Amazon US Search Volume Soars 22.3% YoY in January

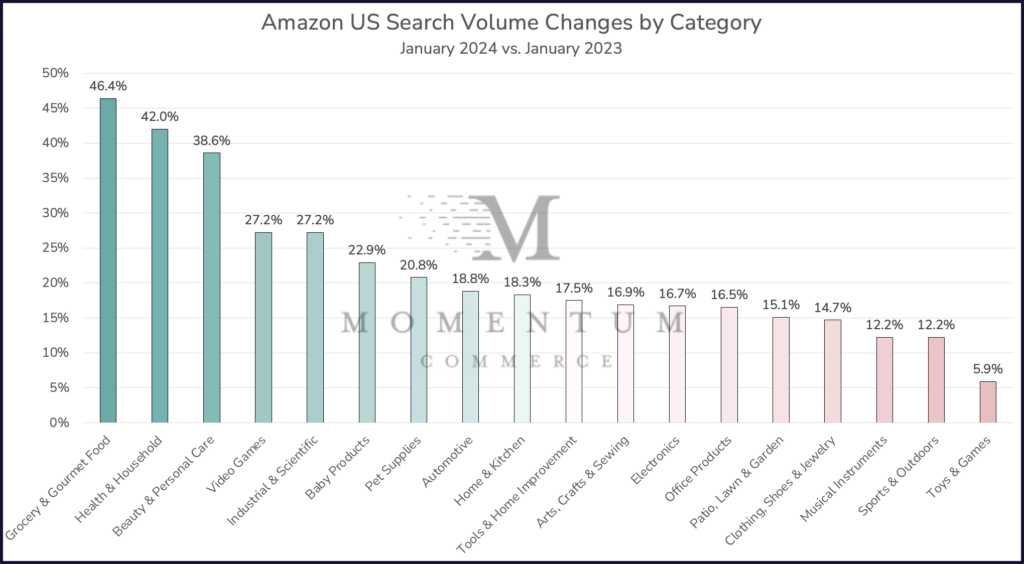

Amazon US search volume increased by more than 22% year-over-year in January 2024- the fifth straight analysis Momentum Commerce has cataloged a year-over-year traffic increase, and the largest YoY increase measured to date. This is also the second analysis where every category studied posted a YoY traffic increase. In a month-over-month view, traffic took an expectedly steep drop after holiday shopping tapered off in December. However, yearly growth continues to be strong for Amazon.

Biggest Takeaways for Brands

- Amazon US remains a growing platform despite newer e-commerce market entrants and competitive moves from other retail giants like Walmart and Target

- Grocery and other CPG categories continue to be where the most growth is on Amazon

- Grocery & Gourmet Food posted the highest YoY search volume increase in January 2024 at 46.4%. This is the highest YoY growth rate measured for any category to date

- The Health & Household and Beauty & Personal Care categories have both posted double-digit YoY growth every single month since July 2023

- The Beauty & Personal Care category is significantly influenced by social media engagement. Trends like #NewYearNewMe have driven over 1.5M views on TikTok, and during the holiday shopping season, we saw brands like COSRX, Sol De Janeiro, and Dyson achieve the most dramatic changes in market share on the back of social-media trends

- This growth, in conjunction with dynamically shifting consumer preferences, presents a tremendous opportunity for brands

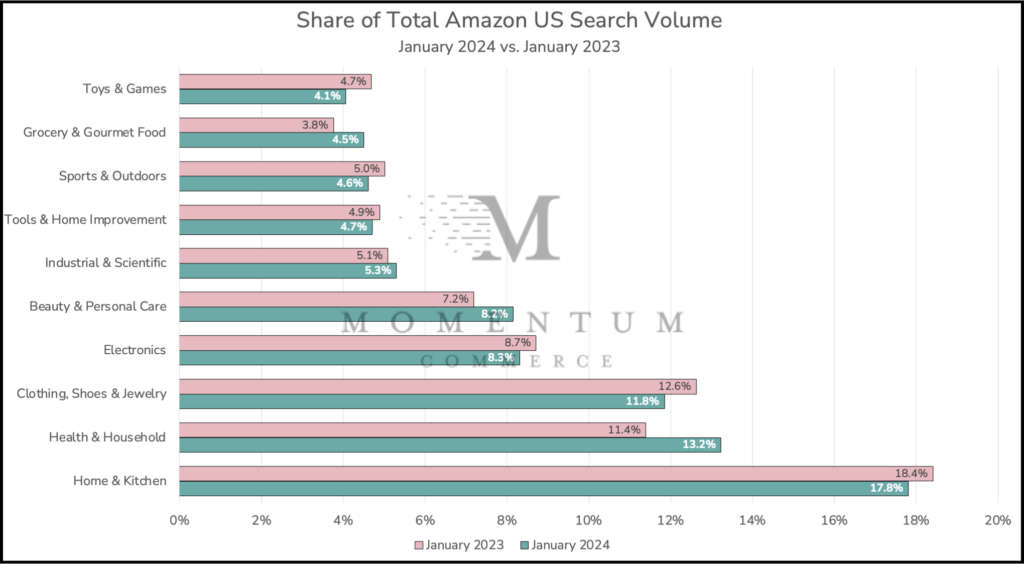

- Clothing, Shoes & Jewelry posted a 6% YoY decline in the category’s share of total Amazon search volume

- This follows a steady decline over the last few months for the category, which is now the third-most searched category on Amazon US – with Health & Household now firmly holding the #2 slot

- Grocery & Gourmet Food (+20%), Industrial & Scientific (+4%), Beauty & Personal Care (+13%), and Health & Household (+16%) were the only categories that captured higher YoY shares of total Amazon search volume

- As mentioned in our previous analysis, recent growth in the Industrial & Scientific category is likely due to the rise of COVID and flu-related illnesses around the holiday season, necessitating consumers to stock up on supplies

- This latest round of growth is a continuation of months-long stretches where CPG categories posted significant traffic increases and further emphasizes how consumers are turning towards Amazon increasingly when shopping for these items

- Toys & Games experienced the most significant YoY drop of any category in terms of share of total Amazon search volume at -13%

- This should be a continued warning sign to brands competing in the category. As overall search is down, it is more important than ever to evaluate paid ad strategies, and carefully plan budgets to focus on pockets of growth and high volume

Methodology

Data included in this analysis is based off of search volume estimates across the top 1,000,000 search terms on Amazon during January 2023 and January 2024. Search terms were categorized based on the top-level category associated with the majority of products appearing on the corresponding search results pages.

These models reflect the updates Amazon has made to its search volume methodologies within Search Query Performance metrics. This includes all historical search volume estimations within this analysis.