Skincare Showdown: CeraVe vs. Cetaphil – Which Cream Reigns Supreme?

Beauty & Personal Care is a thriving category on Amazon, as proven by its ever-growing +27.5% increase in search volume in April 2024, a rate that is well ahead of Amazon’s overall growth. Driven largely by social media trends, Beauty & Personal Care is home to various new entrants, and even more long-standing household names. Among these are CeraVe and Cetaphil, the skincare giants whose range of products provides a quality, gentle skincare routine for users of any age. Let’s have a skincare showdown, Amazon style: CeraVe vs. Cetaphil. Who is driving more branded searches? Who is investing in more paid ad placements? Below, we will walk through various Amazon metrics from Velocity, our Digital Shelf Analytics Platform.

Brand Insights

- CeraVe

- $22.6M Total Revenue in April 2024

- 5.8M Branded Search Volume in April 2024

- 0.8% Market Share

- Cetaphil

- $8.3M Total Revenue in April 2024

- 1.5M Branded Search Volume in April 2024

- 0.3% Market Share

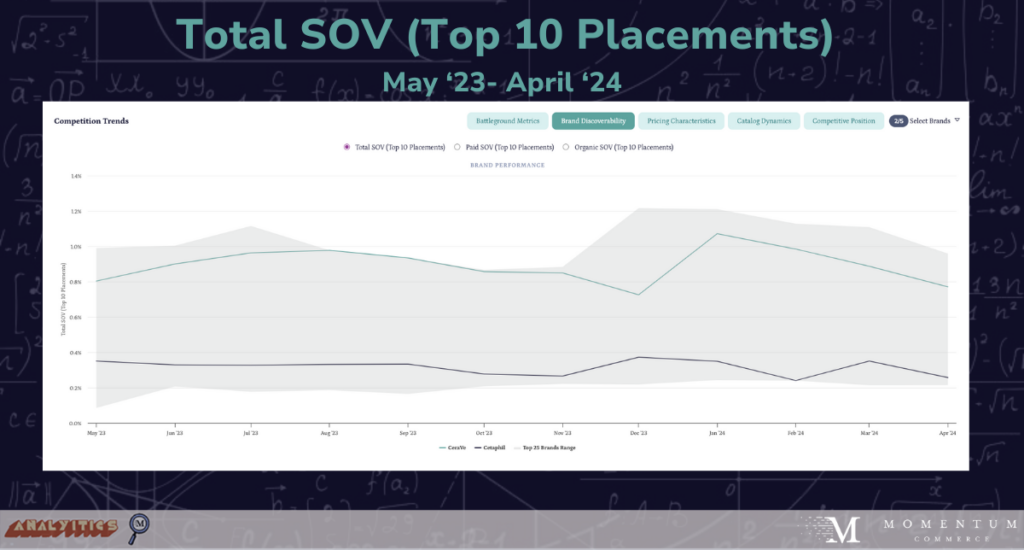

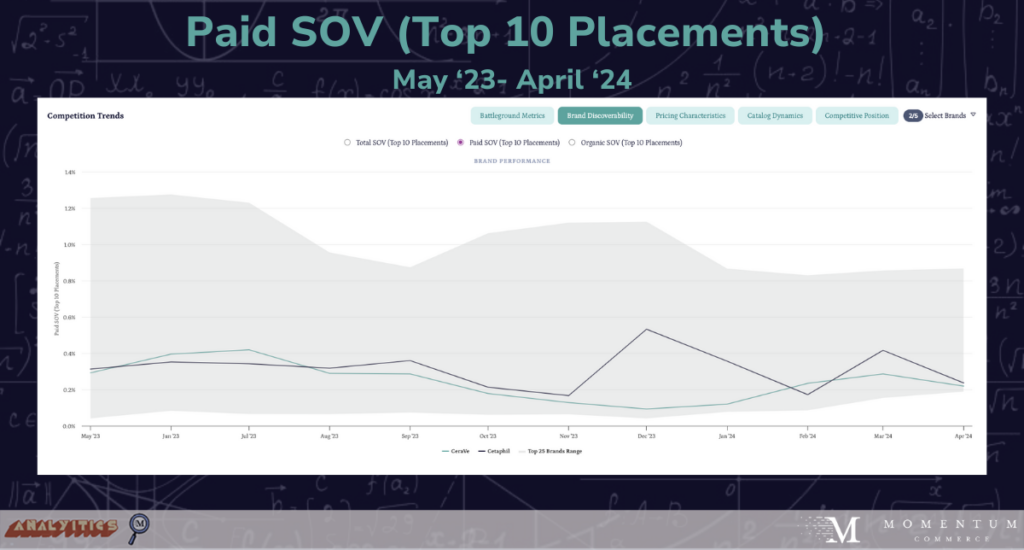

SOV Trends

There are some interesting dynamics when it comes to Share of Voice. When looking at Total SOV across the Top 10 Placements, CeraVe remains on top for the year. However, when looking at Paid SOV in the graph below, CeraVe tends to take the back seat, allowing Cetaphil to up their paid placements beginning in August of 2023 and stretching through the rest of the year.

- For a brand like Cetaphil, increasing paid presence on key search terms and during critical tentpole events like Black Friday/ Cyber Monday is a sound strategy to remain competitive against a much larger competitor

- Cetaphil has many Sponsored Brands placements on CeraVe branded terms, a good offense-minded strategy

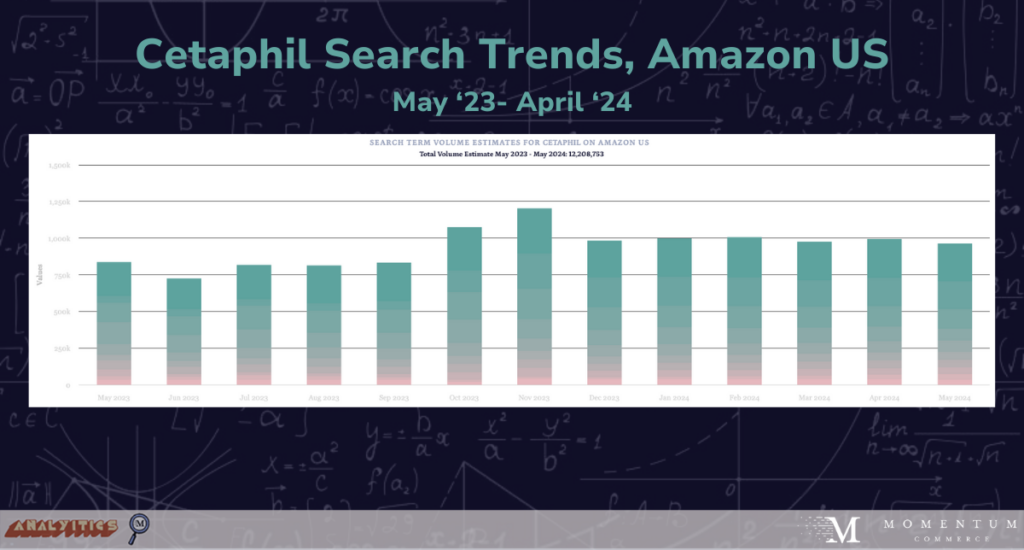

Search Trends

- CeraVe’s Total Branded Search Volume Estimate from May ’23- May ’24: 38M

- In the past year, CeraVe held 2 of the Top 10 highest-searched terms in the Skincare subcategory

- Cetaphil’s Total Branded Search Volume Estimate from May ’23- May ’24: 12.2M

Product Insights

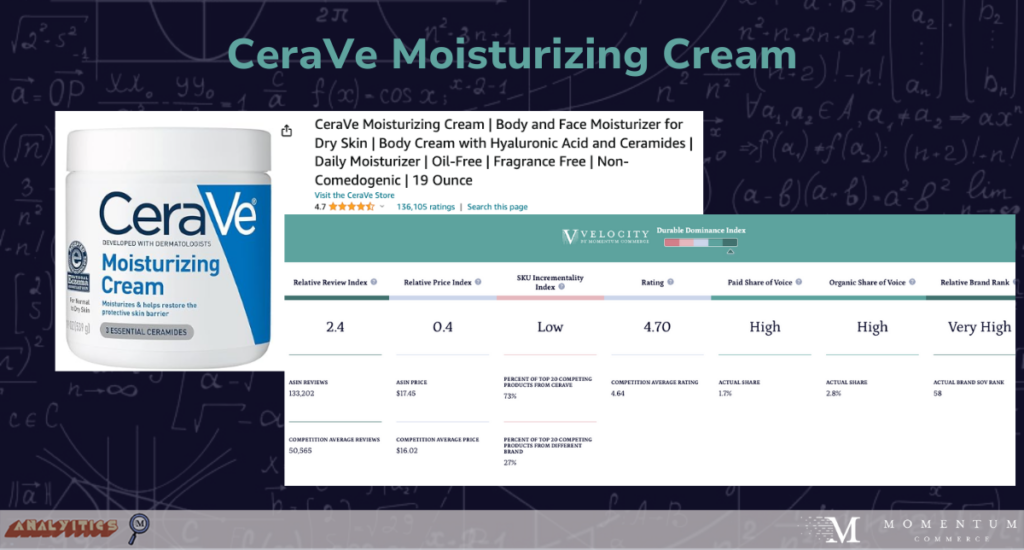

- CeraVe’s top ASIN, the 19 oz. moisturizing cream for Face and Body is well positioned in terms of Momentum Commerce’s Durable Dominance Index across a number of areas including:

- An average review count more than double that of average competitors

- Higher star ratings than its competitors

- Paid search advertising support along with a high organic share of voice

- Cetaphil’s top ASIN, the 16 oz. daily facial cleanser is not as well positioned for success on Amazon, for example:

- An average review count well below that of its competitors, putting this key product at a disadvantage

- However, average rating, paid SOV, and organic SOV are relatively strong

The Takeaway

- CeraVe may be leading the skincare showdown in terms of sales and searches, but Cetaphil is paying to play

- There are numerous ways to increase search visibility. In our most recent analysis, we found that adding a coupon to an ASIN drove a 17.2% increase in search visibility

- Achieving a #1 Best Seller badge can help boost performance across categories and subcategories. Signals like a badge can help illuminate to customers that a product is worth purchasing

- Across top Beauty & Personal Care subcategories, achieving a #1 BSR drove an average +83.3% increase in units sold vs. the week prior to achieving the BSR

- Testing Sponsored Brands creative can help more efficiently capture consumer interest, especially Sponsored Brands Video ads