The Fastest Growing Brands on Amazon in 2023

Outside of top-line growth, brands selling on Amazon should be keenly focused on whether they are growing faster than their own category. Between Q1 2023 and Q3 2023, a number of brands achieved this feat to varying degrees. While most grew their market share across top-level Amazon categories by fractions of percentage points, a select few captured even larger shares of category revenue.

How We Calculated the Fastest Growing Brands

The data itself is drawn from Amazon-specific sales figures cataloged by independent, third-party sources from January 1, 2023 through September 30, 2023. To better illustrate more sustained market share growth, market share figures were averaged from the Q1 period (January through March), and then compared to the Q3 (July through September) average. Leaders are ranked based on the raw percentage point difference between the two periods.

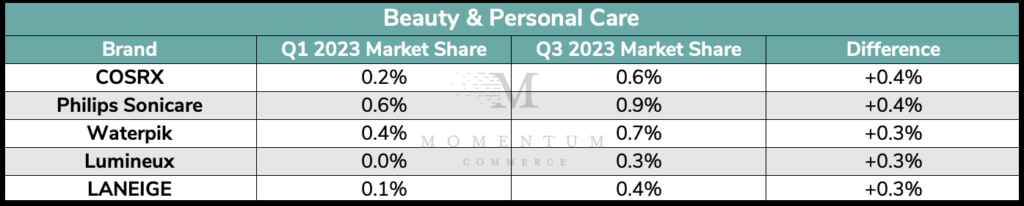

Beauty & Personal Care

- Beauty & Personal Care is one of the fastest growing categories on Amazon, which makes these brands’ ascents that much more impressive. This is a category that is driven by social media trends, and COSRX and LANEIGE in particular are benefitting from massive exposure on TikTok, with 4.6 billion and 66.8 million views respectively.

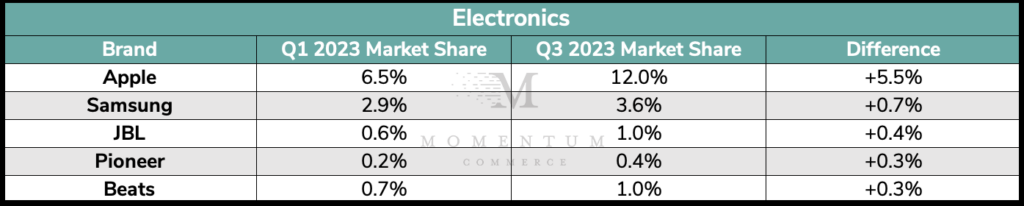

Electronics

- Apple was far and away the fastest-growing brand on Amazon across categories between Q1 and Q3 2023. Thanks in no small part to the launch of the iPhone 15 in September, the brand’s market share in Electronics went up by a full 5.5 percentage points – nearly doubling its share of category revenue. While not keeping pace with Apple, Samsung still grew its share of category revenue by a solid 0.7 percentage points, with Prime Day deals and the launch of the brand’s Z Fold 5 in August 2023 likely playing a role.

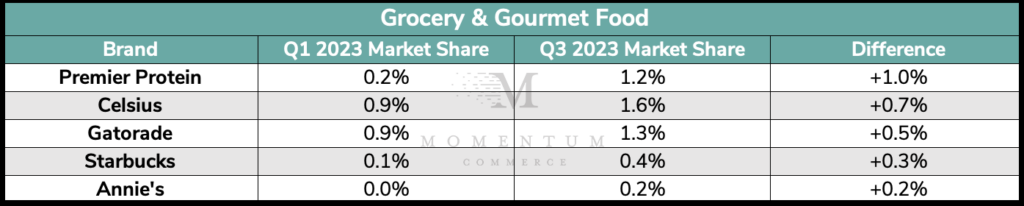

Grocery & Gourmet Food

- Premier Protein had a banner Q3 2023 on Amazon, with the brand’s share of Grocery & Gourmet Food category revenue jumping more than 500% from the Q1 2023 average. This growth comes alongside branded searches for Premier Protein nearly doubling over the same time period. Celsius branded searches have been on a similar trajectory, helping the brand outpace even growing, legacy rivals like Gatorade.

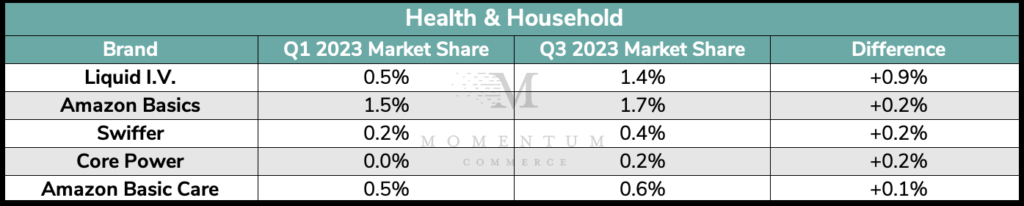

Health & Household

- Liquid I.V. continued its impressive trajectory observed the last time we did this report in 2022. Despite Health & Household being fast growing and the third-most popular category on Amazon overall, the brand more than doubled its share of category revenue. This is a testament to the brand’s staying power with US consumers. Amazon is also making steady progress with its private label brands. The retailer’s non-consumable Amazon Basics brand, along with its OTC medication brand Amazon Basic Care both posted top-five gains in Health & Household category market share.

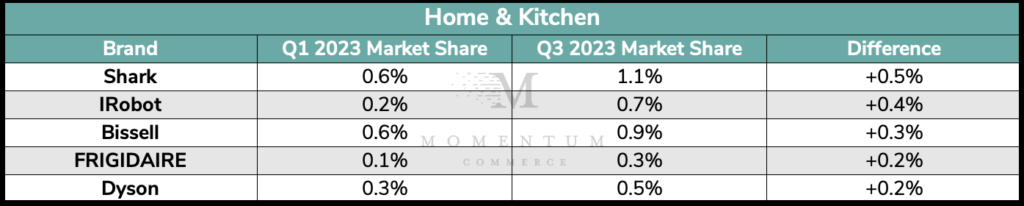

Home & Kitchen

- The five brands that drove the sharpest market share increases in Home & Kitchen during Q3 2023 all ran prominent deals during July Prime Day, likely a key driver behind each brand’s progress. Notably, only Bissell ran a similar level of discounting during Prime Deal Days in October. As we approach Turkey 5 later this month, one trend to watch is whether these brands run a similar playbook as July Prime Day despite largely sitting out the October sale event.

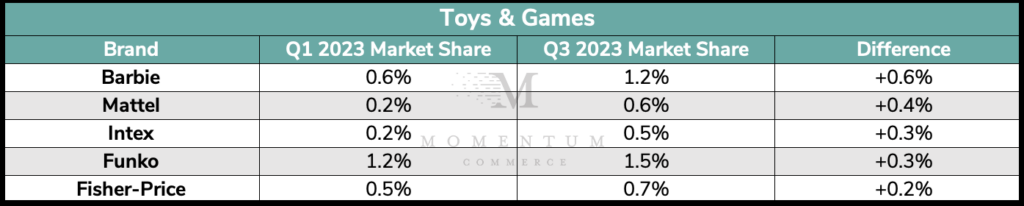

Toys & Games

- Barbie’s place as a cultural touchstone during the summer of 2023 extended to Amazon. Between Q1 and Q3 2023, Barbie-branded products doubled their share of Toys & Games category revenue, while parent company Mattel drove the second-largest market share gain in the category. This category peaks during the holiday shopping season, so despite the encouraging trends for brands like Mattel, increased ad investments and discounting may dramatically change the competitive landscape of this category in a few weeks’ time.

Biggest Takeaways for Brands

- Amazon-specific market share needs to be tracked and contextualized against sales figures

- Every brand selling on Amazon is looking to increase sales, but without platform-specific market share data, you won’t have a clear view of the business’ overall trajectory

- In some cases, category sales can be growing by >30% year-over-year – which means even a nice-looking 20% year-over-year sales growth figure is actually under-indexing the larger market

- Track branded search and use lessons to inform your advertising strategy during peak periods

- In a number of examples cited above, branded search increases preceded increases in market share

- Knowledge around what branded terms are growing in search volume can help you make more informed decisions around which terms are worth defending from competitive conquesting during high-traffic periods

- Discounts work, but need to be tied to driving long-term success

- The ‘lever’ of discounts almost always boosts sales, but how is it positioning your business down the line?

- Restrictions around the depth of discount needed to qualify for event-specific promotions like a Lightning Deal rely on historical data – a steep discount prior to a key sale period can muddy this picture for Amazon

- Also ensure you’re factoring in elements like FBA space and fees into decisions around discounts to maximize the positive, longer-term impact