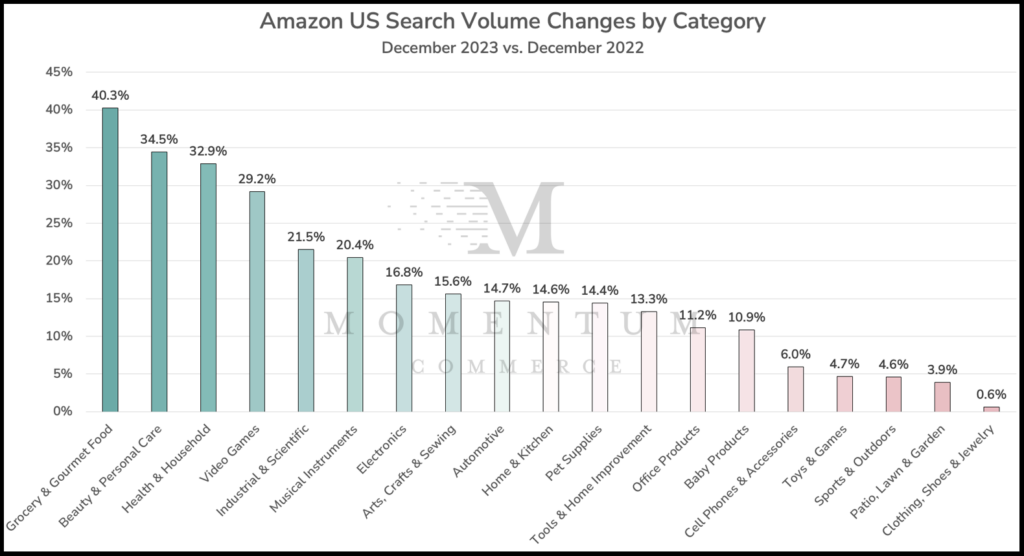

Amazon US Search Volume Skyrockets 15.3% Year Over Year in December 2023

Amazon US search volume increased by more than 15% year-over-year (YoY) in December 2023 – the fourth straight month Momentum Commerce has cataloged year-over-year traffic increases, and the largest YoY increase measured to date. This was the first month since these reports began in 2022 that every studied category posted a YoY search volume increase. Overall, the marked increase in Amazon searches supports the idea that the strong sales figures touted by the retailer over the Cyber Week period continued through the remainder of the holiday shopping season.

Biggest Takeaways for Brands

- Amazon US remains a growing platform despite newer entrants

- Discount retailers like Shein and Temu alongside TikTok Shop are certainly growing, but Amazon’s value proposition with its larger assortment, delivery speed and associated services is still resonating with an increasing number of US consumers

- However, those sites’ apparel- and accessories-heavy seller is likely what is minimizing Clothing, Shoes & Jewelry growth on Amazon in particular

- Grocery and other CPG categories are where there remains the sharpest continued growth on Amazon US

- The substantial 40.3% YoY increase for Grocery & Gourmet Foods continues a months-long stretch of significant traffic increases for the category, underscoring how consumers are increasingly turning to Amazon when shopping for food items

- The Health & Household and Beauty & Personal Care categories have both posted double-digit YoY search volume increases every single month since July 2023.

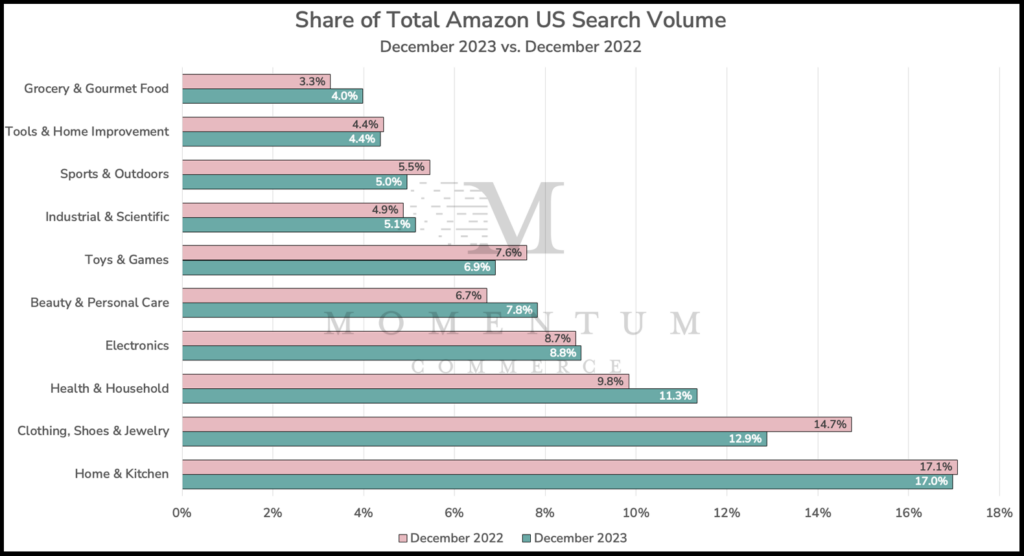

- Beauty & Personal Care overtook Toys & Games as the 5th most searched category on Amazon in November and December 2023, and is poised to surpass Electronics in a matter of months

- Similarly, Health & Household will likely supplant Clothing, Shoes & Jewelry as the second-most searched category on Amazon by the end of 2024

- Continued tightening in the Toys & Games, and Clothing Shoes & Jewelry categories should be a warning light to relevant brands

- While Toys & Games search volume was up 4.7% YoY, that trailed the whole-site average of 15.3%, leading to the category to now make up 6.9% of all search traffic versus 7.6% in December 2022

- Clothing, Shoes & Jewelry searches on Amazon US continues to make up a steadily smaller share of overall site activity

- In both cases, brands operating in these categories should be evaluating their strategies and tactics given the impact of a shrinking shopper pool on Amazon US

- This could include implementing Amazon Marketing Cloud to better align efforts across channels, further optimizing search advertising spend to incremental terms, budgeting towards other ad types on branded terms, or thoughtfully experimenting with pricing changes.

- Industrial & Scientific achieves largest YoY gain ever cataloged for the category – but this is likely transitionary

- After months of modest year-over-year gains, search volume across the Industrial and Scientific category grew 21.5% in December 2023 compared to the prior year

- A sizable portion of this gain was presumably driven by consumers stocking up on disposable masks, test kits, and related items given the marked increase in COVID, flu and other seasonal ailments around the holiday season

Methodology

Data included in this analysis is based off of search volume estimates across the top 1,000,000 search terms on Amazon during December 2022 and December 2023. Search terms were categorized based on the top-level category associated with the majority of products appearing on the corresponding search results pages.

These models reflect the updates Amazon has made to their own search volume methodologies within Search Query Performance metrics. This includes all historical search volume estimations within this analysis